U.S. Oil Surges Past $110 a Barrel Amid Expanding Iran Conflict

Executive Summary 🔸Oil prices surged above US$110 as Middle East conflict disrupted supplies. 🔸Asian markets plunged, with South Korea and Japan hit hardest. 🔸Governments imposed fuel caps and rationing to contain panic buying. (March 9) U.S. oil prices surged above US$110 per barrel on Ma

- International_Student81 :cPA42261897828241408

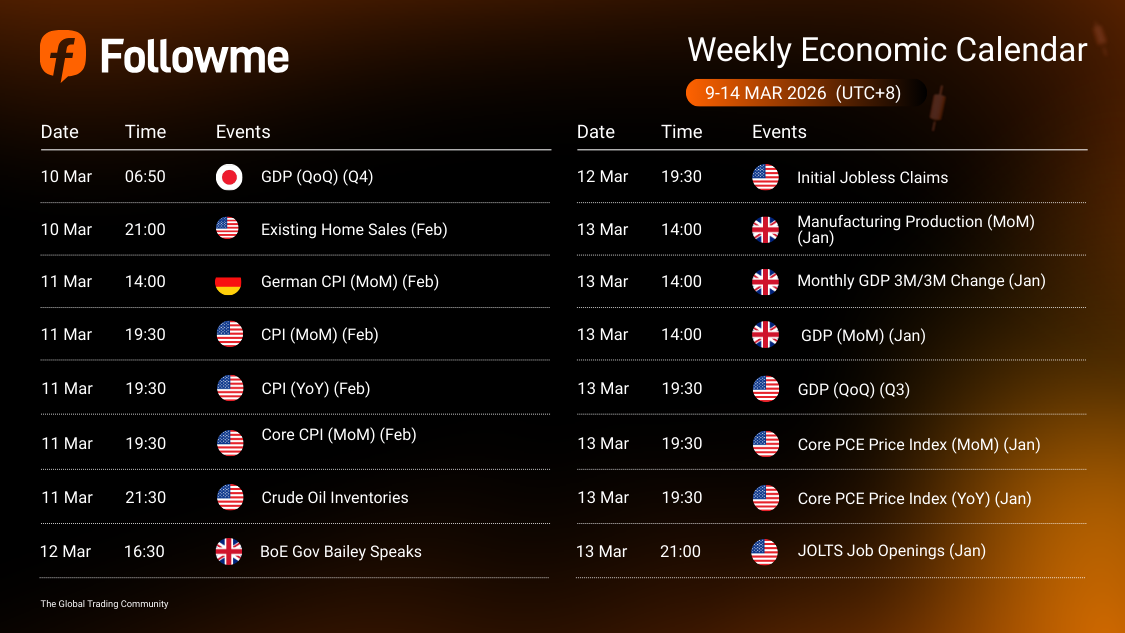

Weekly Economic Calendar: Week of March 9-14, 2026

Weekly Economic Calendar: Week of March 9- 14, 2026 (GMT+8) This week’s macro calendar is driven by a dense mix of U.S. inflation, growth, and labour signals, with market attention building from Wednesday’s CPI cluster into a powerful Friday window of U.S. GDP, Core PCE, and JOLTS data.

USD Holds Strength While Markets Remain Headline-Driven

The Forex market today continued to operate in a high-volatility, headline-driven environment, as geopolitical tensions in the Middle East and expectations surrounding U.S. monetary policy remained the primary drivers of market sentiment. The U.S. dollar maintained its strength against several major

Best Copy Trading Community Platform Indonesia 2026 - Finance Derivative Awards

Followme Recognized as Indonesia’s Best Copy Trading Community Followme is proud to announce that we have been awarded Best Copy Trading Community Platform Indonesia 2026 by the Finance Derivative Awards, recognizing the platform’s strong commitment to building a transparent, collaborati

The Man Who Outsmarted the Market: Jim Simons’ Greatest Trading Lessons

The Man Who Outsmarted the Market: Jim Simons’ Greatest Trading Lessons The man who changed how markets are traded Jim Simons, the mathematician who founded Renaissance Technologies, was not a traditional market operator, he built one of the most successful trading operations in financial hist

USD Strengthens While Gold and Oil React to Rising Geopolitical Risks

Global Forex markets this week traded in a highly volatile and headline-driven environment, as escalating geopolitical tensions in the Middle East became the primary driver of market sentiment. The conflict involving the United States, Israel, and Iran pushed investors toward defensive positioning,

USD Holds Strength While Oil Cools and Gold Remains Volatile

Global financial markets on March 5, 2026 continued to trade cautiously as investors closely monitored geopolitical developments in the Middle East and expectations surrounding U.S. Federal Reserve policy. In this environment, the U.S. dollar maintained its strength, oil prices cooled slightly after

What the Latest Fed Signals Mean: Manufacturing Resilience, Consumer Fatigue, and a Firmer Dollar

What the Latest Fed Signals Mean: Manufacturing Resilience, Consumer Fatigue, and a Firmer Dollar A two track U.S. economy is taking shape: The Federal Reserve’s February Beige Book describes an economy that is still growing in many places, but with more areas stalling. Seven of the 12 d

Oil surges and USD hits a three-month high as Middle East tensions dominate markets

Global financial markets experienced heightened volatility on March 4, 2026, as escalating geopolitical tensions in the Middle East—particularly involving the United States, Israel, and Iran - continued to drive investor sentiment. The market shifted into a more cautious stance, triggering sig

Gold and Crude Oil Surge Amid Rising US-Iran Tensions: A Look at Market Dynamics

Gold and Crude Oil Surge Amid Rising US-Iran Tensions: A Look at Market Dynamics Latest market snapshot: Gold prices have experienced a strong rebound of 1.27% after a sharp 5% drop since last week, fueled by escalating geopolitical tensions, particularly between the U.S. and Iran. In Asian tr

Weekly Data Report | Spotlight on Top Performers 24 February - 2 March 2026

Last Week's Trading Frenzy: $169,309.8 in Total Profit! The Followme trader community has been on fire. Last week's profit isn't just high, it's phenomenal. With market moves this active, our top traders have truly outdone themselves. Let's dive into the leaderboard and follow the stars of the

US–Israel–Iran Tensions Escalate: How Are Forex Markets Reacting?

Gold and oil surge while USD returns as a safe-haven asset in a risk-off environment Global financial markets have entered a period of heightened volatility as military tensions involving the United States, Israel, and Iran escalate, raising concerns about energy supply disruptions and broader econo

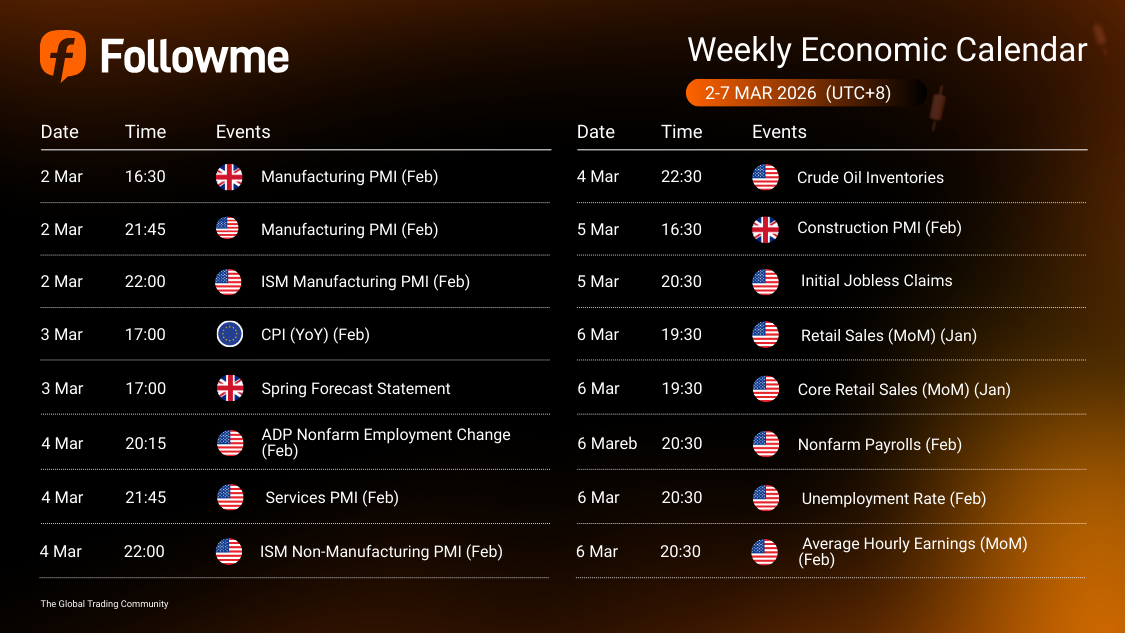

Weekly Economic Calendar: Week of March 2-7, 2026

Weekly Economic Calendar: Week of March 2- 7, 2026 (GMT+8) This week’s macro calendar is driven by a heavy concentration of U.S. growth and labour signals, with the market focus shifting from early-week PMI and ISM activity updates into a powerful Friday cluster of U.S. consumption and employm

USD Swings Persist While Gold Continues to Lead Defensive Flows

Global financial markets this week traded in a high-volatility but low-conviction environment, as investors continuously adjusted expectations in response to monetary policy signals and ongoing macroeconomic risks. In the foreign exchange market, the USD experienced sharp fluctuations driven by head

The Market Didn’t “Hear” Optimism: Gold and oil priced uncertainty after Trump’s 2026 speech

The Market Didn’t “Hear” Optimism: Gold and oil priced uncertainty after Trump’s 2026 speech Latest market snapshot: Gold steadied close to $5,200/oz into late Asian trade Friday, with spot around $5,180.76/oz and futures near $5,211, capping a strong February rebound. Gold&r

正在加载中...