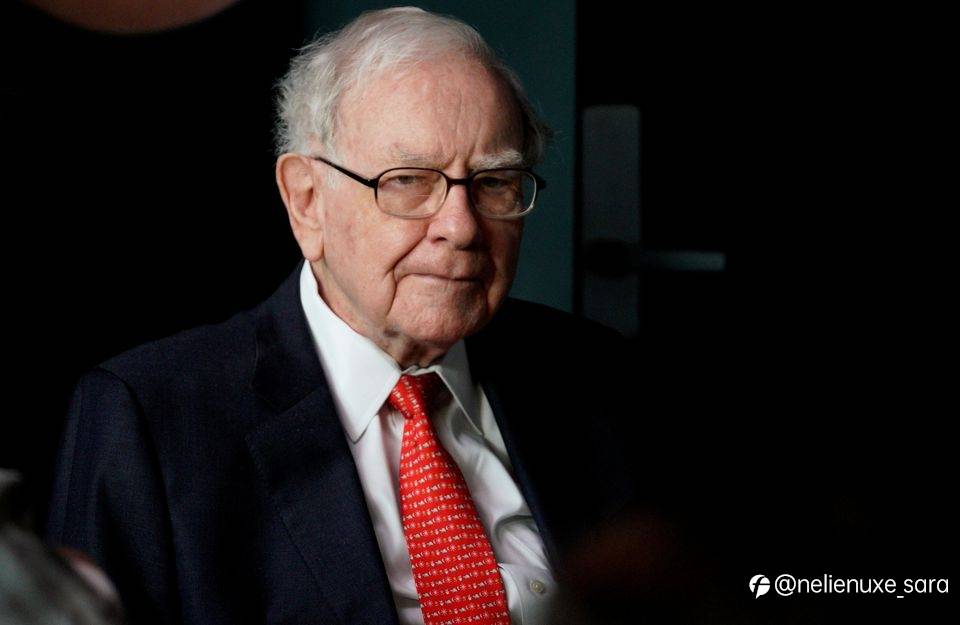

Berkshire Hathaway Inc's (BRKa.N) widely anticipated annual meeting on Saturday will be held virtually for a second year but reclaim one bit of normalcy as Charlie Munger rejoins fellow billionaire Warren Buffett to answer shareholder questions.

The meeting gives Buffett, 90, and Munger, 97, a stage to explain over 3-1/2 hours what to expect from Berkshire's dozens of businesses, markets, and the economy, and whether the company will continue aggressive share repurchases.

Still, with no shareholders in attendance, it will be shorn of the festivities that normally draw about 40,000 annually to Omaha, Nebraska for what Buffett calls Woodstock for Capitalists.

"The Berkshire event, it's hard to describe to someone who's never been there," said Jim Weber, chief executive of the company's fast-growing Brooks Running unit. "Nonetheless, the meeting will go on, and I'll be watching it, probably on my treadmill."

Buffett has run Berkshire since 1965, and Munger has been vice chairman since 1978.

The other vice chairmen, Greg Abel and Ajit Jain, who respectively oversee Berkshire's non-insurance and insurance businesses, will be on hand to answer some questions. They are top contenders to succeed Buffett as Berkshire chief executive.

Saturday's meeting should illustrate how Buffett and Munger have thrived together for so long, despite differences in politics - Buffett is a Democrat, Munger a Republican - and often investment ideas.

Munger, a Californian, did not travel to last year's meeting in Omaha, which was disrupted by the pandemic.

This year, Buffett said in his shareholder letter he is traveling to Los Angeles to reunite with his friend and business partner of more than six decades.

"Charlie's perspective often may challenge Warren's," said Paul Lountzis, president of Lountzis Asset Management LLC in Wyomissing, Pennsylvania, and a Berkshire shareholder. "But he often augments what Warren says, in a more direct way and with a great sense of humor."

Like Buffett, Munger tries to teach as he speaks, thinks long-term, and eschews investments whose main attribute is being in vogue.

"He's reassuring," said Tom Russo, who invests more than $10 billion at Gardner, Russo & Quinn in Lancaster, Pennsylvania, and has invested in Berkshire since 1982. "For people who follow that reassurance, the rewards have been mighty."

已编辑 30 Apr 2021, 17:23

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发