Bitcoin Struggles Below $90K While Gold Breaks Records

Partner Center When uncertainty hits, traders choose sides—and right now, Bitcoin’s getting left behind. Let’s try to break it down and understand this current market rotation dynamic. Bitcoin has been stuck in a frustrating rut. After starting January near $95,000, the world’s largest cryptocurrenc

How Japan and the U.S. Defended the Yen Without Spending

Partner Center Last Friday delivered a stark reminder that in currency markets, words can move billions of dollars faster than any actual transaction. The Japanese yen surged 1.75% in a single day—its sharpest rally since August—after the Federal Reserve Bank of New York conducted “rate checks” with

Kiwi Stays Afloat As New Zealand Inflation Cooled to 0.6% in Q4 2025

Partner Center New Zealand’s consumer price inflation dipped from 1.0% to 0.6% on a quarterly basis in Q4 2025, bringing the annual rate to 3.1%. This surpassed both market expectations of a 0.5% quarter-on-quarter gain and the Reserve Bank of New Zealand’s forecasts, as elevated domestic price pres

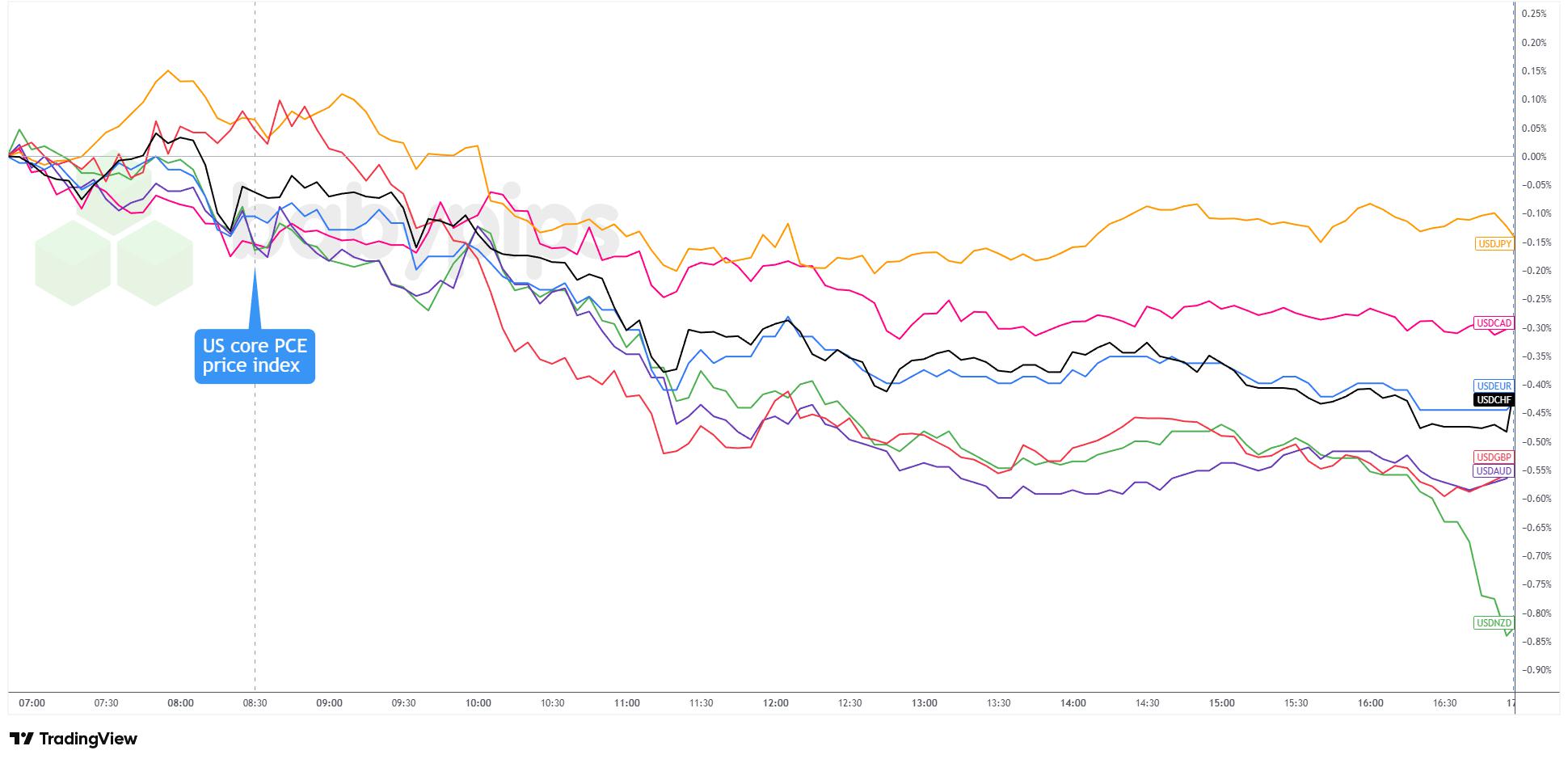

U.S. Core Inflation Remains at 2.8% in November; USD Reaction Limited Amid Improving Risk Sentiment

Partner Center The U.S. core Personal Consumption Expenditures (PCE) price index rose 2.8% year-over-year in November, matching expectations and ticking up from October’s 2.7% reading, according to data released Thursday by the Bureau of Economic Analysis (BEA). The headline PCE price index also inc

The “TACO Trade” Strikes Again: Trump’s Greenland Market Reversal Explained

Partner Center President Trump backed off tariff threats after reaching a Greenland framework deal with NATO, sparking a market rally and reviving Wall Street’s favorite acronym! Markets love patterns. And over the past year, one pattern has emerged so consistently that Wall Street gave it a name: t

Australian Unemployment Fell to 4.1% in December, AUD Drifted Higher

Partner Center Australia’s labor market delivered a robust performance in December 2025, with employment surging stronger than expected at 65.2K versus the 28.3K consensus and the unemployment rate falling more than anticipated from 4.3% to 4.1%. Key Takeaways Employment jumped by 65,200 in seasonal

GBP’s Initial Gains Reverse Despite Hotter UK Inflation as Risk Sentiment Shifts

Partner Center U.K. consumer price inflation rose to 3.4% year-on-year in December, up from 3.2% in November and slightly above the 3.3% market consensus, marking the first increase in five months. The uptick was driven primarily by higher tobacco prices following duty increases announced in the lat

Why Europe’s Treasury Dump Threat Is More Bark Than Bite

Partner Center If you’ve been watching the trade spat between the U.S. and Europe lately, you’ve probably heard a provocative idea floating around: What if Europe just dumped all its US assets? The scenario sounds dramatic. Fed up with President Trump’s tariff threats over Greenland and trade disput

When Japan Sneezes, Global Bonds Catch a Cold

Partner Center A snap election announcement in Tokyo sent shockwaves through bond markets worldwide, teaching traders a painful lesson about financial contagion What Happened With Bonds Today? If you woke up Tuesday morning and checked your trading screens, you might’ve thought someone hit the “sell

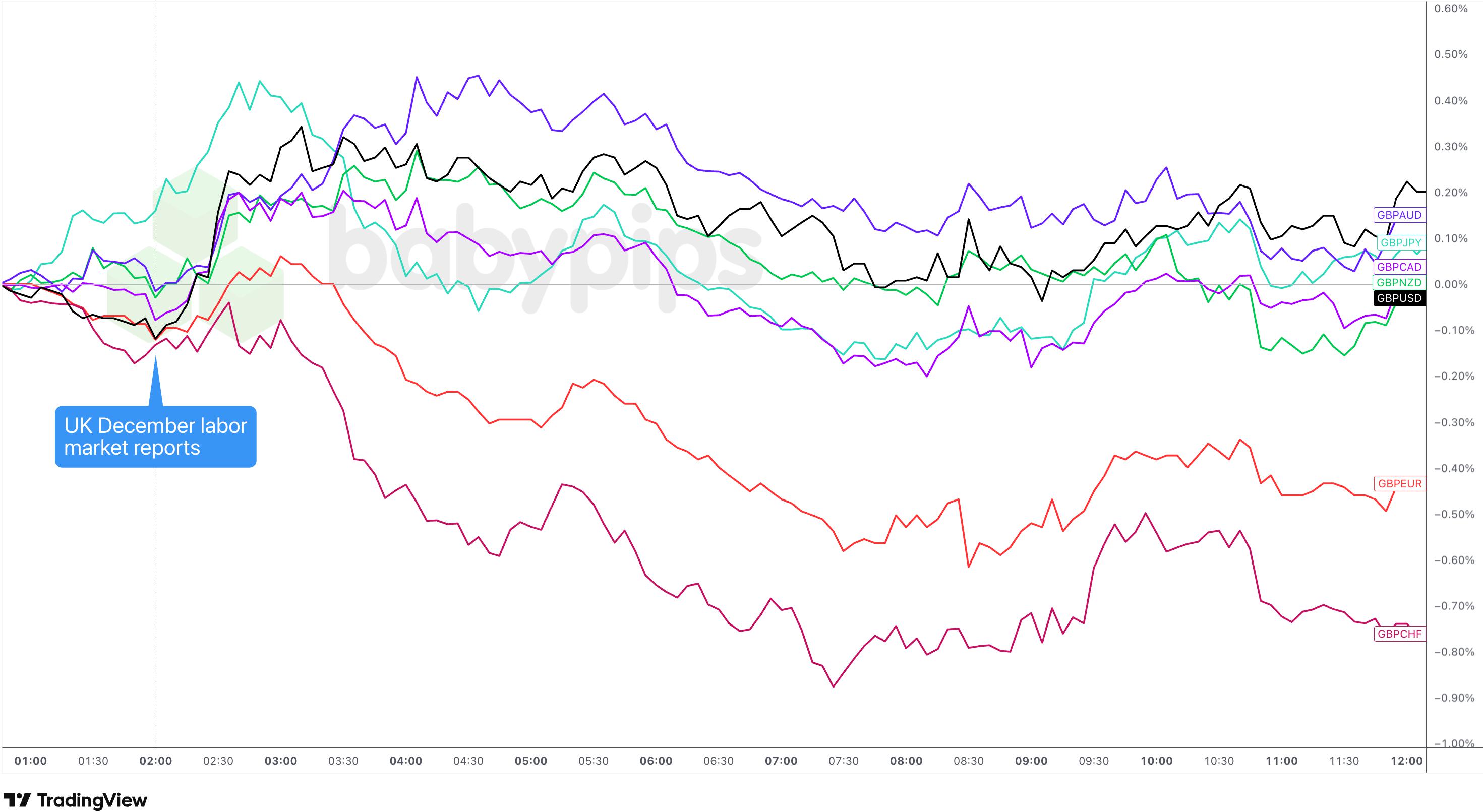

GBP Gives Up Gains as UK Unemployment Holds at Four-Year High, Wage Pressures Ease

Partner Center The U.K. labor market showed further signs of deterioration in the latest employment report, with the unemployment rate climbing to 5.1% for the three months to November while wage growth slowed to its weakest pace in over three years. The Office for National Statistics reported that

Canada Inflation Jumps to 2.4%, But Core Measures Drop Below 3% for First Time Since March

Partner Center Canada’s December inflation report showed headline CPI accelerating to 2.4% y/y from November’s 2.2%, driven primarily by base-year effects from the temporary GST/HST tax holiday that began December 14, 2024. While the uptick exceeded the 2.2% consensus forecast, the Bank of Canada’s

Understanding Backtesting and Optimization: How to Test and Improve Your Trading Strategy

Have you ever written an exam? If you have, it’s safe to say you prepared using past question papers. Most people attempt them under exam conditions. The goal is to determine if the approach and strategy you have been using to study are actually effective. By going through past papers, you can see w

When the U.S. Becomes the Risk: Trump’s Greenland Tariffs Flip Markets

Partner Center The tariff threat over Greenland sent stocks tumbling and gold soaring—but this time, traders fled from the dollar, not to it. What’s Happening Between the U.S. and NATO? Over the weekend, President Trump announced something that caught even seasoned market veterans off guard: the Uni

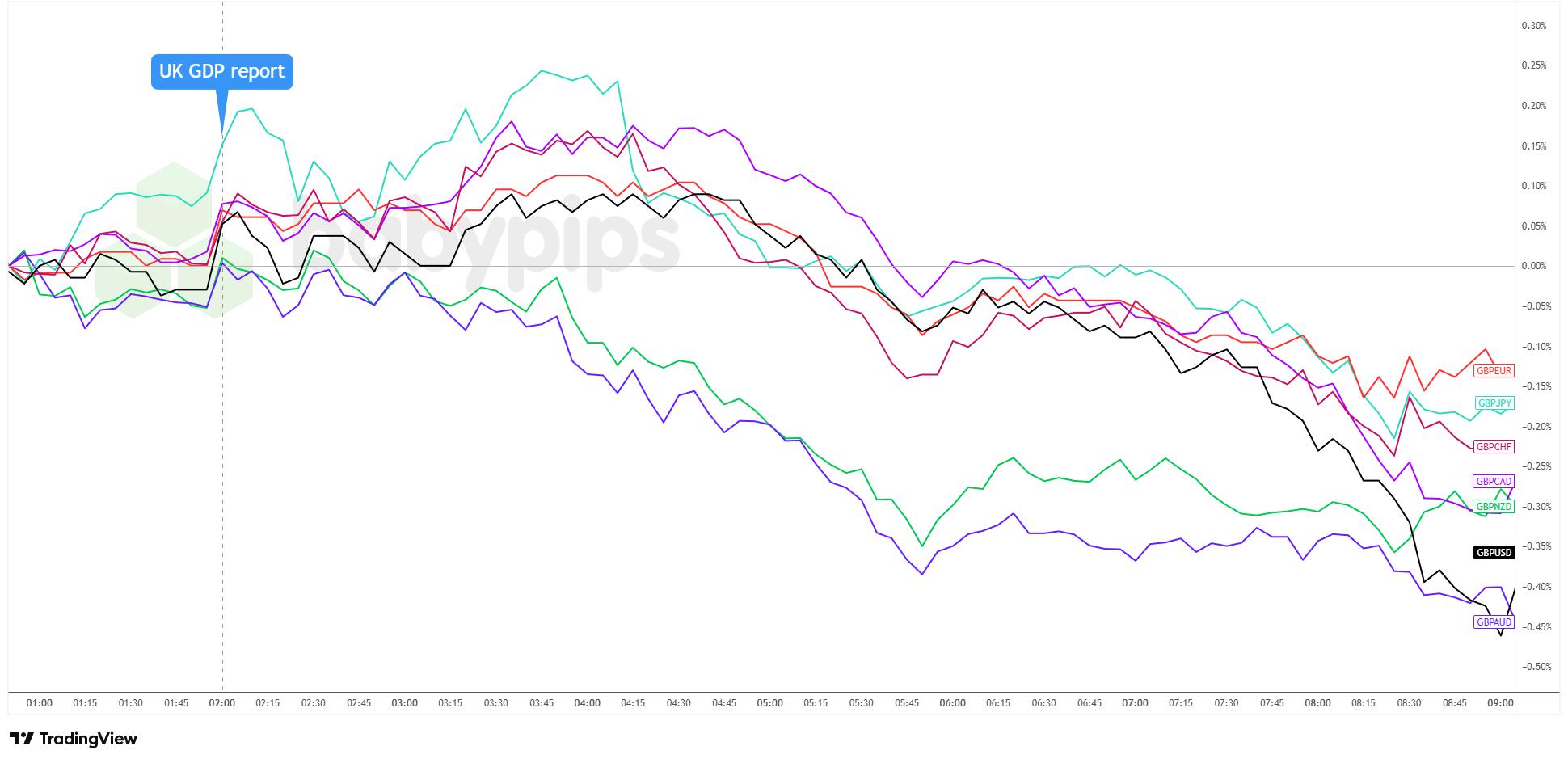

Sterling Closes Lower Despite Upbeat November GDP Report

Partner Center The U.K. economy returned to growth in November 2025, posting a stronger-than-expected 0.3% m/m expansion and reversing October’s contraction. Production rebounded, and services activity picked up, even as pre-Budget uncertainty hung over the economy. Still, the pound finished the day

U.S. Inflation, Tariffs and Data Distortions: What’s Next for the Fed?

Partner Center If you’ve been waiting for inflation to magically drop back to the Fed’s 2% target, December’s data just delivered a reality check. Consumer prices rose 2.7% year-over-year in December 2025, exactly the same pace as November, while core CPI showed a slower than expected 0.2% monthly u

正在加载中...