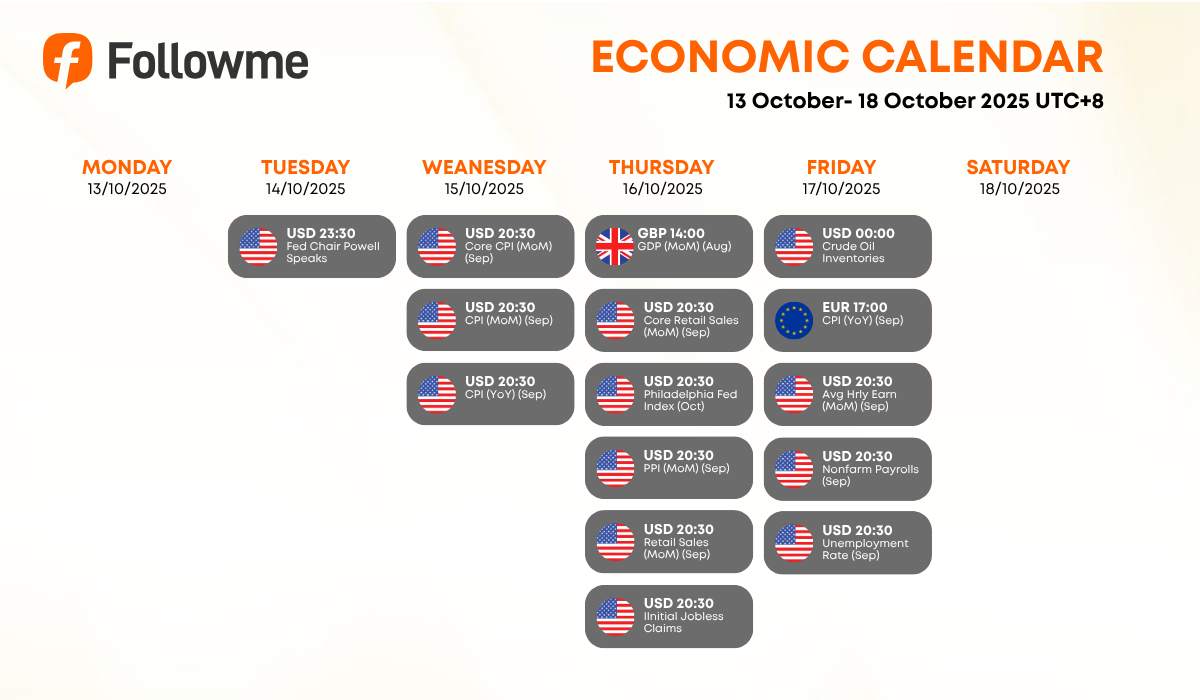

Weekly Economic Calendar: Week of October 13 to 18, 2025 (GMT+8)

This week's economic calendar is packed with U.S. inflation, retail, and labor market data all of which could heavily influence Fed expectations and market sentiment. Fed Chair Powell's speech early in the week will set the tone ahead of the CPI and Nonfarm Payrolls releases. This content is only supported in a Lark Docs| Time | Cur. | Events | Fcst | Prev |

|

Tuesday, October 14, 2025

|

||||

| 23:30 | USD |

Fed Chair Powell Speaks

|

||

| Wednesday, October 15, 2025 | ||||

| 20:30 | USD | Core CPI (MoM) (Sep) | 0.30% | 0.30% |

| 20:30 | USD | CPI (MoM) (Sep) | 0.30% | 0.40% |

| 20:30 | USD | CPI (YoY) (Sep) | 2.90% | |

| Thursday, October 16, 2025 | ||||

| 14:00 | GBP | GDP (MoM) (Aug) | 0.00% | |

| 20:30 | USD | Core Retail Sales (MoM) (Sep) | 0.40% | 0.70% |

| 20:30 | USD | Philadelphia Fed Manufacturing Index (Oct) | 23.2 | |

| 20:30 | USD | PPI (MoM) (Sep) | 0.30% | -0.10% |

| 20:30 | USD | Retail Sales (MoM) (Sep) | 0.40% | 0.60% |

| 20:30 | USD | Initial Jobless Claims | 223K | 218K |

| Friday, October 17, 2025 | ||||

| 00:00 | USD | Crude Oil Inventories | 3.715M | |

| 17:00 | EUR | CPI (YoY) (Sep) | 2.20% | 2.00% |

| 20:30 | USD | Average Hourly Earnings (MoM) (Sep) | 0.30% | 0.30% |

| 20:30 | USD | Nonfarm Payrolls (Sep) | 52K | 22K |

| 20:30 | USD | Unemployment Rate (Sep) | 4.3K | 4.3K |

| Key highlights: |

- 🇺🇸 Fed Chair Powell Speaks – Tuesday, Oct 14 (23:30)

- 🇺🇸 U.S. CPI & Core CPI – Wednesday, Oct 15 (20:30)

- Focus: Inflation remains sticky, and any upside surprise could reignite USD strength and weigh on equities. -

- 🇬🇧 UK GDP (MoM) – Thursday, Oct 16 (14:00)

- Stagnant growth could raise pressure on the Bank of England amid rising inflation risks.

- 🇺🇸 U.S. Retail Sales & PPI – Thursday, Oct 16 (20:30)

- Retail Sales: Forecast +0.4% (prev. +0.6%)

- PPI: Forecast +0.3% (prev. –0.1%)

- Jobless Claims: Forecast 223K (prev. 218K)

Consumer and producer data will provide key insights into spending momentum and inflation pipeline pressures.

- 🇪🇺 Eurozone CPI (YoY) – Friday, Oct 17 (17:00)

- Slight pickup expected — a hawkish sign for ECB watchers.

- 🇺🇸 U.S. Nonfarm Payrolls & Unemployment – Friday, Oct 17 (20:30)

- Unemployment Rate: Forecast 4.3% (prev. 4.3%)

- Average Hourly Earnings: +0.3% MoM (steady)

Labor data will be crucial for assessing whether the Fed maintains its current stance or shifts tone.

Macro Analysis

🇺🇸 United States – Inflation & Jobs in Focus

With Powell’s speech and CPI early in the week, traders will gauge whether inflation remains resilient.

Strong CPI or PPI could delay rate-cut expectations. Later, Nonfarm Payrolls will provide a labor check — any softness could spark dovish bets.

With Powell’s speech and CPI early in the week, traders will gauge whether inflation remains resilient.

Strong CPI or PPI could delay rate-cut expectations. Later, Nonfarm Payrolls will provide a labor check — any softness could spark dovish bets.

🇬🇧 United Kingdom – Growth Stalls

Flat GDP growth highlights ongoing economic weakness, keeping GBP under pressure unless the BoE turns surprisingly hawkish.

Flat GDP growth highlights ongoing economic weakness, keeping GBP under pressure unless the BoE turns surprisingly hawkish.

🇪🇺 Eurozone – Inflation Watch

A mild rebound in CPI could support the euro if the ECB maintains its cautious stance on rate cuts.

A mild rebound in CPI could support the euro if the ECB maintains its cautious stance on rate cuts.

Speculative Outlook for USD Traders

🟢 Bullish USD Scenario

- CPI and PPI print above expectations.

- Powell signals prolonged tightening bias.

- NFP beats forecasts.

→ Possible Trades: Long USD/JPY, Short EUR/USD, Short Gold.

- Powell signals prolonged tightening bias.

- NFP beats forecasts.

→ Possible Trades: Long USD/JPY, Short EUR/USD, Short Gold.

🔴 Bearish USD Scenario

- Inflation data cools more than forecast.

- Powell hints at easing or neutral stance.

- Weak jobs report increases rate-cut expectations.

→ Possible Trades: Long EUR/USD, Long Gold, Long GBP/USD.

- Weak jobs report increases rate-cut expectations.

→ Possible Trades: Long EUR/USD, Long Gold, Long GBP/USD.

🟡 Neutral / Mixed Setup

- CPI meets forecast but labor data disappoints — potential sideways USD moves with short-term volatility spikes.

Watch the full calendar at Followme Economic Calendar Tool

🔔 Don’t forget to follow Followme and stay in sync with the latest updates.

🔔 Don’t forget to follow Followme and stay in sync with the latest updates.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

喜欢的话,赞赏支持一下

暂无评论,立马抢沙发