“Trendlines are simple, but when used correctly, they become one of the most accurate trading tools. Learn how professionals draw and trade trendlines.”

Introduction

Trendlines are one of the oldest yet most effective tools in Forex trading.

They help you:

- Identify the trend

- Spot high-probability entries

- Catch reversals and continuations

- Avoid trading against momentum

The problem?

Most traders draw trendlines incorrectly.

This article fixes that.

What Is a Trendline?

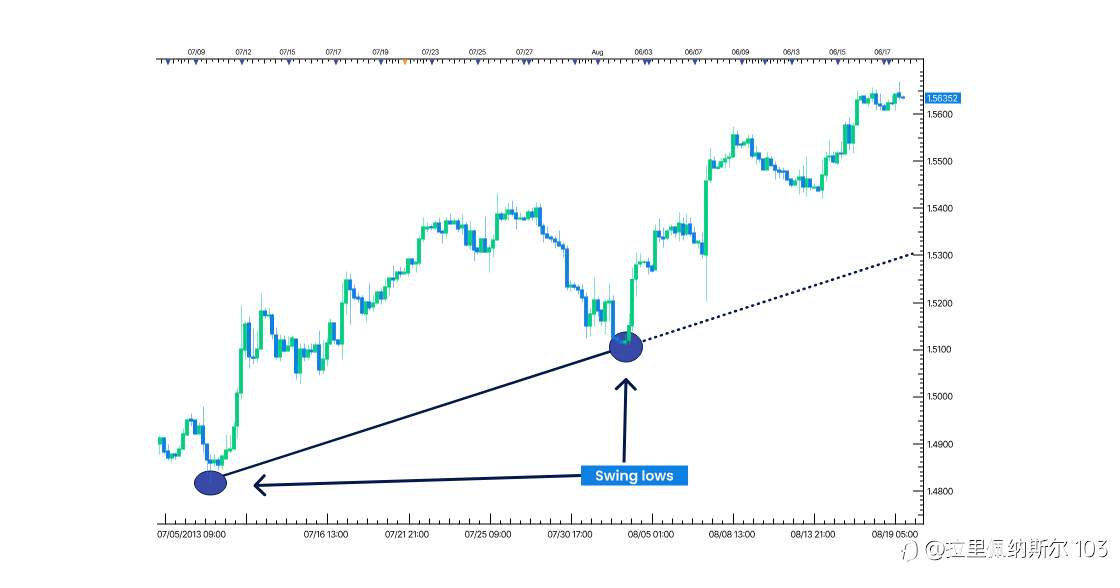

A trendline is a straight line drawn by connecting two or more swing points to show the market direction.

Types of Trendlines:

- Uptrend Trendline → connects higher lows

- Downtrend Trendline → connects lower highs

Trendlines act as dynamic support & resistance.

Rules for Drawing a Correct Trendline

Follow these rules to avoid false signals:

✔ Use at least 2 clean touch points

✔ The third touch confirms validity

✔ Do NOT force the line

✔ Ignore candle wicks when needed

✔ Use higher timeframes for accuracy

A clean trendline is better than a perfect one.

How to Trade Trendline Bounces (Continuation Trades)

✅ BUY Setup (Uptrend)

Conditions:

- Market is in uptrend

- Price pulls back to trendline

- Bullish rejection candle forms

- RSI or structure confirms

Stop Loss: Below trendline

Take Profit: Previous high

✅ SELL Setup (Downtrend)

Conditions:

- Market is in downtrend

- Price retraces to trendline

- Bearish rejection candle forms

- Momentum aligns

Stop Loss: Above trendline

Take Profit: Previous low

Trendline Break & Retest Strategy

Not all trendlines hold forever.

When they break, strong moves often follow.

How to Trade It:

✔ Wait for strong break candle

✔ Do NOT enter immediately

✔ Wait for retest of broken trendline

✔ Enter on rejection

This filters fake breakouts.

How to Avoid Fake Trendline Breaks

Fake breaks trap impatient traders.

Avoid them by:

❌ Trading wick breaks

❌ Entering without candle close

❌ Ignoring higher timeframe trend

❌ Trading during low volume

Always wait for confirmation.

Best Timeframes for Trendline Trading

Most reliable on:

- M15 (intraday)

- H1 (day trading)

- H4 (swing trading)

Higher timeframe = stronger trendline.

Pro Tip (High Accuracy Setup)

Combine trendlines with:

- Supply & Demand zones

- Market Structure

- RSI divergence

- Candlestick confirmation

This creates sniper-level entries.

Conclusion

Trendlines help you trade with structure instead of guessing.

When drawn correctly and combined with confirmations, they offer high-probability trades with low risk.

Master trendlines and you’ll see the market more clearly than most traders.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发