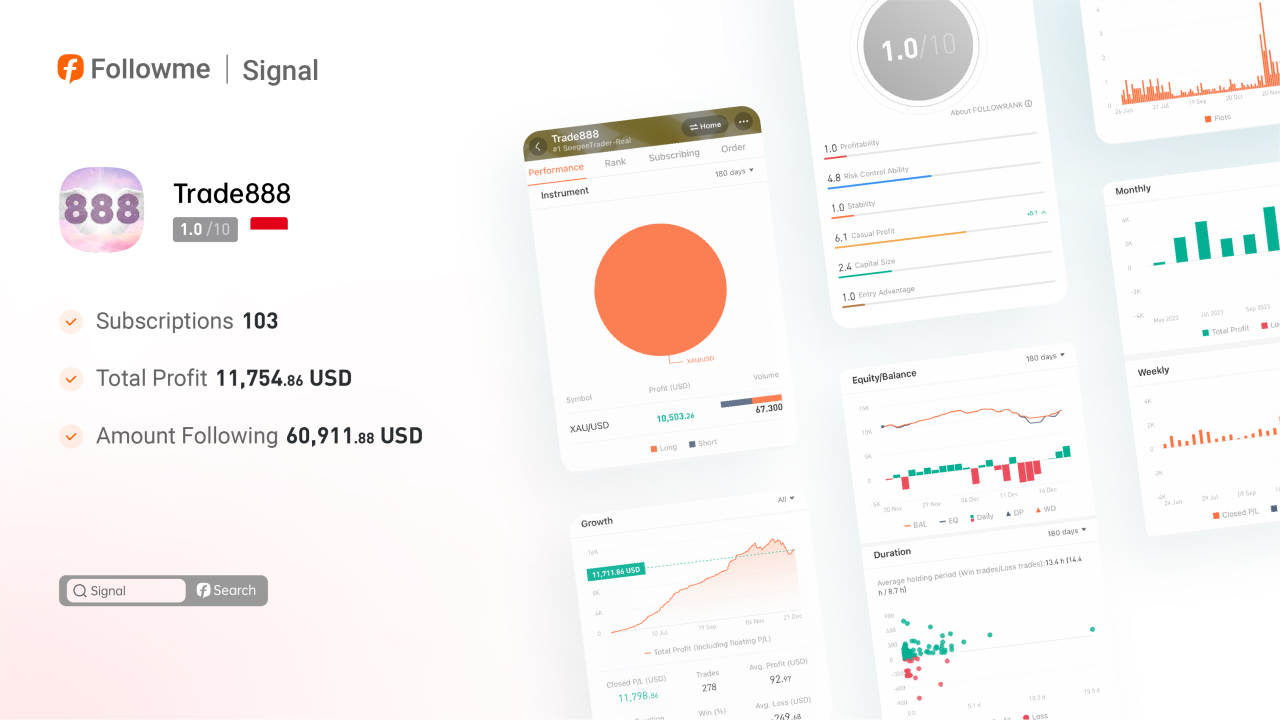

Trader named @Trade888, although the account rating is not high, has achieved a profit of $11,298.84 in 30 weeks, with a profit rate of 226%. In terms of the initial capital of $5,000, the annualized return rate is around 271%, which is quite impressive. Based on his historical records, I have deduced his three key profit strategies:

1. Profits should be secured.

Otherwise, profits will run away. If the first trade reaches the profit target, then within the same day, look for opportunities to increase the position proportionally. Then, wait for the exit point at a profit of 30 pips. Repeat this process until a losing trade ends the current operation. Of course, adding to the position is only feasible with ample funds and position control. Currently, his equity is around $10,000, and both the initial trade and additional positions are 0.5 lots, which is a small position.

2. As long as the strategy is deep enough, the market cannot trap me.

If the first trade incurs a short-term loss, then the strategy is simple: wait! If the floating loss reaches 70 pips, automatically exit the trade and end the current operation. If the floating loss turns into a floating profit, repeat the "first key rule." This way, you can see that his success rate is very high, at 85.29%.

3. As long as I run fast enough, risks cannot catch up with me.

As a trader, it is crucial to avoid turning short-term trades into medium-term trades and to mitigate the risks associated with time. Therefore, the average holding time for losing trades is only 8.7 hours, while profitable trades are held for an average of 14.4 hours.

4. If you often stand by the river, your shoes will inevitably get wet.

When conducting trend-following operations, there may be times when the market catches you off guard, continuously oscillating without giving you an opportunity to add to your position. It keeps hitting your stop-loss and forcing you to exit frequently. For example, in mid-December of this year, out of 16 trades, 12 resulted in losses, leading to his drawdown of 35.84%.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()