Weekly Economic Calendar: Week of November 17 - 22, 2025

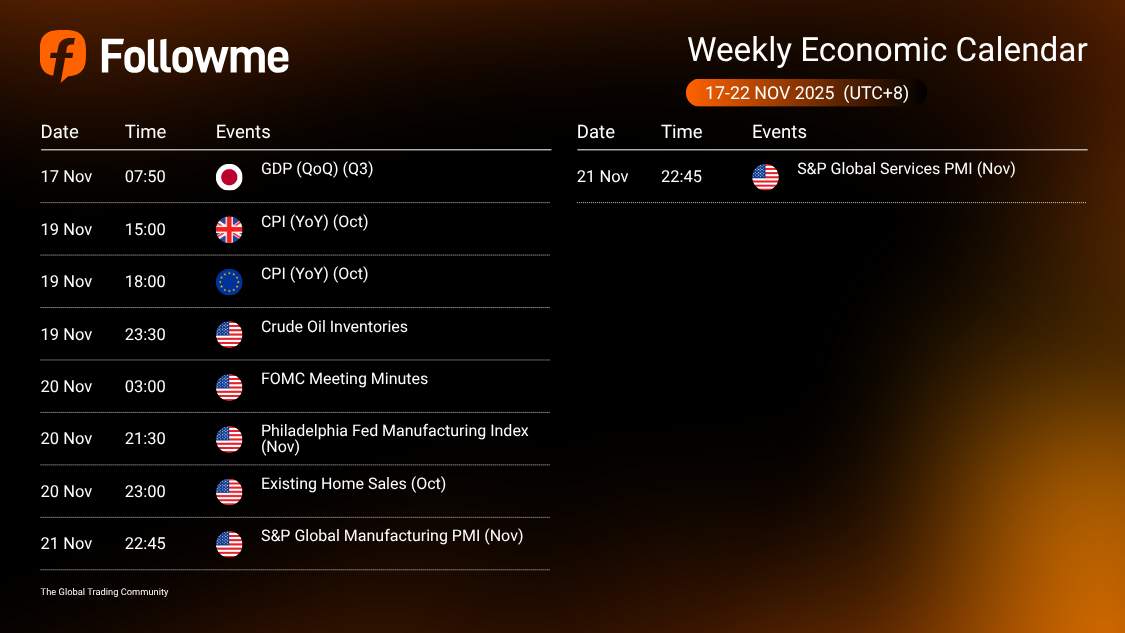

Weekly Economic Calendar: Week of November 17 - 22, 2025 (GMT+8)

This week brings a mix of key inflation figures, central bank insights, and U.S. economic indicators that could set the tone for market sentiment. While the early part of the week is quiet, activity picks up from Wednesday onward, with traders closely watching how fresh data might shape expectations for policy moves from major central banks.

This week brings a mix of key inflation figures, central bank insights, and U.S. economic indicators that could set the tone for market sentiment. While the early part of the week is quiet, activity picks up from Wednesday onward, with traders closely watching how fresh data might shape expectations for policy moves from major central banks.

Key Highlights

Monday, Nov 17

🇯🇵 Japan GDP (QoQ, Q3) 07:50

- Previous: 0.50%

Japan’s latest quarterly GDP will offer a read on how well the economy is holding up amid persistent currency weakness and global slowdown concerns.

Japan’s latest quarterly GDP will offer a read on how well the economy is holding up amid persistent currency weakness and global slowdown concerns.

Wednesday, Nov 19

🇬🇧 UK CPI (YoY, Oct) 15:00

- Forecast: 3.60% | Previous: 3.80%

A continued decline in inflation would ease pressure on the Bank of England, while a surprise rebound could give GBP a lift.

A continued decline in inflation would ease pressure on the Bank of England, while a surprise rebound could give GBP a lift.

🇪🇺 Eurozone CPI (YoY, Oct) 18:00

- Forecast: 2.20% | Previous: 2.20%

Markets expect inflation to hold steady. Any deviation could influence expectations for upcoming ECB decisions.

Markets expect inflation to hold steady. Any deviation could influence expectations for upcoming ECB decisions.

🇺🇸 U.S. Crude Oil Inventories 23:30

- Previous: 6.413M

Oil markets remain sensitive, and another build or drawdown could add volatility—especially in energy-linked assets.

Oil markets remain sensitive, and another build or drawdown could add volatility—especially in energy-linked assets.

Thursday, Nov 20

🇺🇸 FOMC Meeting Minutes 03:00

Investors will be combing through the minutes for clues on the Fed’s stance regarding interest rates and the broader economic outlook.

🇺🇸 Philadelphia Fed Manufacturing Index (Nov) 21:30

- Forecast: -1.4 | Previous: -12.8

A sharp improvement is expected. If the number holds, it may point to early signs of recovery in the U.S. manufacturing sector.

A sharp improvement is expected. If the number holds, it may point to early signs of recovery in the U.S. manufacturing sector.

🇺🇸 U.S. Existing Home Sales (Oct) 23:00

- Forecast: 4.06M | Previous: 4.06M

The housing market has been sluggish, and another flat reading would reinforce the view that higher financing costs are still weighing on demand.

The housing market has been sluggish, and another flat reading would reinforce the view that higher financing costs are still weighing on demand.

Friday, Nov 21

🇺🇸 S&P Global Manufacturing PMI (Nov) 22:45

- Previous: 52.5

🇺🇸 S&P Global Services PMI (Nov) 22:45

- Previous: 54.8

Both indices remain in expansion territory, and this week’s updates will show whether business activity is holding steady as the year winds down.

Both indices remain in expansion territory, and this week’s updates will show whether business activity is holding steady as the year winds down.

Macro Analysis

United States The focus is firmly on Fed communication and the health of manufacturing, services, and housing sectors.

United Kingdom & Eurozone CPI data will shape expectations for monetary policy trajectories into early 2026.

Energy Markets Oil inventory data continues to influence inflation sentiment and commodity-linked currencies.

United Kingdom & Eurozone CPI data will shape expectations for monetary policy trajectories into early 2026.

Energy Markets Oil inventory data continues to influence inflation sentiment and commodity-linked currencies.

Speculative Outlook for USD Traders

🟢 Bullish USD:

Stronger U.S. data, upbeat PMI readings → Potential upside for USD/JPY, pressure on Gold

🔴 Bearish USD:

Weak manufacturing or soft Fed tone → Gold and GBP/USD could see renewed support

🟡 Neutral:

Mixed data → Likely range-bound trading as markets wait for clearer signals from the Fed

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

喜欢的话,赞赏支持一下

暂无评论,立马抢沙发