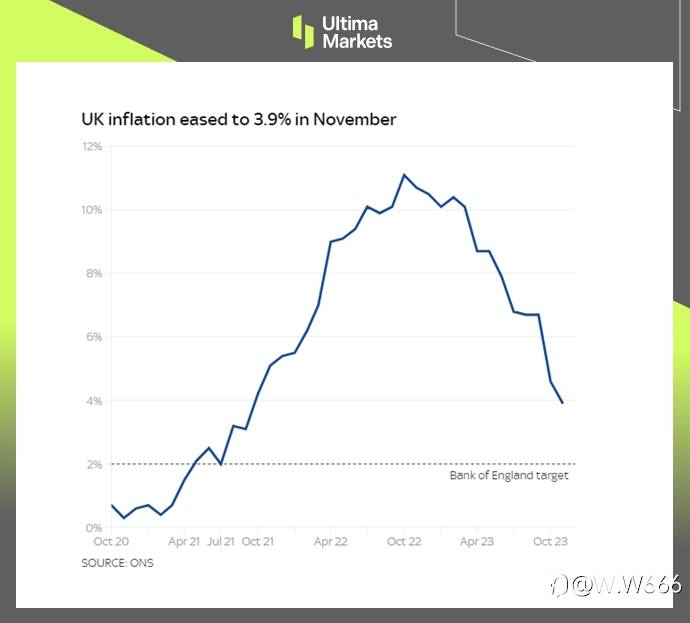

Inflation fell to 3.9% last month, the Office for National Statistics reported, a significant drop from the 4.6% seen the previous month. This slowdown was driven by decelerating price hikes in areas like transport, recreation, culture, and food, with fuel prices exerting the most downward pressure. Economists polled by Reuters had predicted a slightly smaller decrease to 4.4%.

There were declines across various input costs: raw materials fell 2.6%, transport costs dropped 1.4%, and factory gate prices dipped 0.2%. Despite the decrease, the 3.9% rate remains nearly double the Bank of England’s 2% inflation target. As such, policymakers indicated it is premature to discuss interest rate cuts, though the hikes implemented this year have increased borrowing costs in an attempt to control inflation.

At a 2-year low, inflation is showing signs of relief from the recent cost of living crisis, yet still undershoots the Bank’s objective. Core inflation, which excludes volatile categories like food and energy, also moderated from 5.7% to 5.1%. The Monetary Policy Committee watches this closely when setting interest rates. The UK’s inflation now aligns with other G7 economies of similar size. It matches France’s rate and exceeds Germany and the United States.

Chancellor Jeremy Hunt commented that these data points demonstrate progress in removing inflationary pressures, supporting healthy, sustainable growth alongside the business tax cuts introduced last quarter. However, with many households still burdened, addressing cost of living challenges remains a priority.

#Chancellor#

#EconomicTrends#

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发