The Australian dollar saw a moderate increase on Wednesday after the finalised deal between the US and UK marks a good start to a string a trade talks. However, Iran-Israel conflict capped its gains.

Iron ore headed for the lowest close since September on a slowdown in demand. The rainy season in southern China, as well as high temperatures in the north, is slowing construction, Shanghai Metals Market said.

China's factory output growth hit a six-month low in May, while new home prices extended a two-year long stagnation. The 3.3% decrease in PPI also highlight challenges to the metal.

Citigroup has cut prompt-to-three month price forecast to $90 a ton from $100, while the six-to-twelve month target was scaled back to $85 from $90. US tariff pose additional risks to Australia.

Australians are distrustful of Trump, according to a new survey released by the Lowy Institute think tank, complicating Canberra's task of managing ties with the world's largest economy.

In May, the country's seasonally adjusted balance on goods and services saw a surplus increase of A$1,337 million, as a notable rise in beef and wheat exports offset the decline in commodity exports.

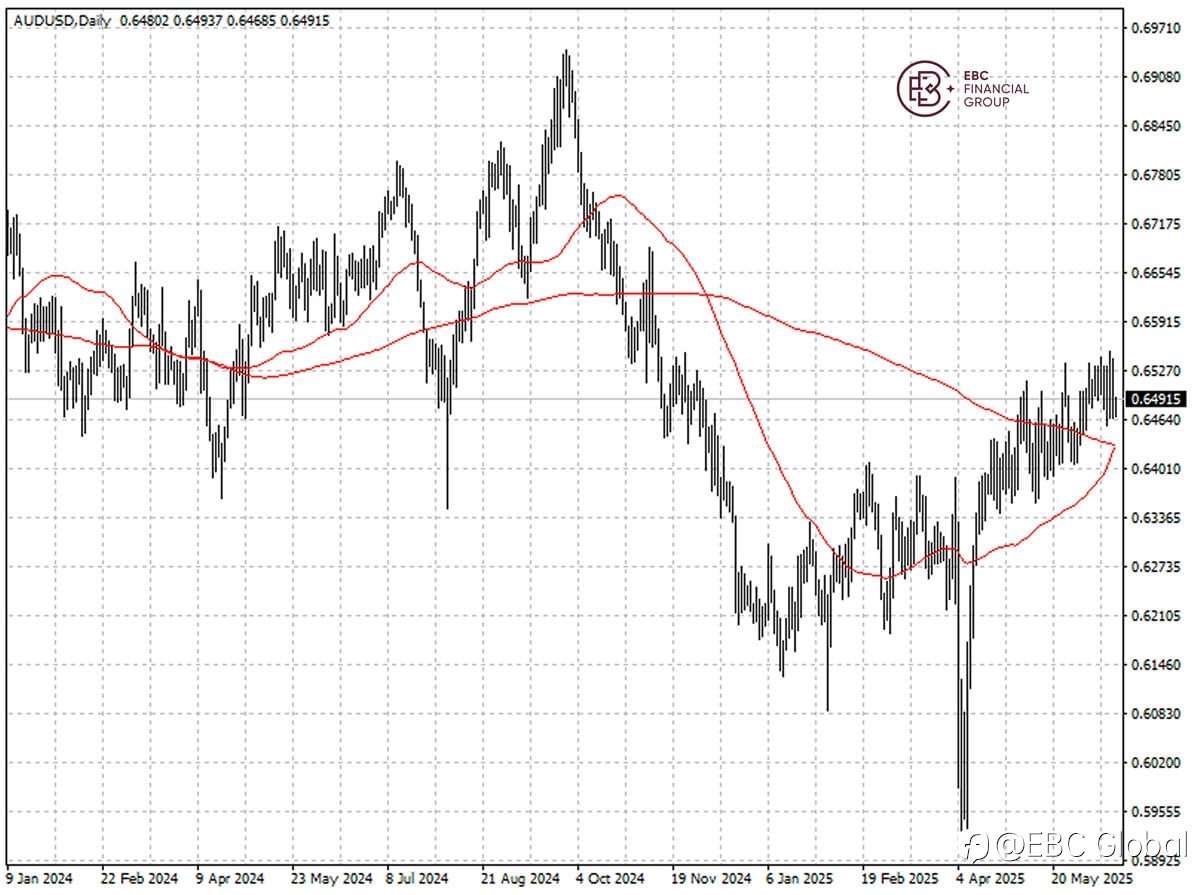

The Aussie dollar is about to show the golden cross. If that happens, we expect another leg higher which could lead to 0.6600, last seen in November 2024.

EBC Forex Market Analysis Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Industry In-depth Analysis or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()