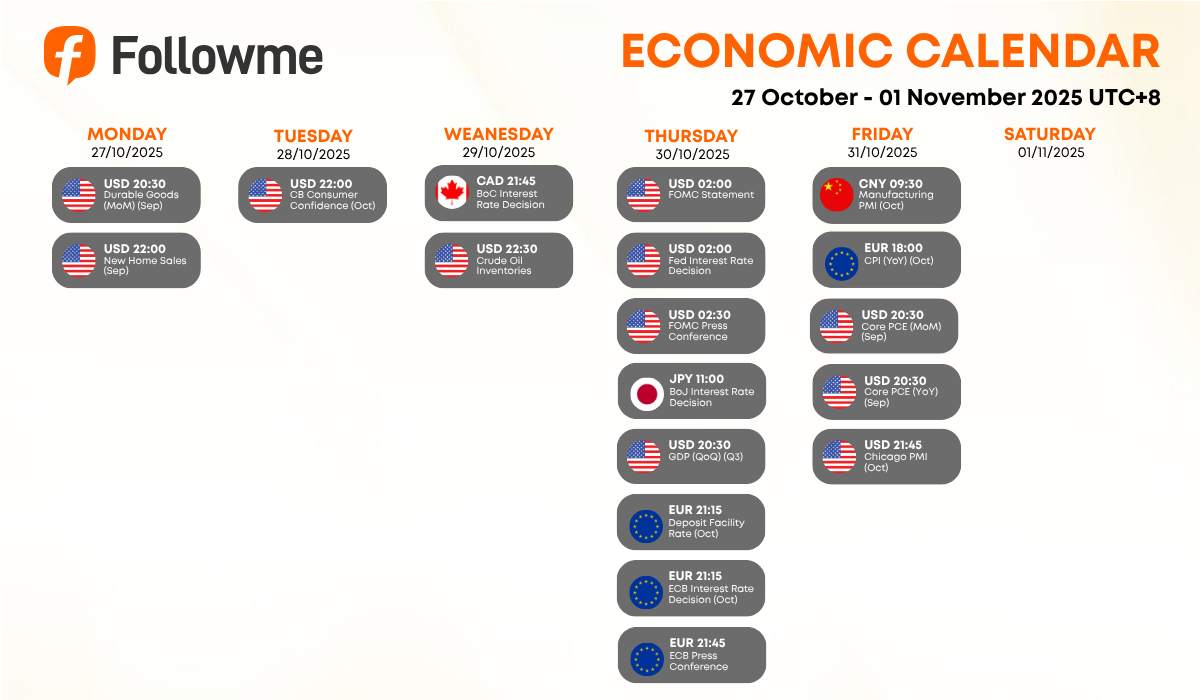

Weekly Economic Calendar: Week of October 27– November 01, 2025 (GMT+8)

A highly eventful week lies ahead — packed with central bank meetings (Fed, BoJ, ECB, BoC) and top-tier U.S. inflation and GDP data that could reshape global monetary outlooks. Traders should brace for heightened volatility across USD, JPY, and EUR pairs.

|

Time |

Cur. |

Events |

Fcst |

Prev |

|

Monday, October 27, 2025

|

||||

|

20:30 |

USD |

Durable Goods Orders (MoM) (Sep) |

2.70% |

|

|

22:00 |

USD |

New Home Sales (Sep)

|

710K |

800K |

|

Tuesday, October 28, 2025 |

||||

|

22:00 |

USD |

CB Consumer Confidence (Oct) |

93.9 |

94.2 |

|

Wednesday, October 29, 2025 |

||||

|

21:45 |

CAD |

BoC Interest Rate Decision |

2.25% |

2.50% |

|

22:30 |

USD |

Crude Oil Inventories |

-0.961M |

|

|

Thursday, October 30, 2025 |

||||

|

02:00 |

USD |

FOMC Statement |

|

|

|

02:00 |

USD |

Fed Interest Rate Decision |

4.00% |

4.25% |

|

02:30 |

USD |

FOMC Press Conference |

||

|

11:00 |

JPY |

BoJ Interest Rate Decision |

0.50% |

0.50% |

|

20:30 |

USD |

GDP (QoQ) (Q3) |

3.0% |

3.8% |

|

21:15 |

EUR |

Deposit Facility Rate (Oct) |

2.00% |

2.00% |

|

21:15 |

EUR |

ECB Interest Rate Decision (Oct) |

2.15% |

2.15% |

|

21:45 |

EUR |

ECB Press Conference |

||

|

Friday, October 31, 2025 |

||||

|

09:30 |

CNY |

Manufacturing PMI (Oct) |

49.7 |

49.8 |

|

18:00 |

EUR |

CPI (YoY) (Oct) |

2.10% |

2.20% |

|

20:30 |

USD |

Core PCE Price Index (MoM) (Sep) |

0.20% |

0.20% |

|

20:30 |

USD |

Core PCE Price Index (YoY) (Sep) |

2.90% |

|

|

21:45 |

USD |

Chicago PMI (Oct) |

42.0 |

40.6 |

|

Key highlights: |

🇺🇸 U.S. Durable Goods Orders (MoM) — Monday, Oct 27 (20:30)

Forecast: — | Previous: -2.70%

A rebound in durable goods would indicate stronger manufacturing momentum. Another drop could reinforce signs of weakening U.S. business investment.

🇺🇸 New Home Sales (Sep) — Monday, Oct 27 (22:00)

Forecast: 710K | Previous: 800K

The housing sector remains under pressure amid high borrowing costs. A sharper-than-expected decline could weigh on market confidence and the USD.

🇺🇸 CB Consumer Confidence (Oct) — Tuesday, Oct 28 (22:00)

Forecast: 93.9 | Previous: 94.2

Confidence is expected to remain soft. Weak consumer sentiment could hint at slower spending heading into Q4.

🇨🇦 BoC Interest Rate Decision — Wednesday, Oct 29 (21:45)

Forecast: 2.25% | Previous: 2.50%

Markets expect a rate cut, signaling the Bank of Canada may shift toward easing as growth slows. CAD volatility likely.

🛢️ U.S. Crude Oil Inventories — Wednesday, Oct 29 (22:30)

Previous: -0.961M

Oil traders will monitor whether supply draws continue; tightening inventories could support crude prices.

🇺🇸 FOMC Statement & Fed Rate Decision — Thursday, Oct 30 (02:00)

Forecast: 4.00% | Previous: 4.25%

The Fed is widely expected to cut rates by 25bps, marking a policy pivot as inflation moderates.

🇺🇸 FOMC Press Conference — Thursday, Oct 30 (02:30)

Chair Powell’s tone will be critical — dovish guidance could pressure the dollar and lift gold.

🇯🇵 BoJ Interest Rate Decision — Thursday, Oct 30 (11:00)

Forecast: 0.50% | Previous: 0.50%

No change expected, but traders will watch for commentary on inflation and possible yield curve tweaks.

🇺🇸 GDP (QoQ) (Q3) — Thursday, Oct 30 (20:30)

Forecast: 3.00% | Previous: 3.80%

Growth expected to slow; a sharp miss may intensify expectations for further Fed easing.

🇪🇺 ECB Interest Rate Decision — Thursday, Oct 30 (21:15)

Forecast: 2.15% | Previous: 2.15%

No change expected. Focus on Lagarde’s remarks at the 21:45 press conference for clues on 2026 rate path.

🇨🇳 Manufacturing PMI (Oct) — Friday, Oct 31 (09:30)

Forecast: 49.7 | Previous: 49.8

A reading below 50 signals contraction. China’s manufacturing pulse remains fragile amid weak external demand.

🇪🇺 CPI (YoY) (Oct) — Friday, Oct 31 (18:00)

Forecast: 2.10% | Previous: 2.20%

Eurozone inflation cooling could reinforce the ECB’s dovish stance and weigh on EUR.

🇺🇸 Core PCE Price Index (MoM) — Friday, Oct 31 (20:30)

Forecast: 0.20% | Previous: 0.20%

🇺🇸 Core PCE Price Index (YoY) — Friday, Oct 31 (20:30)

Forecast: 2.90% | Previous: 2.90%

The Fed’s preferred inflation gauge — any surprise higher could delay rate-cut expectations.

🇺🇸 Chicago PMI (Oct) — Friday, Oct 31 (21:45)

Forecast: 42.0 | Previous: 40.6

Manufacturing sentiment remains weak; a rebound could ease U.S. recession worries.

Macro Analysis

🇺🇸 United States — Central Focus Week

With both Fed and GDP data, the U.S. dominates market direction. A dovish rate cut may weigh on USD initially, but resilient GDP or inflation could limit downside.

🇪🇺 Eurozone — Inflation Cooling

Soft CPI and steady rates could add downward pressure on EUR unless Lagarde surprises with a hawkish tone.

🇯🇵 Japan — Steady Policy, Watch Yen

BoJ stability contrasts with global easing; any hint of tightening could lift JPY sharply.

🇨🇳 China — Weak Manufacturing Pulse

Sub-50 PMI readings highlight persistent weakness in industrial activity, weighing on Asian risk sentiment.

💡 Speculative Outlook for USD Traders

🟢 Bullish USD Setup

GDP beats expectations

Core PCE remains elevated

Powell signals cautious tone

→ Possible trades: Long USD/JPY, Short Gold, Short EUR/USD

🔴 Bearish USD Setup

GDP misses, CPI softens

Fed signals multiple rate cuts

→ Possible trades: Long Gold, Long EUR/USD, Long GBP/USD

🟡 Neutral / Range Setup

Data mixed; markets await clarity post-Fed

→ Sideways USD moves with short-term spikes in volatility.

Watch full calendar at Followme Economic Calendar Tool

Don’t forget to follow Followme and stay in sync with the latest updates.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()