Hello everyone! In today’s article, we’ll review the recent performance of Boeing Co ($BA) through the lens of Elliott Wave Theory. We’ll look at how the pullback from recent 52 week highs unfolded as a textbook 3-swing correction and discuss what could come next. Let’s explore the structure and the expectations for this stock.

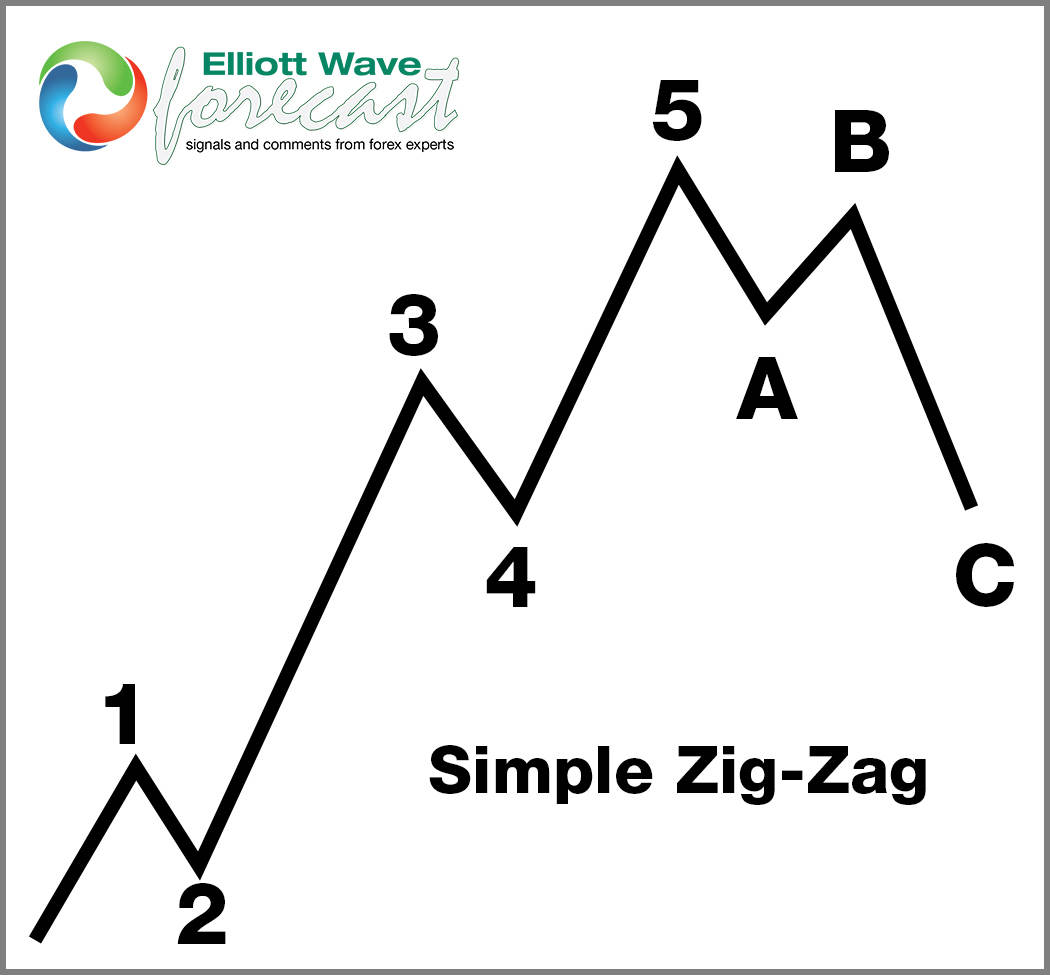

5 Wave Impulse Structure + ABC correction

$BA 4H Elliott Wave Chart 11.17.2025:

In the 4H chart from Nov 11, 2025, $BA completed a clear 5-wave impulsive cycle labeled ((1)). After such a move, a corrective pullback is typical. As expected, the stock began to retrace in three swings, forming what we identify as an ABC correction.

The price action suggested that buyers would likely appear near the extreme area between $194.15 and $170.06. This zone represents the ideal region where a correction usually ends and a new bullish cycle begins.

In other words, the market took a brief pause before potentially resuming its primary uptrend. Therefore, this structure aligns well with a standard Elliott Wave correction, offering traders a technical roadmap.

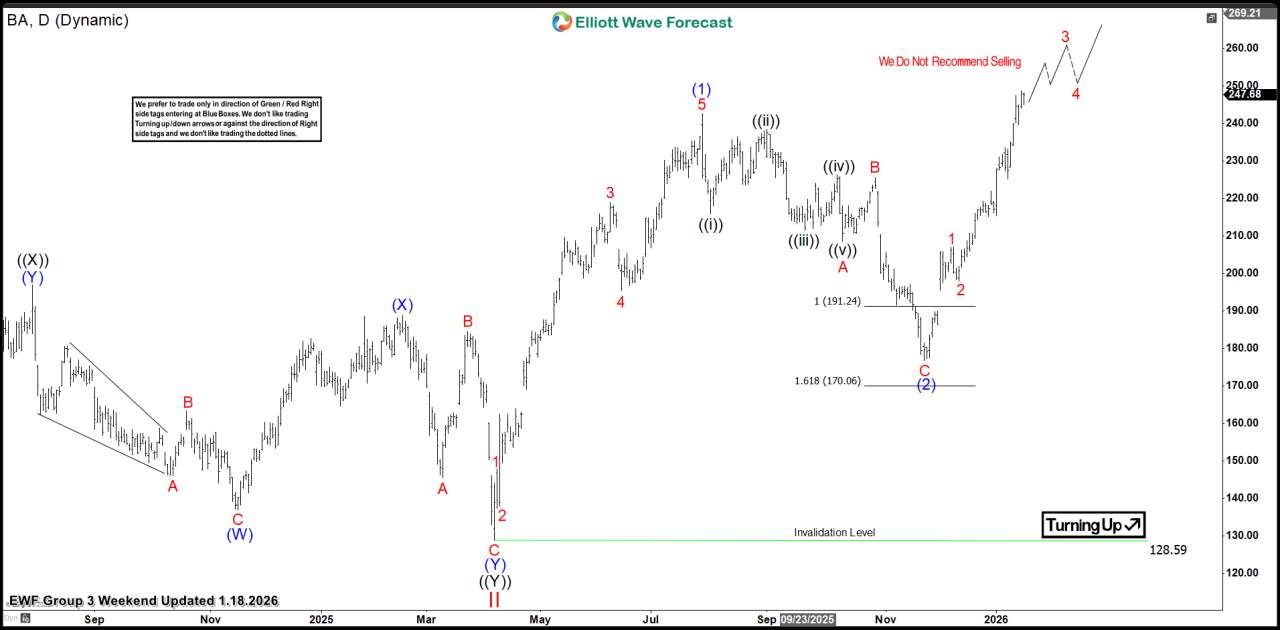

$BA Daily Elliott Wave Chart 1.18.2026:

The latest daily chart update, shows that the stock bounced and made new highs confirming the bullish trend. Currently, it is looking to remain supported against 11/21 low and higher in wave 3 of (3). Longs should be risk free and looking for $291-318 area as the next possible target.

Conclusion

In conclusion, our Elliott Wave analysis of $BA suggests the stock continues to trade within a bullish framework. By using Elliott Wave Theory, traders can better anticipate market structure, identify continuation zones, and plan trades with greater confidence.

In addition, understanding how impulse and correction phases interact helps improve risk control, especially in volatile markets like this one. Therefore, maintaining flexibility and discipline remains key as this structure evolves.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发