#Inflation#

1.84k 浏览

330 讨论

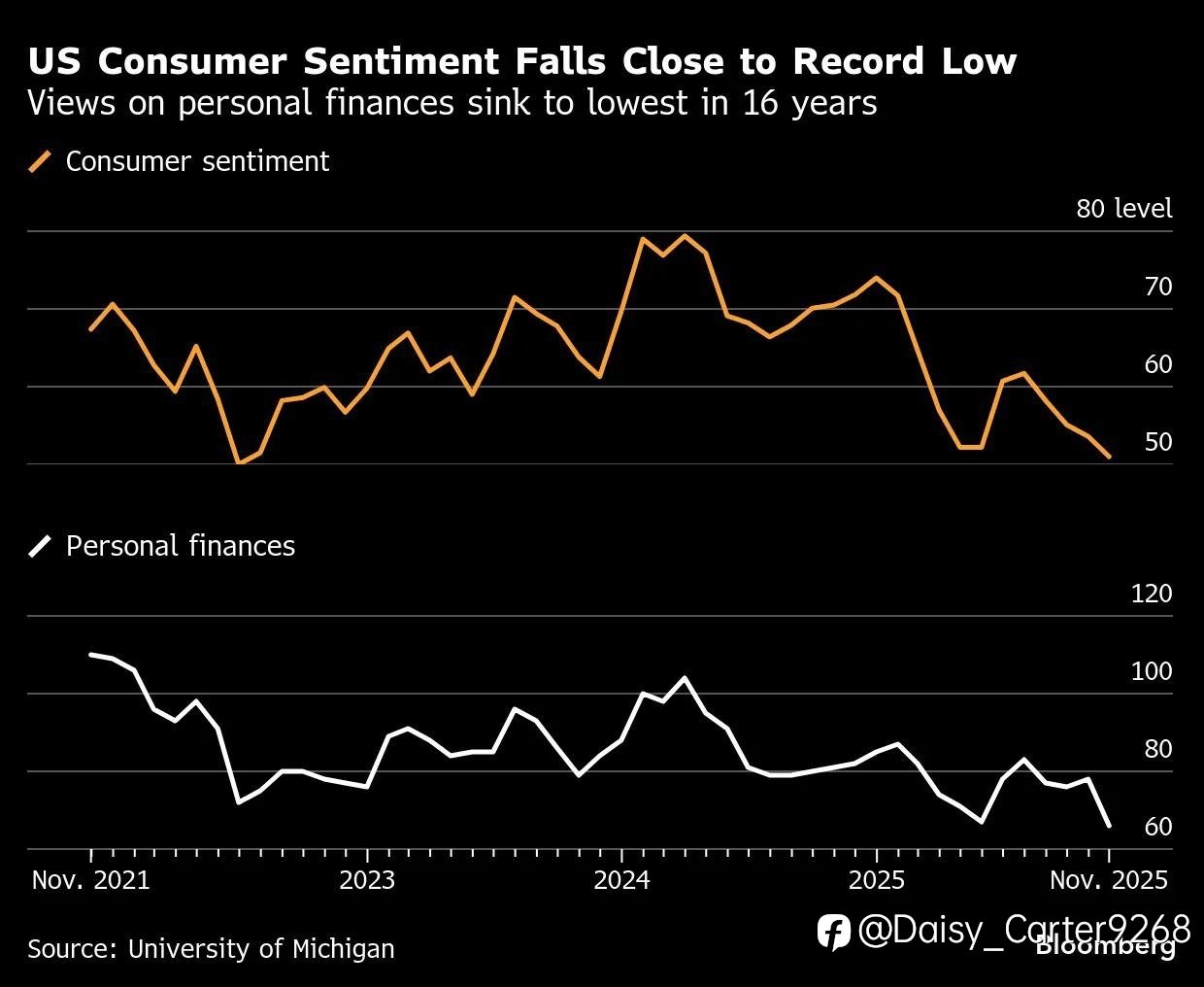

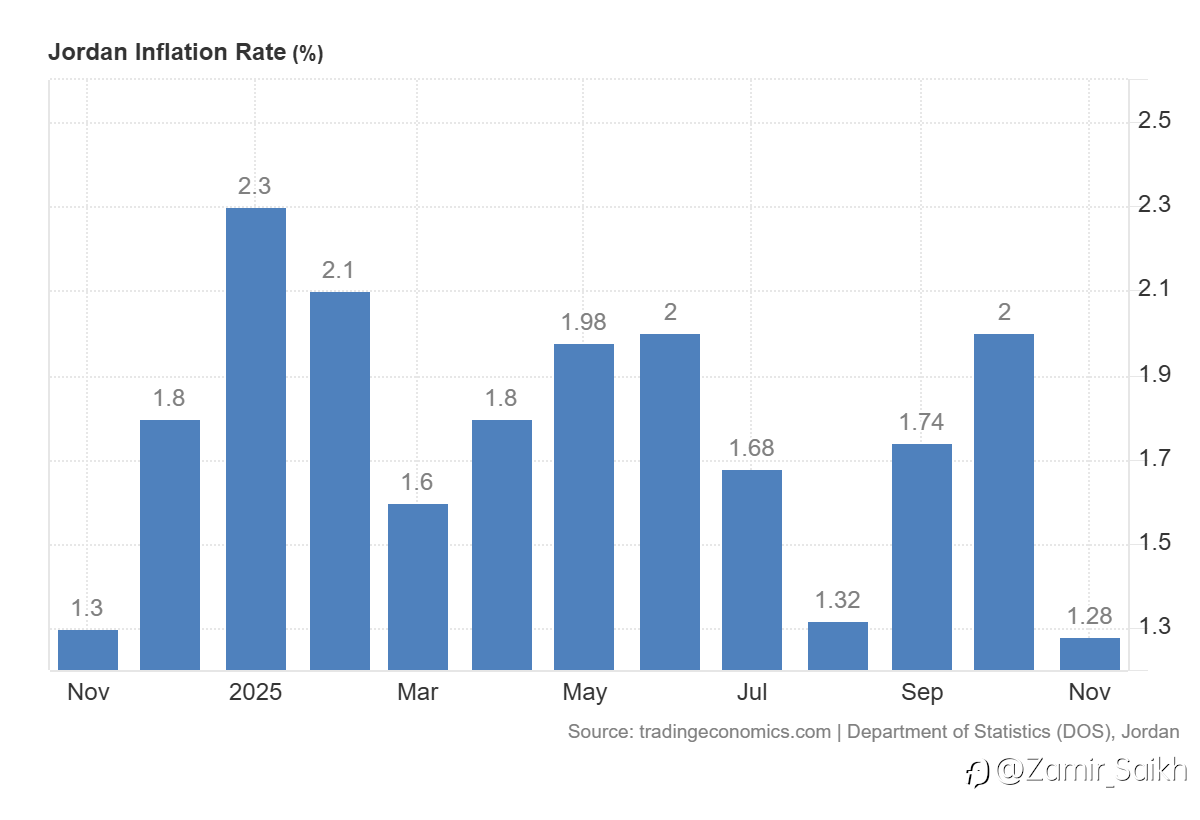

Inflation is a quantitative measure of the rate at which the average price level of a basket of selected goods and services in an economy increases over some period of time. It is the rise in the general level of prices where a unit of currency effectively buys less than it did in prior periods.

正在加载中...