The US economy is showing resilience, especially in the services sector. The US consumer sentiment is optimistic, being supported by wage gains and falling inflation expectations. The core PCE is at 4.6 percent which is above the 2 percent FED target. Canada's inflation is falling faster than the US inflation currently at 3.2 percent which is relatively close to BOC 2 percent target.

Interest rate differential

The FED is expected to hike rates in September and November each by 25 basis points pushing the fed fund rates to the range of 5.5-5.75 percent while Canada's rates are expected to have peaked. Canada's inflation rates are close to target meaning BOC could be the first to cut rates.

The interest rate differential between US and Canadian bond yields has been growing in favor of the dollar it the large part of the week while USDCAD has been falling. That divergence will be reflected in the currency.

Positioning and Sentiment

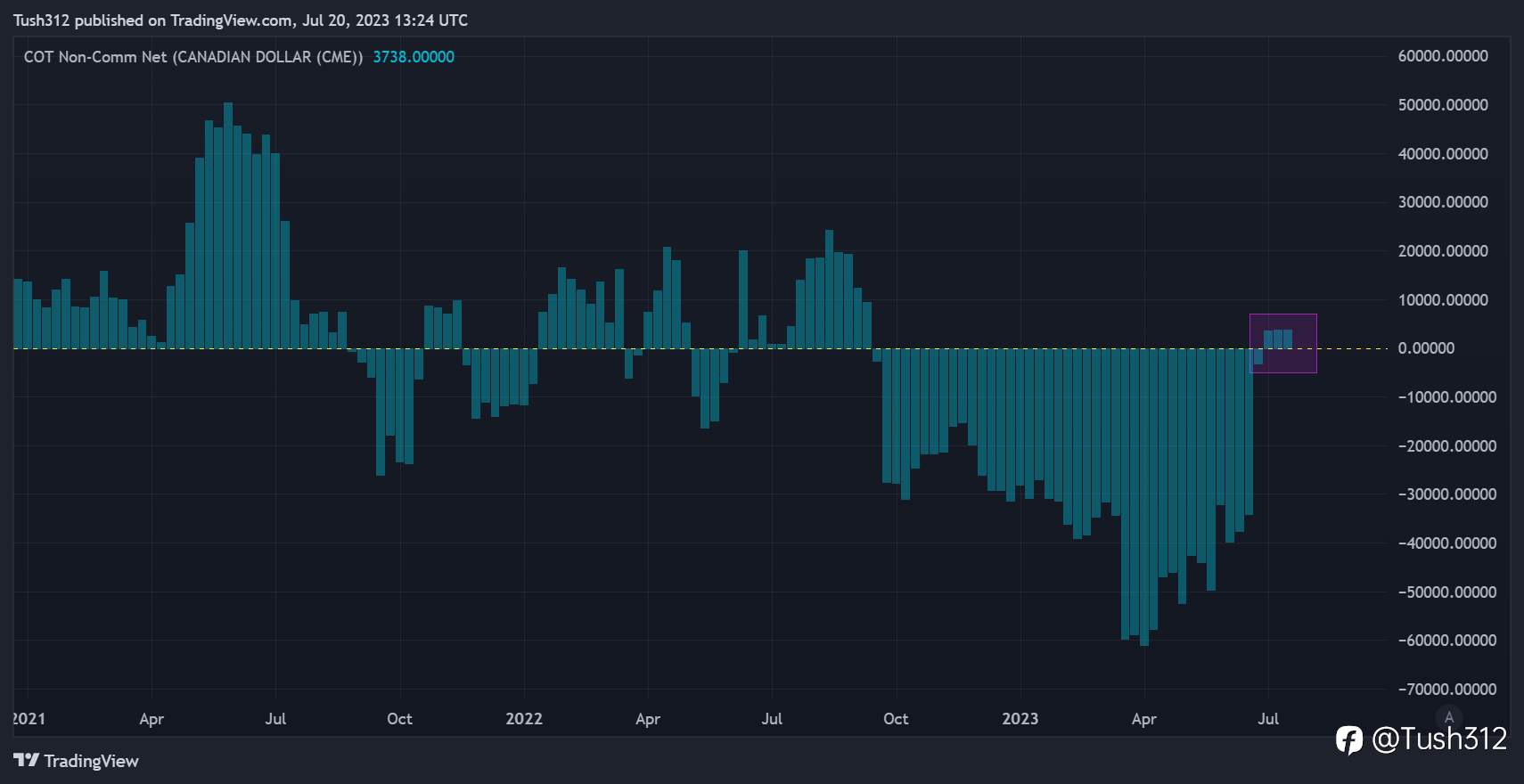

Leveraged funds bets on CAD is slightly bullish which can easily flip to bearish wagers as CAD weakens further.

Price action

Fundamentals tell us what will happen in the future then price tells us when that will happen. Any price structure that supports bullish direction of the currency close to 1.300 might present a good buy opportunity.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发