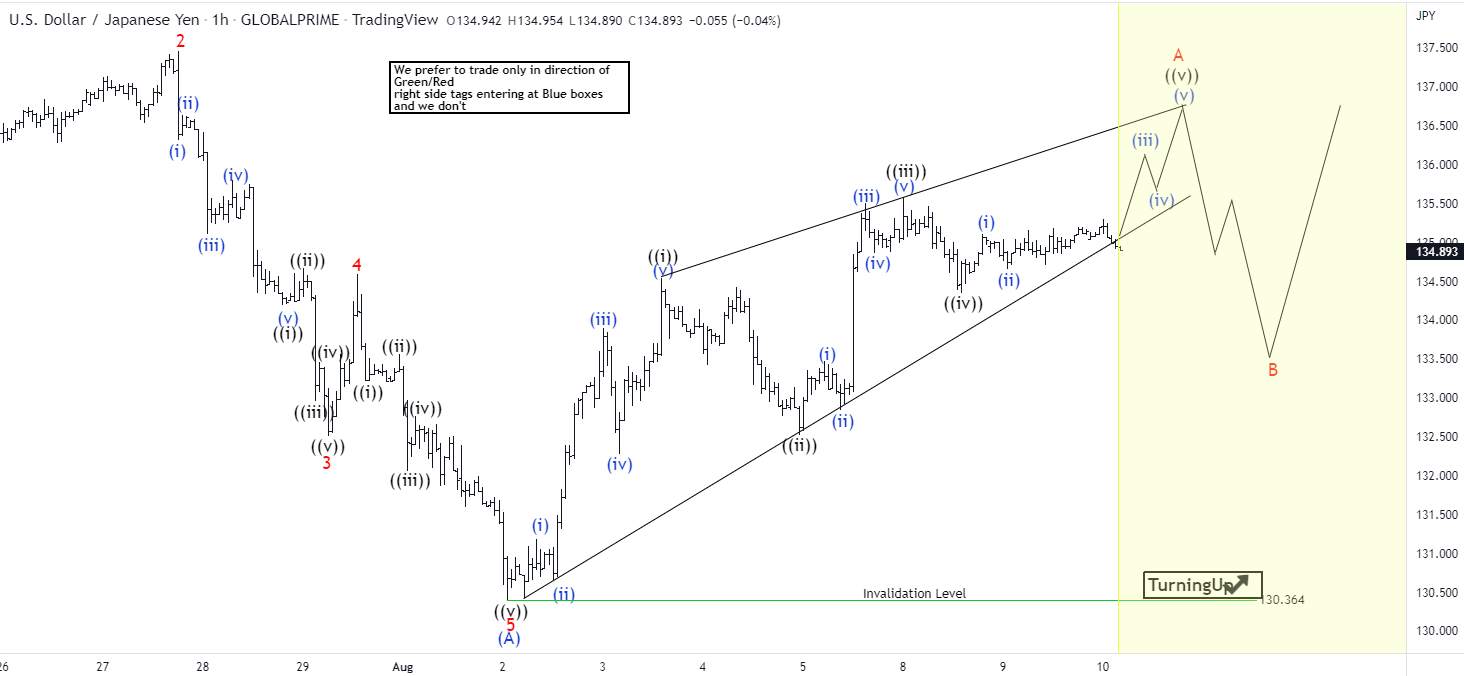

Short Term Elliott Wave View in USDJPY suggests decline from 7.11.2022 high is unfolding as a zigzag Elliott Wave structure. Down from 7.11.2022 high, wave 1 ended at 135.54 and rally in wave 2 ended at 137.46. Pair then extended lower in wave 3 towards 132.48, and rally in wave 4 ended at 134.59. Final leg lower in wave 5 ended at 130.364 which completed wave (A) in higher degree.

Wave B rally is currently in progress with internal subdivision as another zigzag in lesser degree. First leg wave (A) unfolded as a 5 waves diagonal. Up from wave (A), wave ((i)) ended at 134.55, and pullback in wave ((ii)) ended at 132.5. Pair then extended higher again in wave ((iii)) towards 135.58, and dips in wave ((iv)) ended at 134.33. Expect pair to extend 1 more leg before ending wave ((v)) and this should complete wave A in higher degree. Pair should then pullback in wave B to correct cycle from 8.2.2022 low before the next leg higher in wave C. Near term, as far as pivot at 130.364 low stays intact, expect dips to find support in 3, 7, 11 swing for further upside.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

喜欢的话,赞赏支持一下

加载失败()