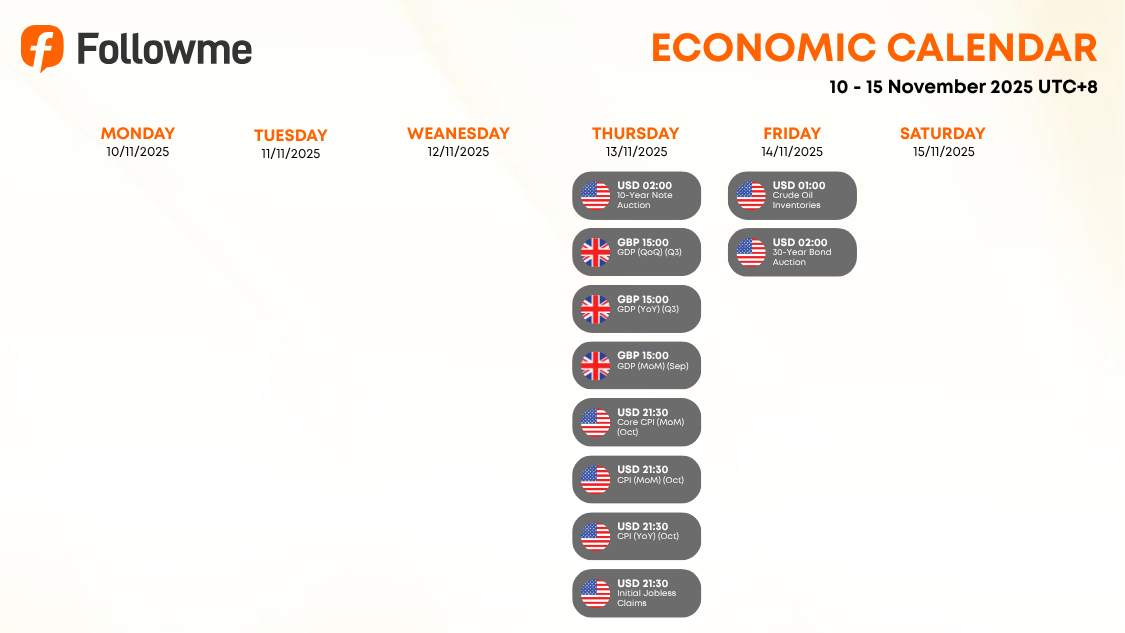

Weekly Economic Calendar: Week of November 10 - 15, 2025 (GMT+8)

A relatively light week on U.S. data, but Thursday's lineup could move markets with UK GDP and U.S. CPI on deck. Traders are watching closely for signs of how inflation and growth trends may shape the next moves from the Fed and Bank of England.

Key Highlights :

Thursday, 13 November 2025

🇬🇧 UK GDP (Q3 & Sep) (15:00)

Forecast: QoQ 0.3% | YoY 1.4% | MoM 0.1%

→ A steady reading would confirm that the UK economy is holding up modestly despite higher borrowing costs. Any downside surprise could weigh on GBP sentiment.

🇺🇸 Core CPI (Oct) (21:30)

Forecast: +0.2% MoM

→ Investors will be looking for confirmation that inflation pressures continue to cool. A stronger print could revive rate hike speculation.

🇺🇸 CPI (YoY, Oct) (21:30)

Forecast: 3.0% | Previous: 3.0%

→ Stable headline inflation would support expectations of steady Fed policy into year-end.

🇺🇸 Initial Jobless Claims (21:30)

Forecast: 218K

→ Labor market remains tight; any uptick could hint at a gradual slowdown.

Friday, 14 November 2025

🛢️ U.S. Crude Oil Inventories (01:00)

→ Oil traders will watch for another drawdown that could push prices higher and keep inflation risks alive.

🇺🇸 30-Year Bond Auction (02:00)

→ Results will gauge investor appetite for long-term Treasuries after recent yield volatility.

Macro Analysis

- U.S. Inflation and labor data remain the main focus, as traders gauge whether the Fed can stay on hold.

- U.K. GDP readings will show if growth momentum is stabilizing amid persistent price pressures.

- Energy markets Oil inventories could add fuel to the inflation narrative if supply tightens again.

💡 Speculative Outlook for USD Traders

🟢 Bullish USD: CPI beats forecast, jobless claims steady → Long USD/JPY, Short Gold

🔴 Bearish USD: Softer CPI, weaker labor data → Long Gold, Long GBP/USD

🟡 Neutral: Mixed data → Range-bound USD ahead of next Fed clues

🔴 Bearish USD: Softer CPI, weaker labor data → Long Gold, Long GBP/USD

🟡 Neutral: Mixed data → Range-bound USD ahead of next Fed clues

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

喜欢的话,赞赏支持一下

-THE END-