The euro dipped on Tuesday s Washington and Beijing remained locked in trade talks that left markets unsettled. China-Europe trade maintained growth momentum in Q1 despite headwinds.

The ECB cut interest rates as expected on Thursday but hinted at a pause in its year-long easing cycle given inflation within target. Markets sees a just one more rate cut toward the end of the year, possibly in December.

The central bank is "nearly done" cutting interest rates if inflation settles at 2% as expected and any surprises in growth and inflation data would "affect" the policy path, Boris Vujcic said on Saturday.

Ongoing trade tensions escalated by Washington are a shock to the global economy, meaning the Fed's and the ECB's monetary policies are unlikely to diverge for long, Isabel Schnabel said.

The latest interest-rate moves prime policymakers to meet medium-term inflation goal but what lies ahead of them "will be delicate and very uncertain," President Christine Lagarde said in an interview.

The EU is likely to retaliate against any permanent US tariffs, raising the cost of trade. Firms could relocate some activity to avoid trade barriers but changes to supply chains are also likely to raise costs.

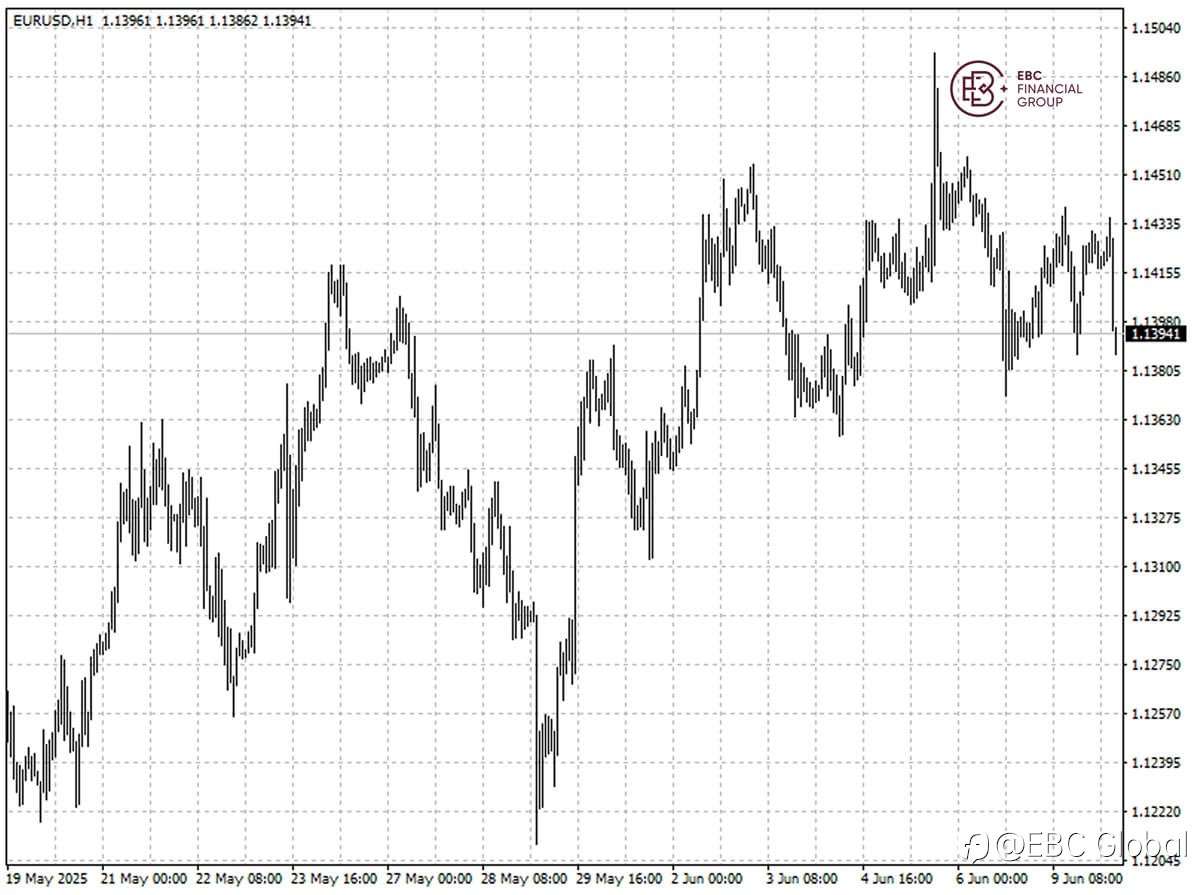

The euro rebounded from its previous low around 1.1387. The range trading may well continue, so we see the common currency keep going north with initial resistance at 1.1411.

EBC Forex Market Analysis Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Industry In-depth Analysis or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()