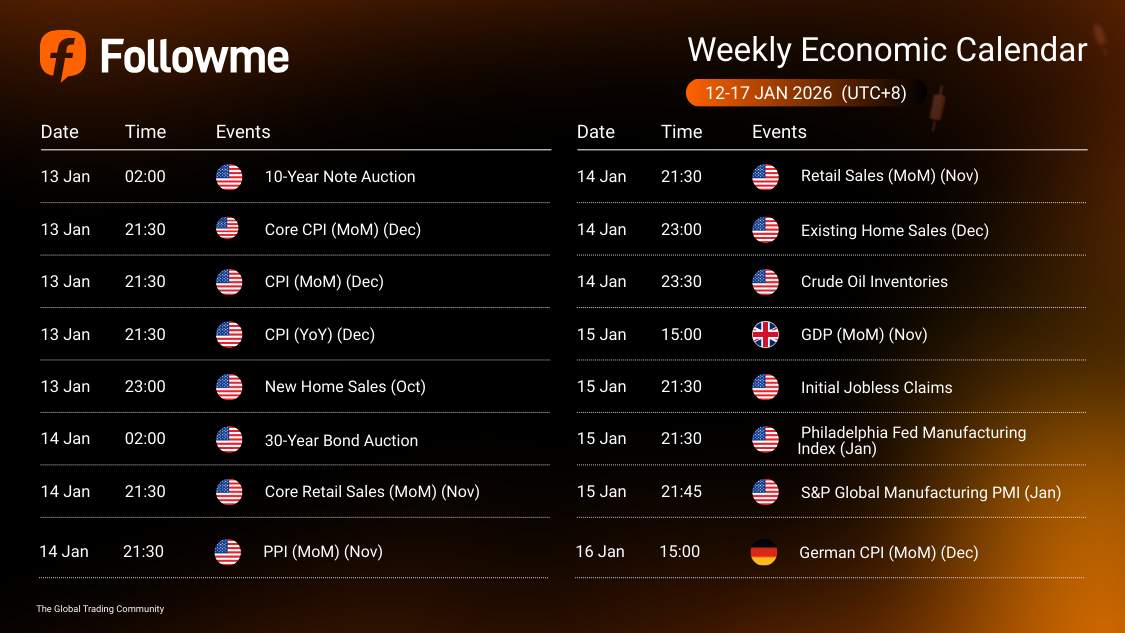

Weekly Economic Calendar: Week of January 12 - 17, 2026 (GMT+8)

This week’s macro calendar is driven by U.S. inflation + consumer demand (CPI → Retail Sales) and rates sensitivity (Treasury auctions), with follow-through risk from U.S. labour + manufacturing checks late-week. Expect the sharpest moves around the U.S. CPI on Tuesday and U.S. Retail Sales on Wednesday, while German CPI and UK GDP can shift EUR/GBP pricing and ripple into broader USD positioning.

| Time | Cur. | Events | Fcst | Prev |

| USD | ||||

| USD | ||||

| USD | ||||

| 30-Year Bond Auction | ||||

| Core Retail Sales (MoM) (Nov) | ||||

| USD | PPI (MoM) (Nov) | |||

| Retail Sales (MoM) (Nov) | 0.40% | |||

| Existing Home Sales (Dec) | ||||

| USD | Crude Oil Inventories | |||

| Philadelphia Fed Manufacturing Index (Jan) | ||||

| S&P Global Manufacturing PMI (Jan) | ||||

| German CPI (MoM) (Dec) |

| Key highlights: |

Macro Analysis

U.S. CPI Stack (Core CPI + CPI) – Tuesday

CPI is the main volatility trigger for USD and yields this week. A hotter CPI/Core CPI print supports a “sticky inflation” narrative (USD-supportive via higher yields), while a softer print can pull yields down and weigh on USD, especially if markets interpret it as faster disinflation.

U.S. Demand Stack (Retail Sales + Core Retail Sales + PPI) – Wednesday

Retail Sales is the key growth confirmation after CPI. Stronger sales supports “resilient demand” and can extend USD strength; weaker sales can flip the tone into growth concerns and increase two-way volatility—especially if PPI contradicts Tuesday’s inflation signal.

U.S. Rates Supply (10Y + 30Y Auctions) – Tuesday/Wednesday

Treasury auctions can shift yields and amplify (or fade) CPI/Retail Sales reactions. Weak demand can push yields up and support USD; strong demand can cap yields and dampen USD upside even if data is firm.

U.S. Housing Pulse (New Home Sales + Existing Home Sales) – Tuesday/Wednesday

Housing is secondary versus CPI/Retail Sales, but surprises can influence the growth narrative at the margin—especially if paired with big moves in yields.

Crude Oil Inventories – Wednesday

Inventory surprises can move oil sharply, impacting inflation expectations and oil-sensitive FX. A large draw can lift crude and inflation hedges; a big build can pressure crude and cool inflation fears.

U.S. Labour + Manufacturing Checks (Claims + Philly Fed + S&P Global Manufacturing PMI) – Thursday

This is the late-week “confirmation set” for whether the CPI/Retail Sales-driven move should hold. Rising claims can signal cooling; improving manufacturing indicators can reinforce stabilization and support risk sentiment and yields.

Germany & UK Macro (German CPI + UK GDP) – Friday/Thursday

The German CPI influences EUR rate expectations, while UK GDP can shift GBP pricing. Big surprises can move EUR/GBP crosses and indirectly affect USD positioning through broad risk and rates repricing.

Speculative Outlook for USD Traders

This is a CPI + Retail Sales week, expecting positioning to shift fast as inflation and demand data either confirm (or contradict) the rates narrative.

CPI/Core CPI surprises firmer than expected (sticky inflation signal)

Retail Sales/Core Retail Sales prints resilient (demand holds up)

Auctions lean soft (yields supported)

Claims stay steady, and manufacturing indicators avoid deterioration

🔴 Bearish USD Scenario

CPI/Core CPI comes in softer

Retail Sales disappoint (growth cooling) and/or PPI cools further

Auctions are strong

Claims tick higher, and manufacturing data weakens sentiment

🟡 Wild Cards (High Whipsaw Risk)

CPI composition (core drivers) vs headline reaction

Retail Sales mix (headline vs core) driving a reversal after CPI

Auction quality unexpectedly moving yields into/after the data

Oil inventory shock shifting inflation expectations midweek

Watch the full calendar at Followme Economic Calendar Tool

Don’t forget to follow Followme and stay in sync with the latest updates.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发