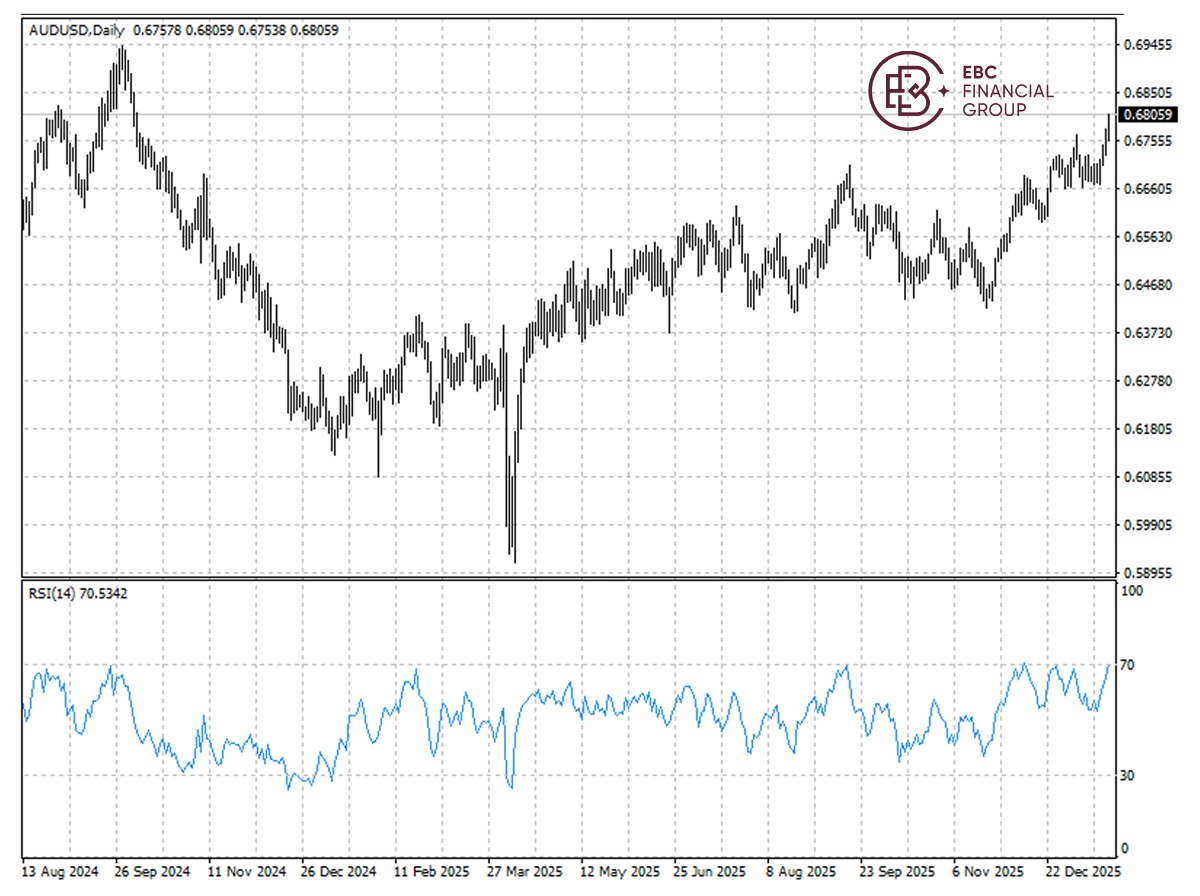

AUDUSD

Australian Dollar / US Dollar

0.69908

-0.00145

(-0.21%)

Prices By FOLLOWME , in USD

数据

更多

LOW

HIGH

0.69858

0.70217

做空

做多

47.19%

52.81%

1 W

+1.52%

1 MO

+4.78%

3 MO

+6.86%

6 MO

+8.84%

What Is The US Dollar Index And How Can You Trade It?

What is the US Dollar Index? The US Dollar Index (DXY, DX, USDX) measures the value of the United States dollar relative to a basket of other currencies, including the currencies of some of the US’s major trading partners. The Dollar Index rises when the US dollar gains strength compared to the othe

- Jenny Claude :Trade with Mr Anthony M Lucas on facebook 👉 Anthony M Lucas or WhatsApp 👉 +44 7576 723901 for more winning profits. 💯Legit

- Jenny Claude :Trade with Mr Anthony M Lucas on facebook 👉 Anthony M Lucas or WhatsApp 👉 +44 7576 723901 for more winning profits. 💯Legit

- Jenny Claude :Trade with Mr Anthony M Lucas on facebook 👉 Anthony M Lucas or WhatsApp 👉 +44 7576 723901 for more winning profits. 💯Legit

EBC Markets Briefing | Aussie dollar may lose steam; gas prices skyrocketed

The Australian dollar hit 15-month highs on Thursday as a de-escalation in Greenland tensions soothed risk sentiment, while a strong set of domestic jobs data narrowed the odds on a near-term rate hike. The unemployment rate fell unexpectedly to 4.1%, the lowest in seven months, mirroring signs of a

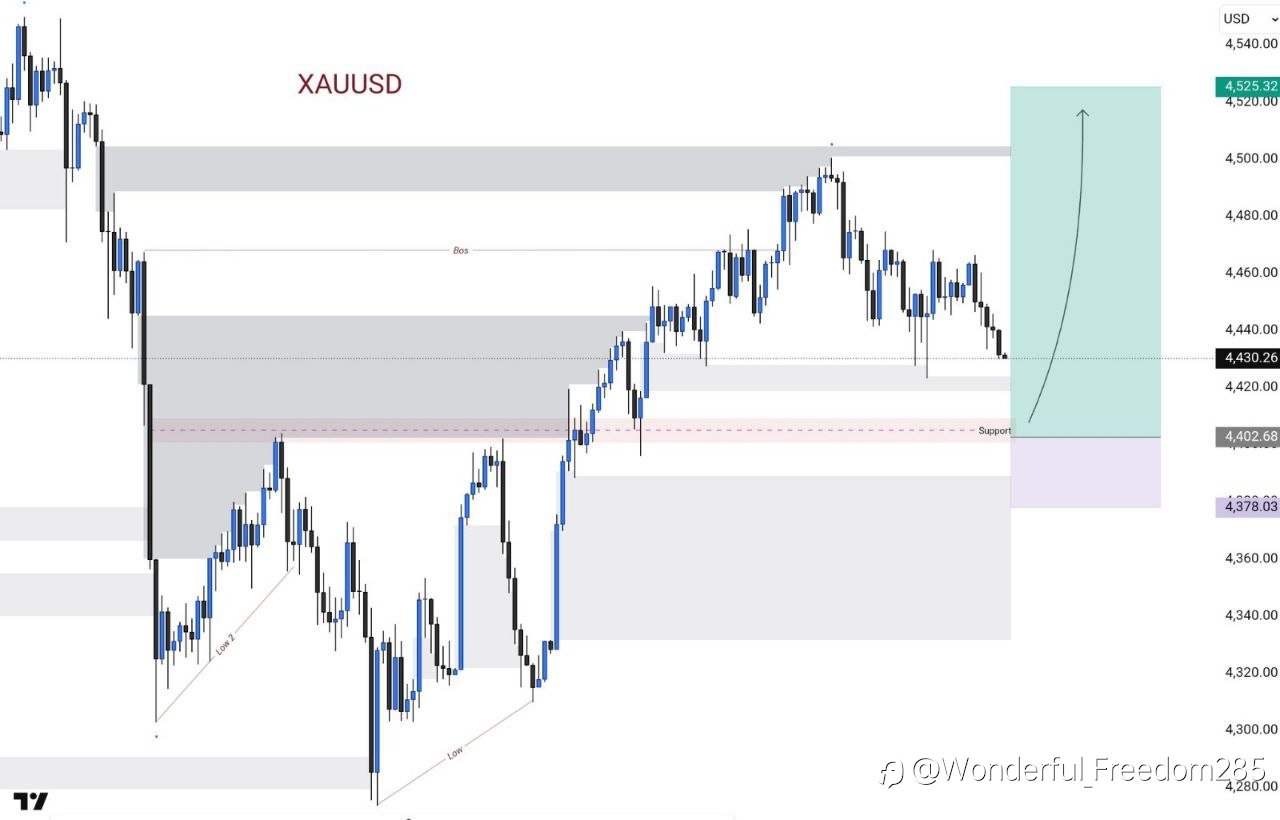

XAUUSD Update

Gold holds strong near 4400 support, reacting from a higher-TF demand zone. The recent dip looks like a healthy pullback, not a trend change. 📈 Bullish above 4400 🎯 Targets: 4480 → 4520 → 4560 ⚠️ Below 4380 weakens the bias Geopolitical risks & USD uncertainty keep gold supported on dips.

- Elon Musk Fan page :HOW ALLIANCELEGACY TRADE WORKS Download and register any bitcoin wallet app, you buy bitcon or USDT from $50 up and you will choose a plan of your choice and invest and the system trade it automatic...

Gold price keeps achieving the positive targets – Analysis - 09-03-2022

Gold price provided additional positive trades and approach our next target at 2075.00, and the chances seem valid to continue the rise and surpass this level to open the way to achieve more gains on the intraday and short term basis, noting that the next station reaches 2100.00$ barrier. Therefore,

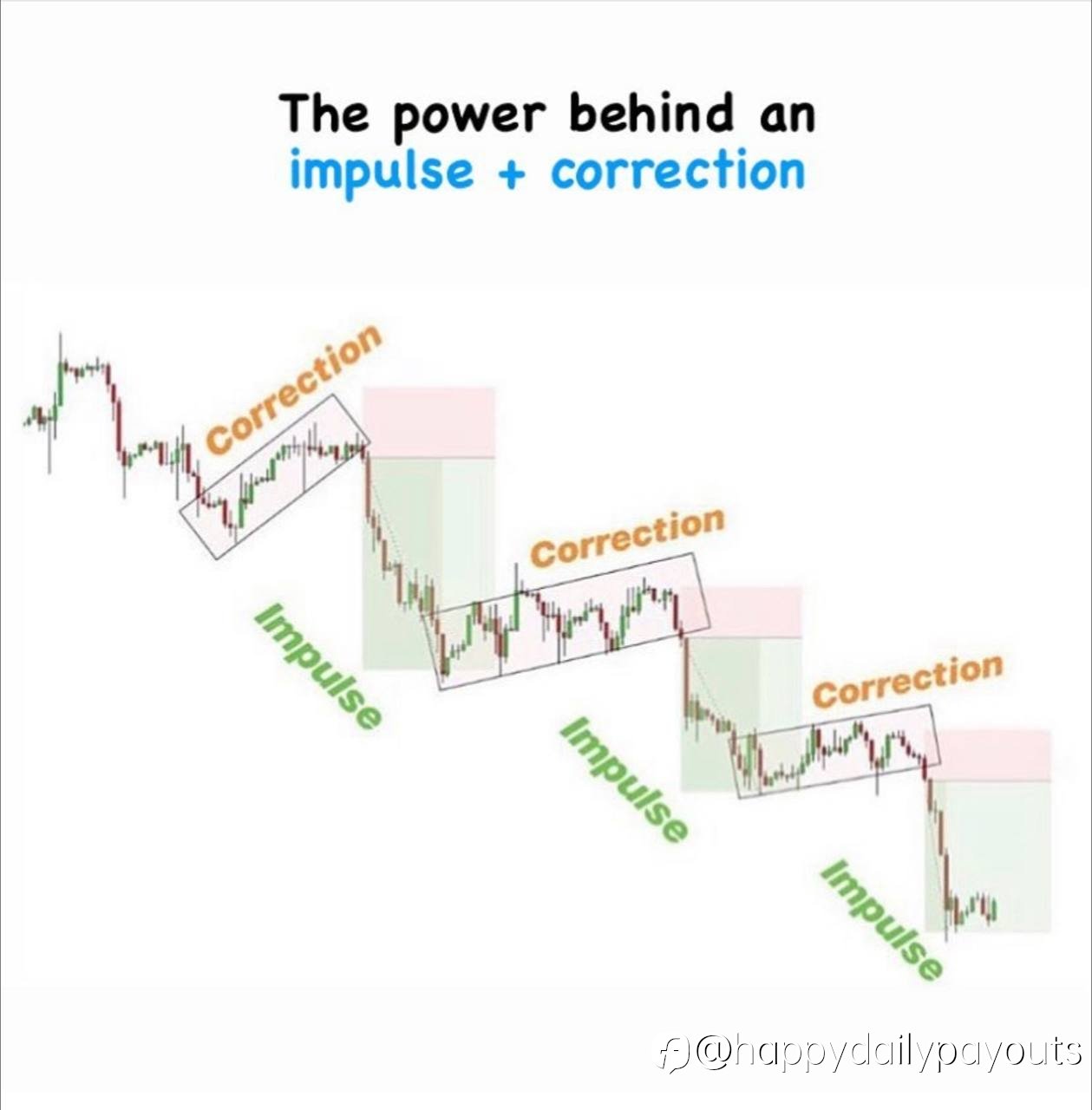

Top 5 Indicators Every Beginner Trader Should Know

💡 Indicators are your toolkit in the markets. They cut through the noise, highlight key patterns, and help you make more confident, informed decisions — especially when you’re starting out. 🔢 Moving Averages (MA) 🔵 What it does: Smooths price action to reveal the overall trend. ✅ Use it for: Iden

- Marcusalberttt :in totally would be ?

正在加载中...