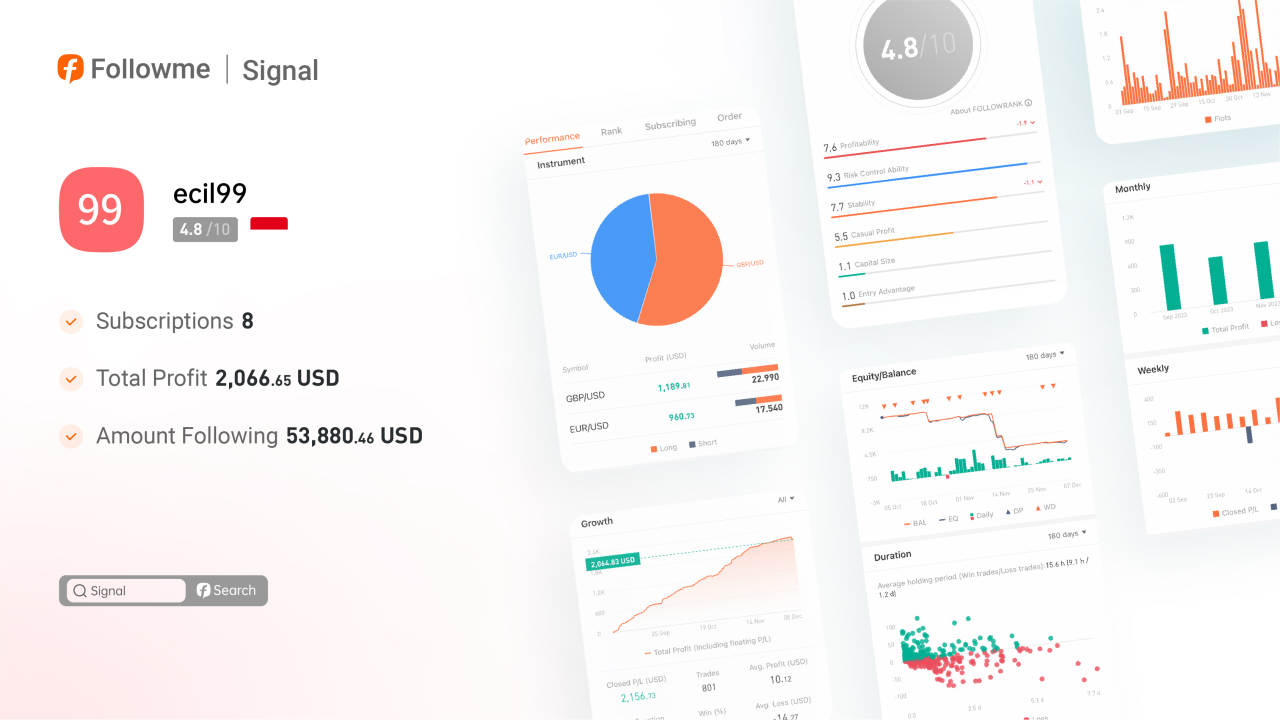

This week, while browsing the community's Signal List, I came across a trader whose ID immediately caught my attention: @ecil99. Upon further inspection of their trading performance, I decided to have a conversation with them. There was once a trading prodigy in the community whose ID also had the suffix "99."

While being low-key is not a trader's capital, profitability certainly is, especially when it amounts to 21.4% in just 13 weeks with a drawdown of 13.16%. The ratings are not particularly outstanding, but they received high scores (above 9.0) in terms of both profitability and risk management abilities.

The risk-to-reward ratio is not impressive, with an average profit of $10.07 and an average loss of -$14.19, resulting in a ratio of only 0.71. However, if we calculate the number of trades and points, it comes out to an average profit of over 15 points per trade across 8.6 trades per day. Does this mean that they rely on win rate rather than position management?

Sure enough, their strategy involves entering the market with 0.01 or 0.02 lots and adding the same lot size every 10 points if the trend aligns with their expectations until the market reverses. After the reversal, they follow specific rules to add positions with lot sizes of 0.03, 0.05, 0.08, 0.12, and 0.18, continuing until the market returns and the floating losses turn into profits. This kind of position scaling can lead to exponential growth in the position size. However, if the market is range-bound and volatile within the day, it can ensure a high success rate for this trader, as evidenced by their win rate of 69.67% in the community.

Of course, the downside of having a high number of trades and a high win rate is the intensity of position scaling. If aggressive position scaling encounters a relentless market trend without any turning points, it can easily lead to a chaotic situation.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发