On December 10, 2025, the Federal Reserve delivered its anticipated holiday gift to markets—a 25 basis point rate cut, trimming the federal funds target to 3.50%-3.75%. This marks the third consecutive easing move in 2025, signaling confidence in cooling inflation but wariness over persistent pressures. The decision, passed 9-3, highlighted internal rifts: Fed Governor Miran pushed for a bolder 50 bp slash, while Chicago's Goolsbee and Dallas' Schmid voted to hold steady, citing sticky job growth.

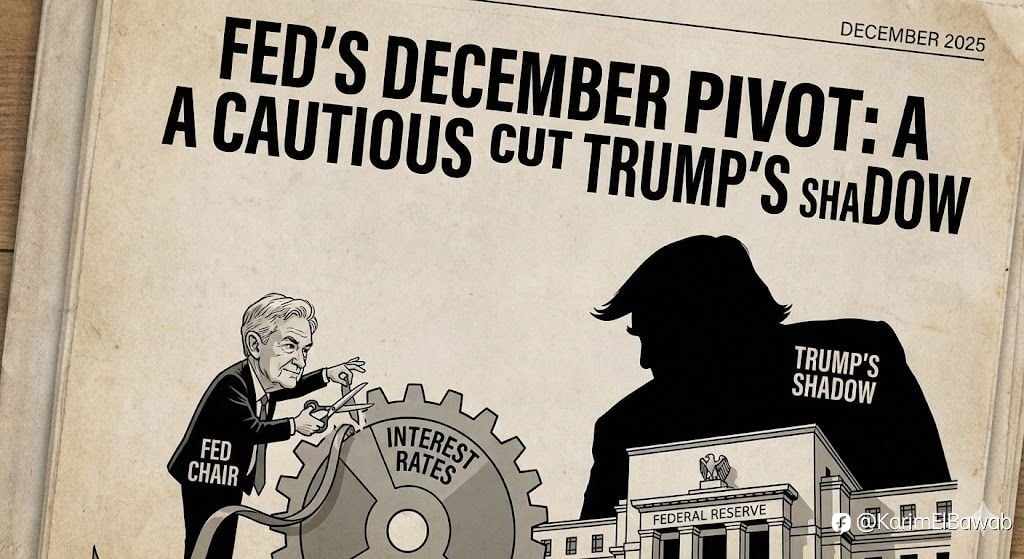

Jerome Powell's presser painted a nuanced picture of "progress on dual mandate" while dodging direct jabs at President Trump's vocal demands for deeper cuts. "We're not rushing; data dictates," Powell quipped, emphasizing balanced risks between recession and reacceleration. He nodded to Trump's fiscal plans—tariffs and tax extensions—as potential inflationary wildcards, hinting at a "higher for longer" path into 2026.

- Market Jitters: Equities dipped modestly (S&P 500 -0.5%), but bonds sold off sharply—10-year Treasury yields spiked to 4.21%, a three-month peak, as traders bet on fewer future easings.

- Crypto Crossfire: Bitcoin tumbled 1.4% to $92K on the "hawkish cut" vibe, while Ethereum eked out a 0.6% gain, buoyed by ETF inflow hopes.

- Global Echoes: The dollar strengthened 0.8% versus majors, pressuring emerging markets and yen carry trades.

Powell's composed tone masked the Fed's tightrope: easing without igniting Trump's ire or derailing the soft landing. With just two meetings left in 2026 before potential leadership shakeups, this cut feels like a bridge to uncertain waters.

Takeaway: The Fed's measured step buys time, but Trump's megaphone looms large—watch yields for the real policy tell. What's your bet on the next cut: January or bust?

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发