What if we traded using double top and double bottom patterns throughout 2023?

Double top and double bottom patterns are two popular chart patterns among forex traders. Almost everyone knows about these patterns because they are very easy to identify. A double top pattern looks like a letter M, and a double bottom pattern looks like a letter W.

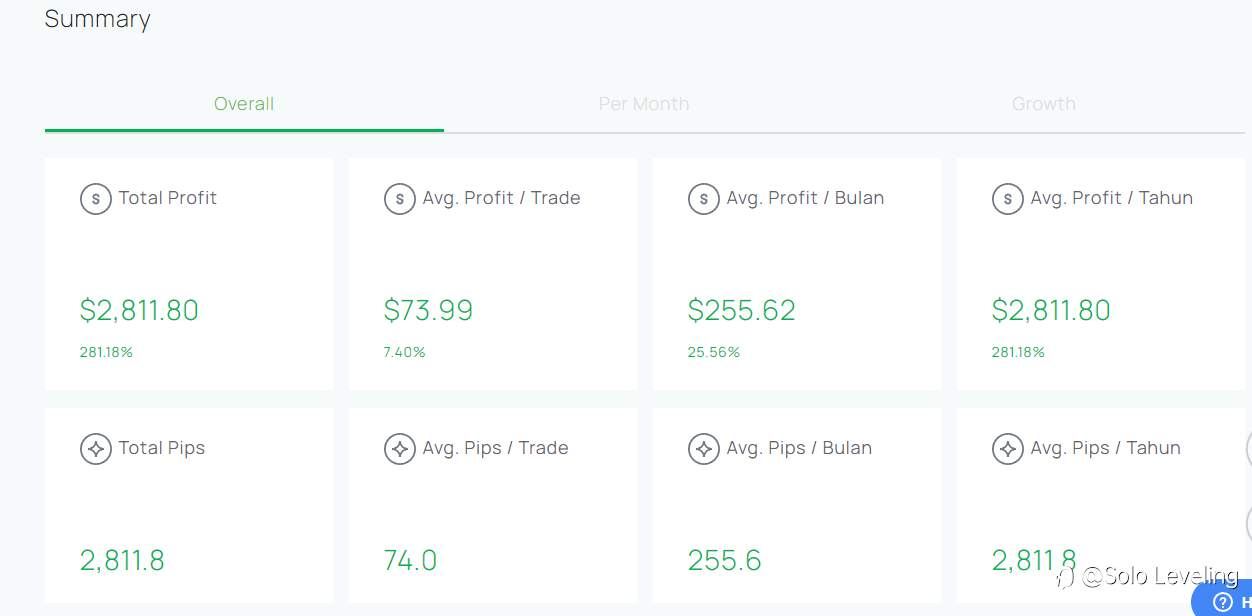

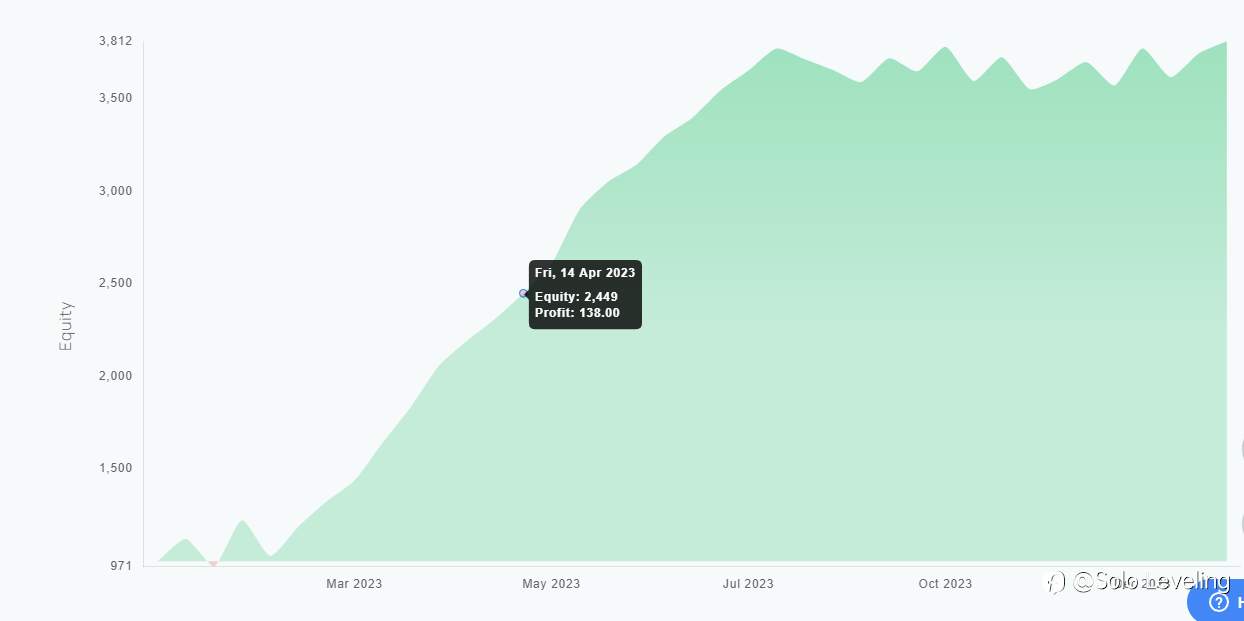

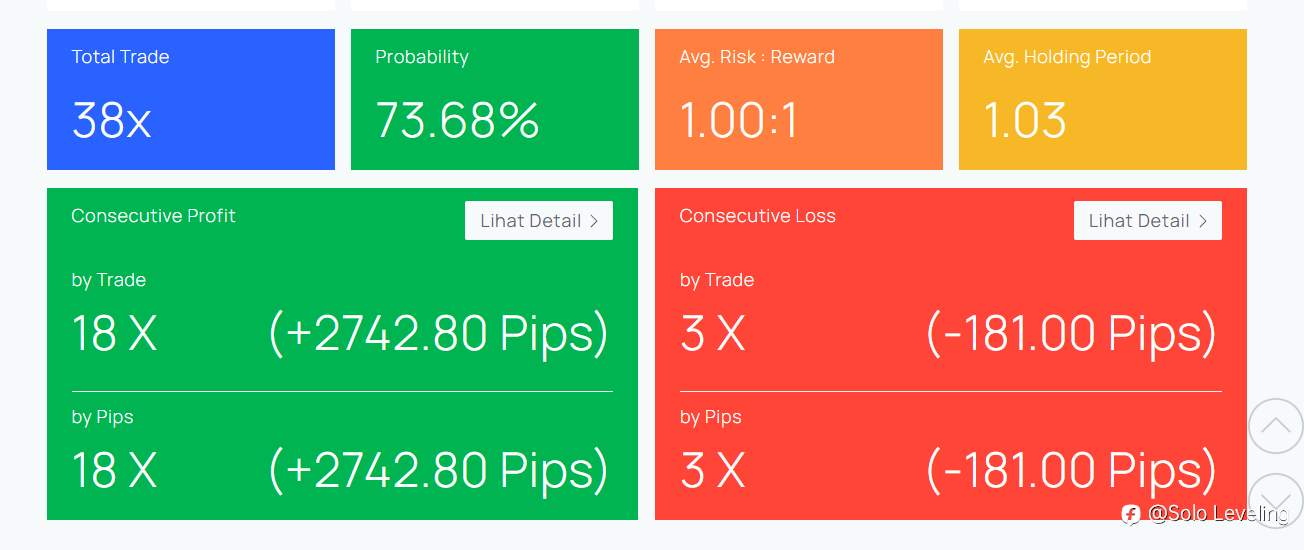

I tried to track back the performance of double top and double bottom patterns. I did it on the XAUUSD H4 timeframe from January 2023 to December 2023. And it turns out that even though these two patterns are very simple, their performance throughout the period was not simple at all.

But before you see the backtest results, you need to understand first how I identify double top and double bottom patterns.

In determining a pattern as a double top or double bottom, I do not fully refer to the general understanding of these two patterns. According to the general concept that you can find on the internet, books, and other mainstream sources, double top patterns are preceded by an uptrend and double bottom patterns are preceded by a downtrend. This means that double top and double bottom patterns always occur at the end of a trend.

I have my own understanding, and I do not think that double top must be preceded by an uptrend and double bottom must be preceded by a downtrend. I understand double top patterns as a letter M and double bottom patterns as a letter W, regardless of whether they are at the end or in the middle of a trend.

For example:

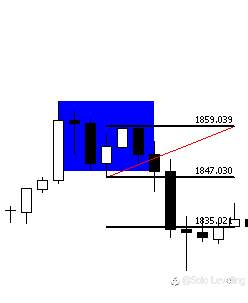

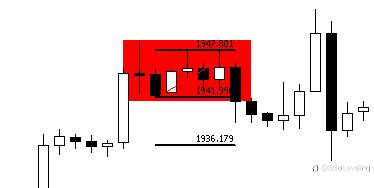

In the chart above, I see a price correction that forms a letter W. This is a characteristic of a double bottom pattern. Another criterion I use to identify a double bottom is that the first swing (a) high is higher than the second swing high (b). This is the opposite of a double top pattern, where the first swing low is lower than the second swing low. I added this criterion to my analysis to help distinguish between double top and double bottom patterns and rectangle patterns.

To determine the entry level, I place a pending order (buy stop or sell stop) right on the neckline. The stop loss is placed at the lower peak for a double top pattern and the higher trough for a double bottom pattern. The take profit is set at a ratio of 1:1 to the stop loss

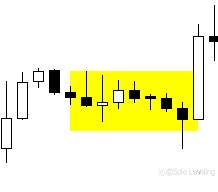

As part of my backtesting process, I marked successful patterns with blue and failed patterns with red. I also marked questionable patterns with yellow.

These questionable patterns (yellow marks) are ones that I might not be able to identify in real-time trading or patterns that don't give me the opportunity to place a pending order.

To see where I have marked these patterns on the chart, install this tempate in your Metatrader 5 terminal: backtest.tpl

I excluded the questionable patterns (yellow marks) from the calculation, because I wanted to simulate a real-time trading scenario. However, I still marked the patterns so that you can understand how I backtested and why I missed some double top and double bottom patterns.

The backtest results were simulated using a $1000 account and a lot size of 0.1 for each trade. The results are as follows:

Here are the details of the transactions in the backtest: Backtest.csv

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发