他点赞了

- Troy_Opinion55 :message

他点赞了

他点赞了

他点赞了

他点赞了

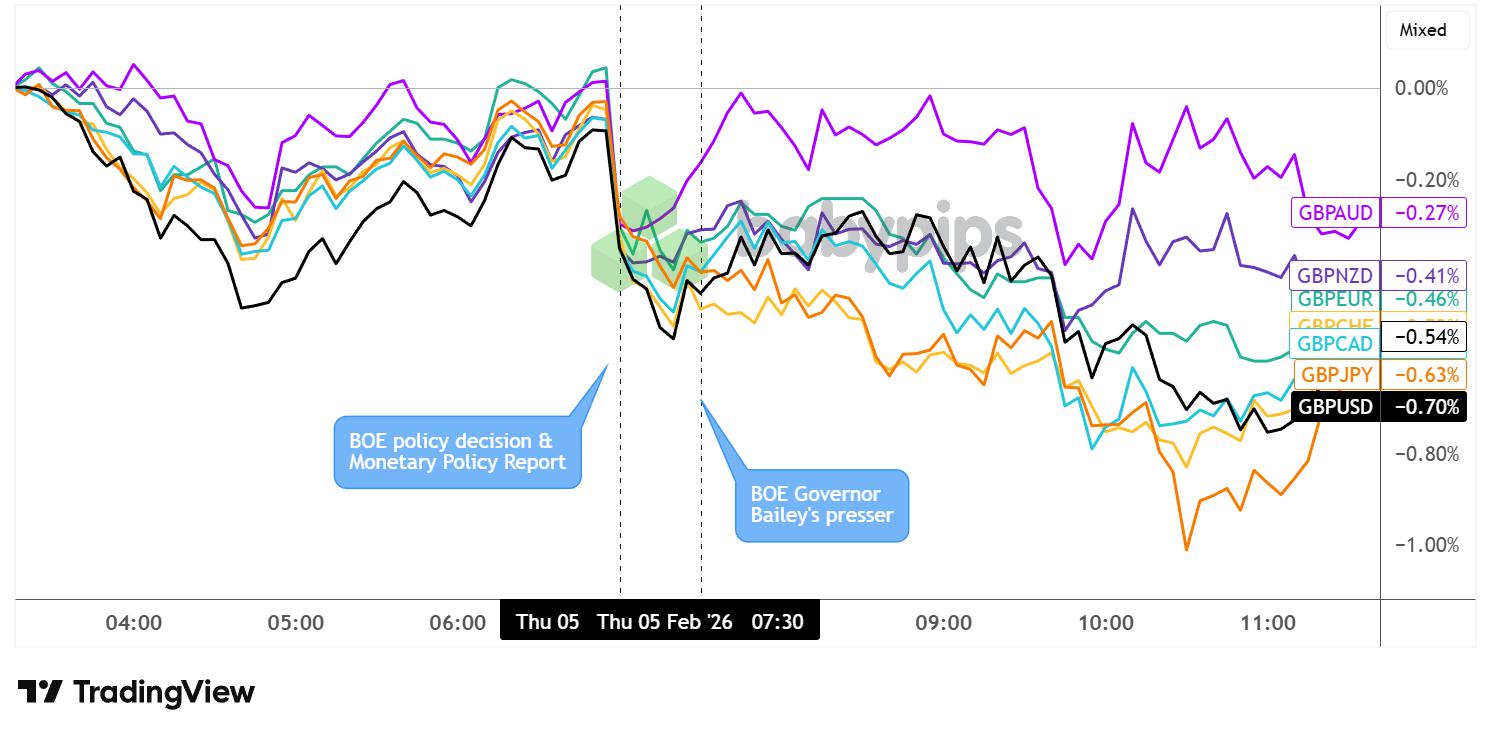

BOE “Dovish Hold” Weighed on GBP, March Rate Cut Odds Higher on New Framework

Partner Center The Bank of England maintained its policy rate at 3.75% in a closely contested decision, with four members voting for an immediate cut. The divided vote and dovish guidance suggest mounting pressure for easing as inflation approaches target. Key Takeaways Policy Decision: MPC voted 5-

他点赞了

他点赞了

📘50 RULES OF TRADING

50 RULES OF TRADING by Raheel Nawaz RISK & CAPITAL Capital preservation comes first Protect downside before upside Risk management > entries Never risk money you can’t lose Small losses are victories Risk a fixed % per trade Never increase risk to recover Survival is success Flat is a positio

他点赞了

他点赞了

Commodity Prices and Yield Spreads: Why the CAD’s Rise Wasn’t a Surprise for Experienced Traders

As someone who’s been through enough market cycles to recognize patterns, the recent rise of the Canadian dollar to a five-month high doesn’t surprise me, but it does remind me of a lesson I wish I’d learned earlier. The correlation between commodity prices and the CAD has be

他点赞了

他点赞了

他点赞了

他点赞了

Tensions Ignite: The US-Venezuela Standoff and the Shadow of War

As December 2025 dawns, the world watches with bated breath as the United States and Venezuela teeter on the brink of open conflict. What began as economic sanctions and diplomatic barbs has escalated into a naval armada in the Caribbean and veiled threats of regime change. This isn't just a regiona

- Followme :Weibo has obtained the basic prize in the Opinion Leader Program: 20 Points that can withdraw. Click to know more details about //soci...

- Followme :Weibo has obtained the basic prize in the Opinion Leader Program: 500 Points that can withdraw. Click to know more details about //soc...

正在加载中...