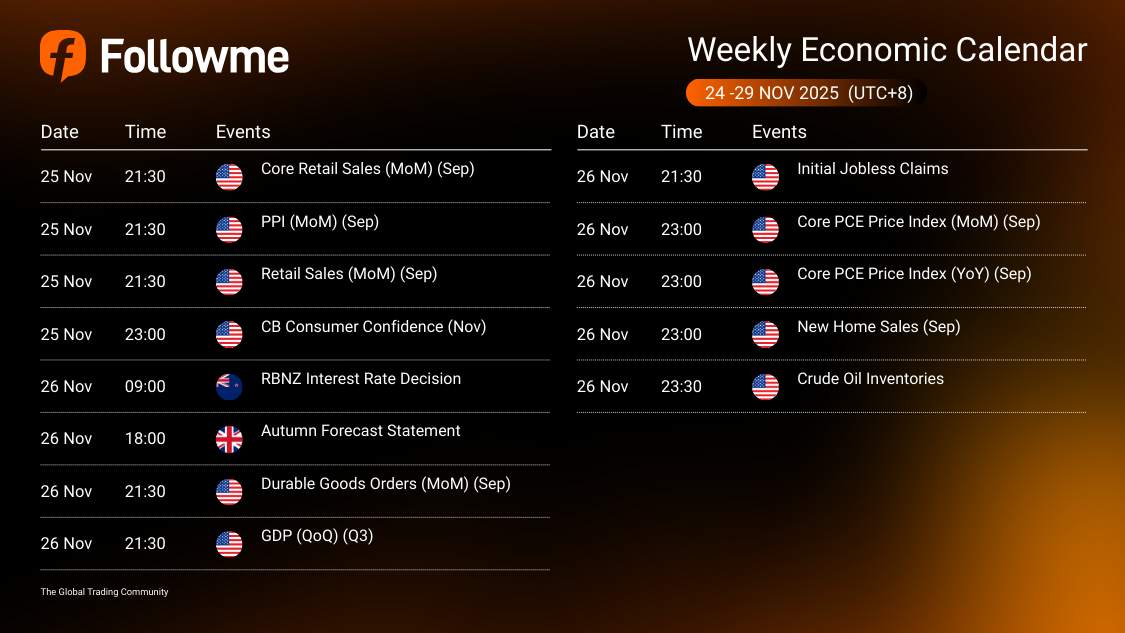

Weekly Economic Calendar: Week of November 24 - 29, 2025 (GMT+8)

This week features a steady flow of U.S. data retail sales, consumer sentiment, key inflation gauges and GDP updates. Activity picks up midweek with the RBNZ decision and several top-tier U.S. releases that could shape Fed expectations and market tone into December.

Key Highlights

Tuesday, Nov 25

🇺🇸 Core Retail Sales (MoM, Sep) 21:30

Previous: 0.70% — A key read on consumer strength. Softness would hint at cooling household demand.

🇺🇸 PPI (MoM, Sep) 21:30

Forecast: 0.30% | Previous: -0.10% — Watch upstream price pressure that feeds into CPI later on.

🇺🇸 CB Consumer Confidence (Nov) 23:00

Forecast: 93.4 | Previous: 94.6 — Soft sentiment would confirm cautious consumer behavior.

Wednesday, Nov 26

🇳🇿 RBNZ Interest Rate Decision 09:00

Forecast: 2.25% | Previous: 2.50% — Markets will watch for guidance; any easing signal could move NZD.

🇬🇧 UK Autumn Forecast Statement 18:00

Fiscal outlook that could affect yields and GBP depending on spending and tax plans.

🇺🇸 Durable Goods Orders (MoM, Sep) 21:30

Forecast: 0.20% | Previous: 2.90% — Likely cooling after last month’s surge; watch business investment trends.

🇺🇸 GDP (QoQ, Q3) 21:30

Previous: 3.80% — Revisions will influence the narrative on U.S. momentum into Q4.

🇺🇸 Initial Jobless Claims 21:30

Forecast: 220K — Labor data remain a key barometer for Fed policy timing.

🇺🇸 Core PCE (MoM & YoY, Sep) 23:00

Forecast MoM: 0.20% | YoY: 2.90% — The Fed’s preferred gauge; any upside could alter rate-cut expectations.

🇺🇸 New Home Sales (Sep) 23:00

Forecast: 710K | Previous: 800K — Higher mortgage rates continue to weigh on housing demand.

🛢️ U.S. Crude Oil Inventories 23:30

Previous: -3.426M — Further draws could push energy prices up and keep inflation worries alive.

Macro Analysis

United States Midweek data (PCE, GDP, durable goods) will be critical for the Fed narrative. Expect markets to parse the details for any change in rate-cut timing.

New Zealand RBNZ’s move could signal the start of easing if growth softens, increasing NZD volatility.

United Kingdom & Eurozone Fiscal and inflation developments will shape policy expectations into 2026.

Energy markets Oil inventory dynamics remain an important inflation input and driver for commodity-linked currencies.

New Zealand RBNZ’s move could signal the start of easing if growth softens, increasing NZD volatility.

United Kingdom & Eurozone Fiscal and inflation developments will shape policy expectations into 2026.

Energy markets Oil inventory dynamics remain an important inflation input and driver for commodity-linked currencies.

Speculative Outlook for USD Traders

🟢 Bullish USD

Stronger PCE, firm jobless claims, solid GDP → USD strength; potential downside in Gold

🔴 Bearish USD

Soft retail sales, lower GDP revision, weak PCE → Boost for Gold and EUR/USD

🟡 Neutral

Mixed signals across spending, inflation, and labor → Sideways USD trading as markets wait for December data

Watch the full calendar at Followme Economic Calendar Tool

🔔 Don’t forget to follow Followme and stay in sync with the latest updates.

🔔 Don’t forget to follow Followme and stay in sync with the latest updates.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

喜欢的话,赞赏支持一下

-THE END-