Elliott Wave Impulse in DAL Since April 07, 2025 — Structural Warning to World Indices

Since April 07, 2025, Delta Air Lines (NYSE: DAL) has traced a textbook five-wave impulsive advance under classical Elliott Wave Theory. The structure satisfies all core impulsive criteria and suggests that the advance from the April cycle low represents a mature motive phase. When a transport leade

Energy Sector ETF $XLE Incomplete Bullish Sequence, With $75 Target Still Ahead

Hello everyone! In today’s article, we’ll examine the recent performance of Energy Sector ETF ($XLE) through the lens of Elliott Wave Theory. We’ll review how the rally from the April, 2026, low unfolded as a 5-wave impulse and discuss our forecast for the next move. Let’s dive into t

Johnson Controls (JCI) Favors Rally Up To 151.5 Before Correcting Next

Johnson Controls International plc, (JCI) engages in engineering, manufacturing, commissioning & retrofitting building products & systems in United States & globally. It operates in four segments like Building Solutions in North America, Building Solutions EMEA/LA, Building Solutions Asi

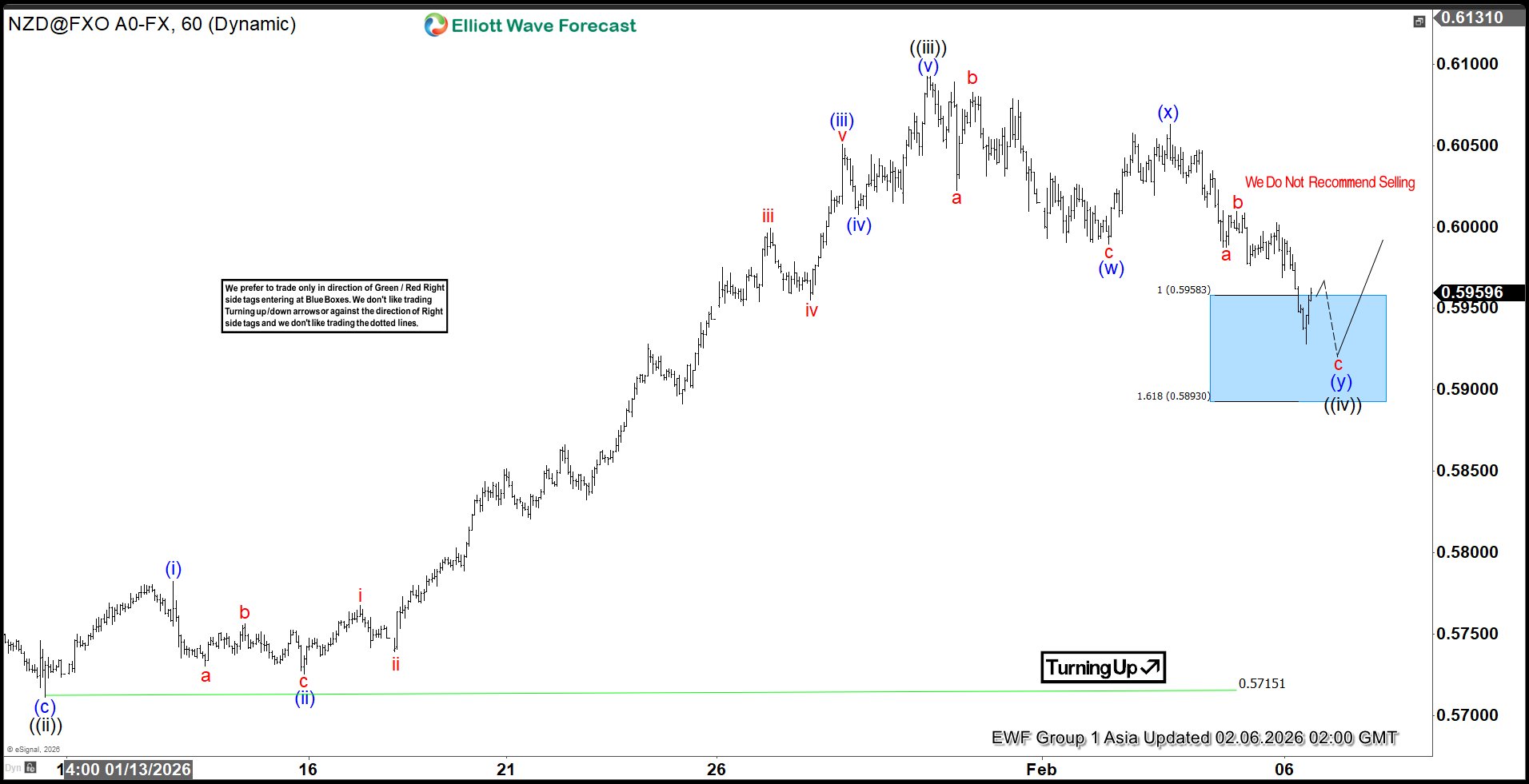

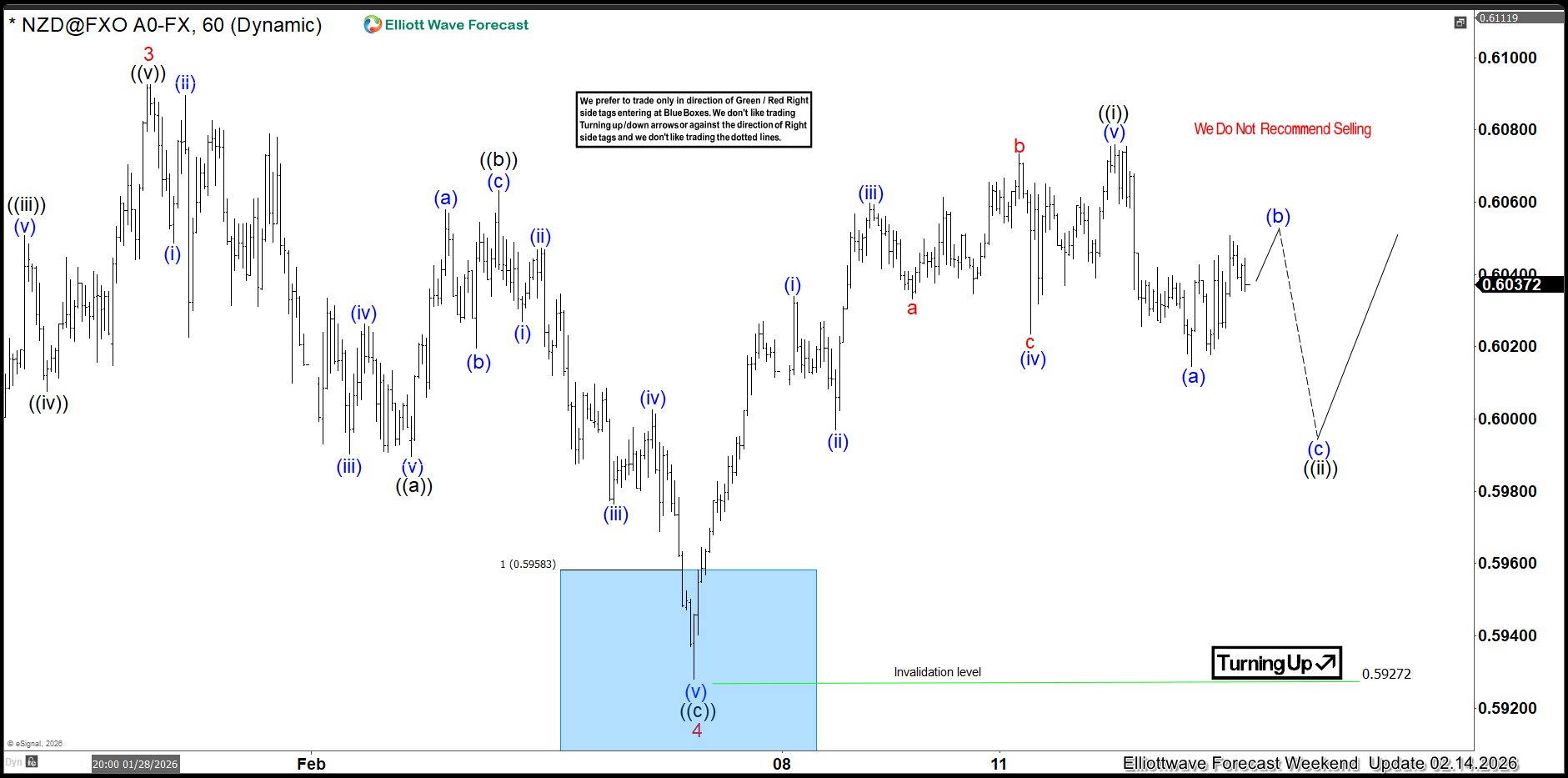

NZDUSD Validates Blue Box Strategy, Offers Buy Setup

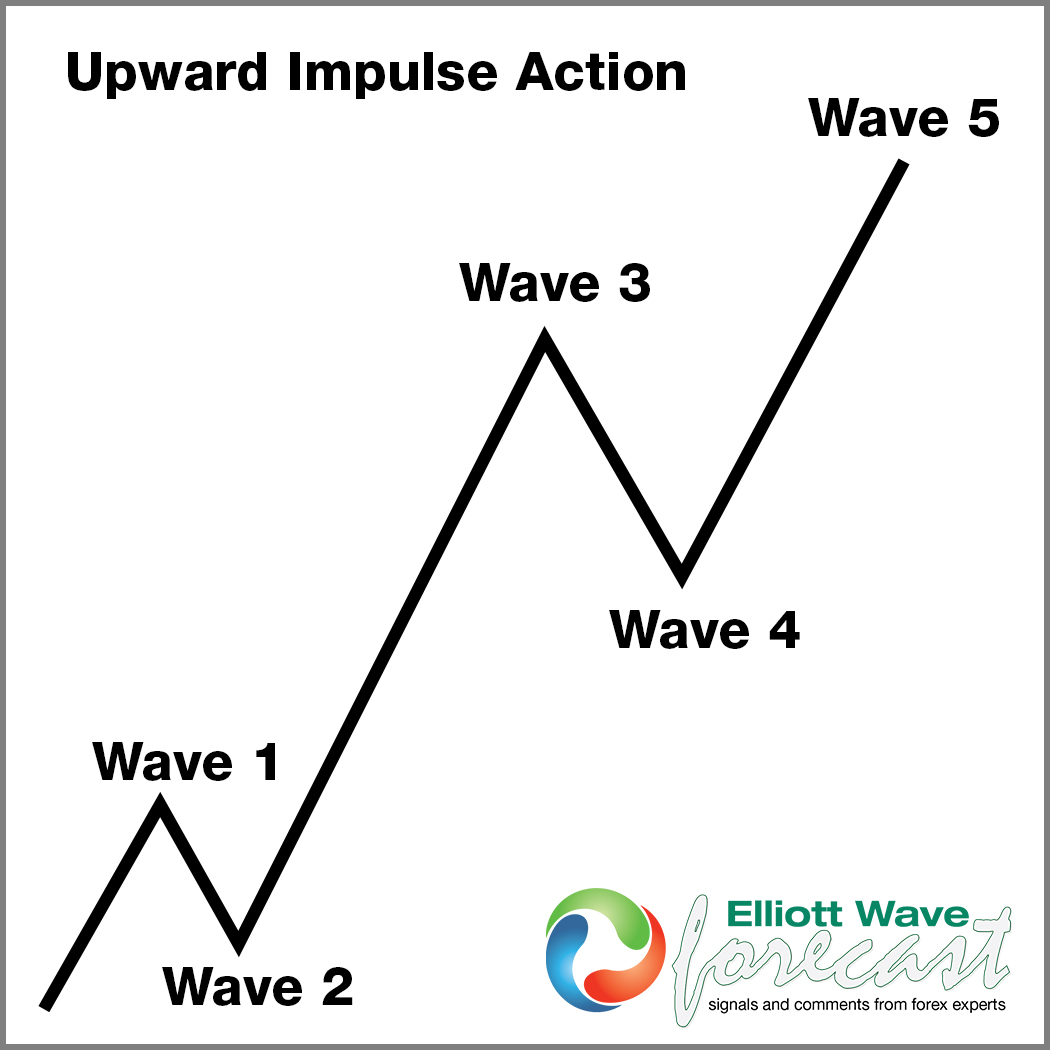

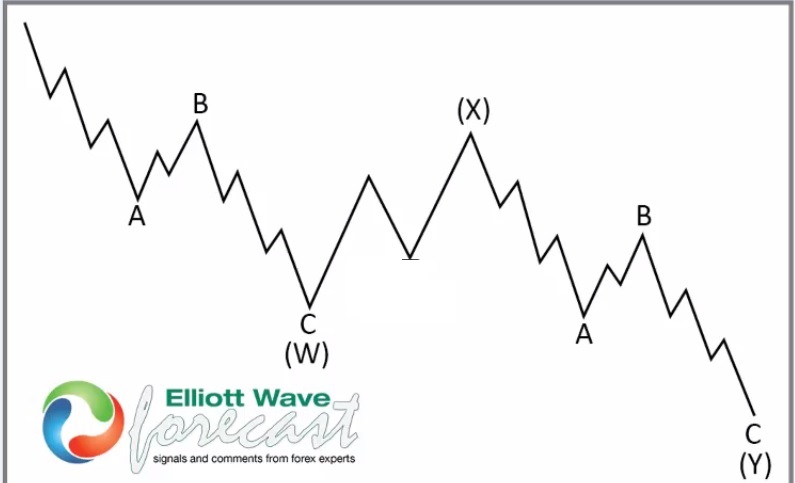

In this technical blog, we will look at the past performance of the 1-hour Elliott Wave Charts of NZDUSD. In which, the rally from 21 November 2025 low is unfolding as an impulse & showed a higher high sequence therefore, called for an extension higher to take place. We knew that the structure i

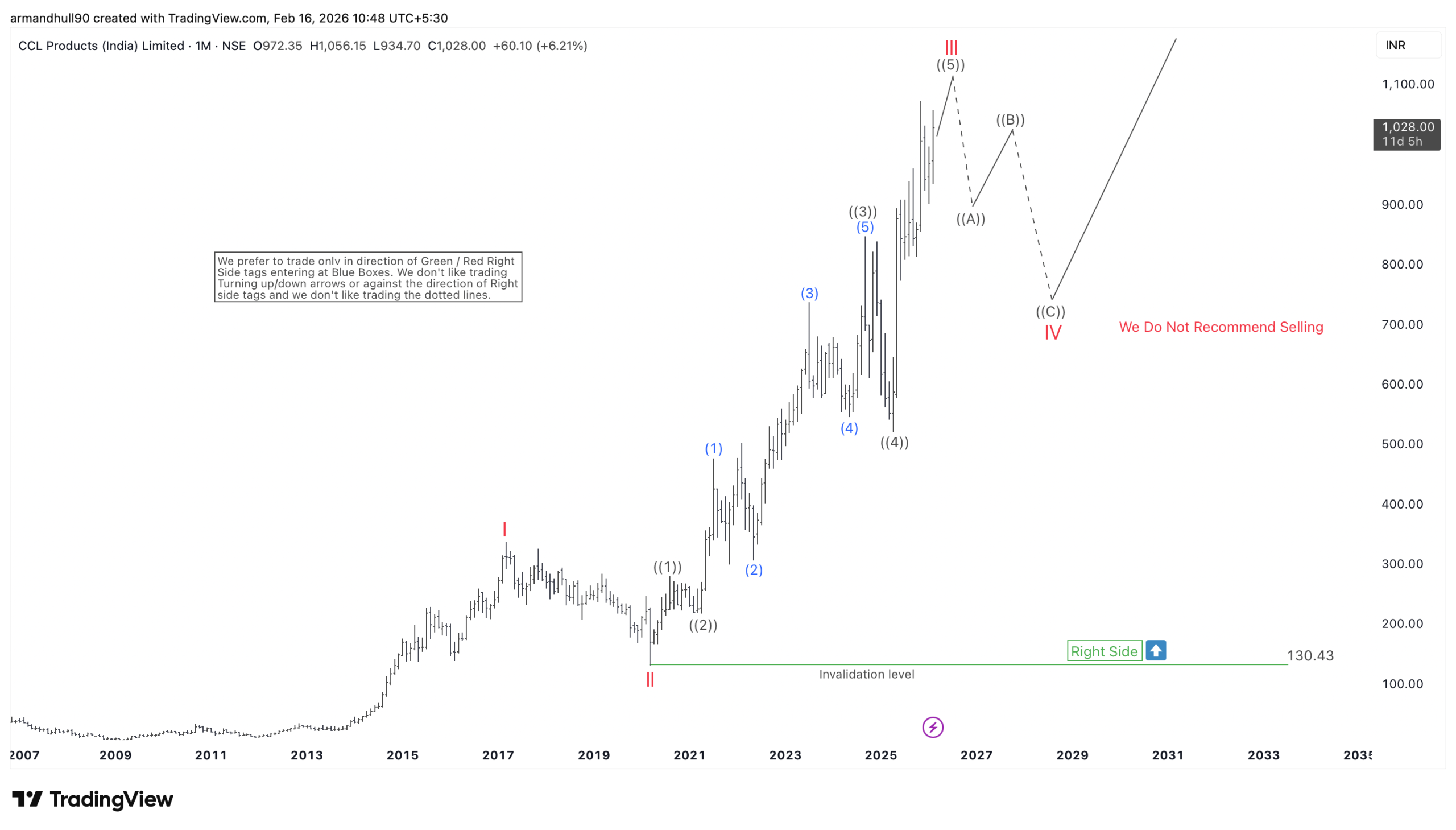

CCL Products Elliott Wave Forecast: Wave III Ending, Wave IV Pullback Ahead

Momentum is nearing exhaustion in Wave III, setting up a corrective pullback that could create the next high-probability buying opportunity for the Wave V advance. CCL Products (India) Limited continues to follow a strong bullish Elliott Wave structure on the monthly chart. The long-term trend began

Dixon Technologies Elliott Wave Forecast: Wave V Rally Targeting 21,500+

Bullish reversal from the blue box support signals the next impulsive rally phase Dixon Technologies (India) Ltd has delivered a technically clean reaction from a major Elliott Wave support region. The weekly structure now suggests the corrective phase has likely ended and the next impulsive advance

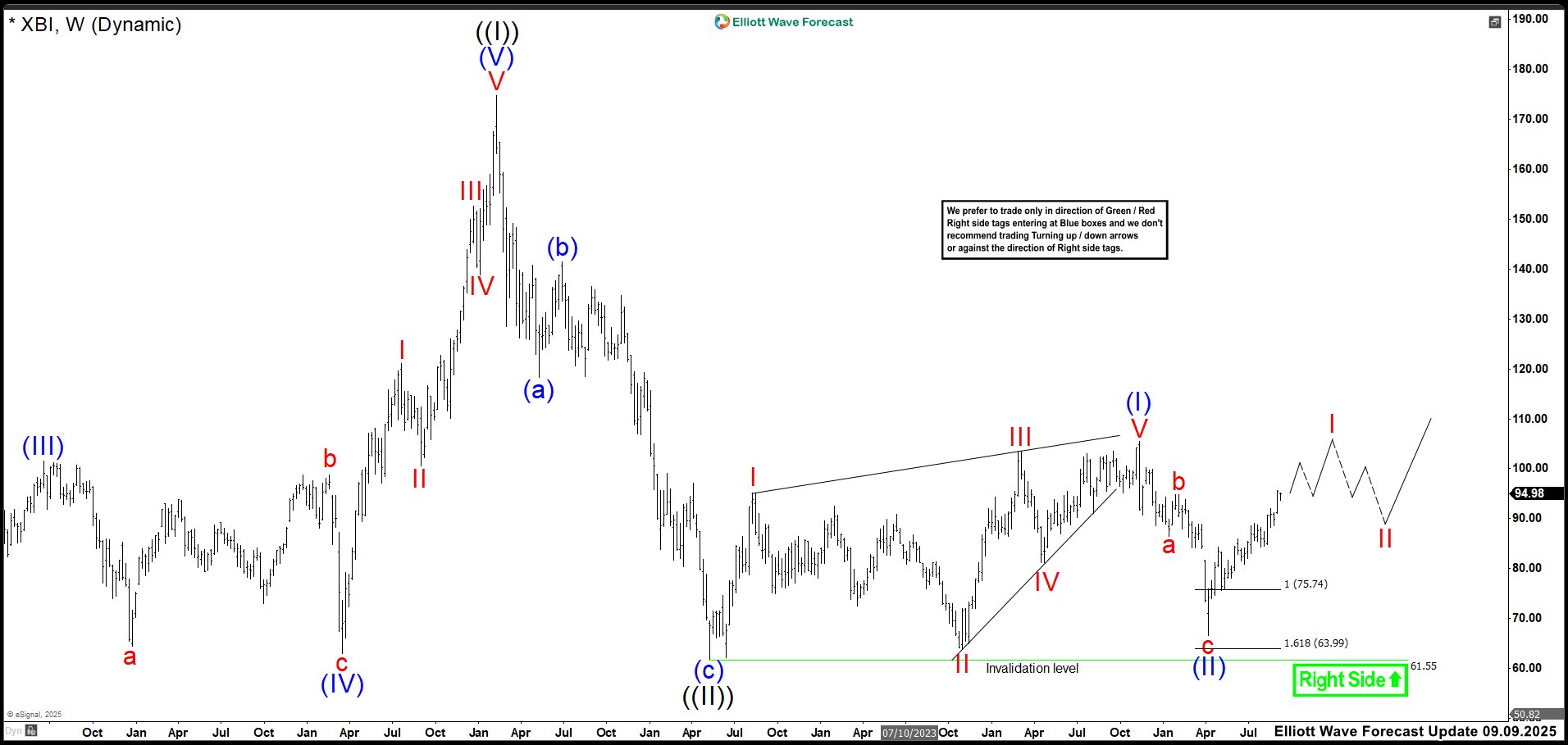

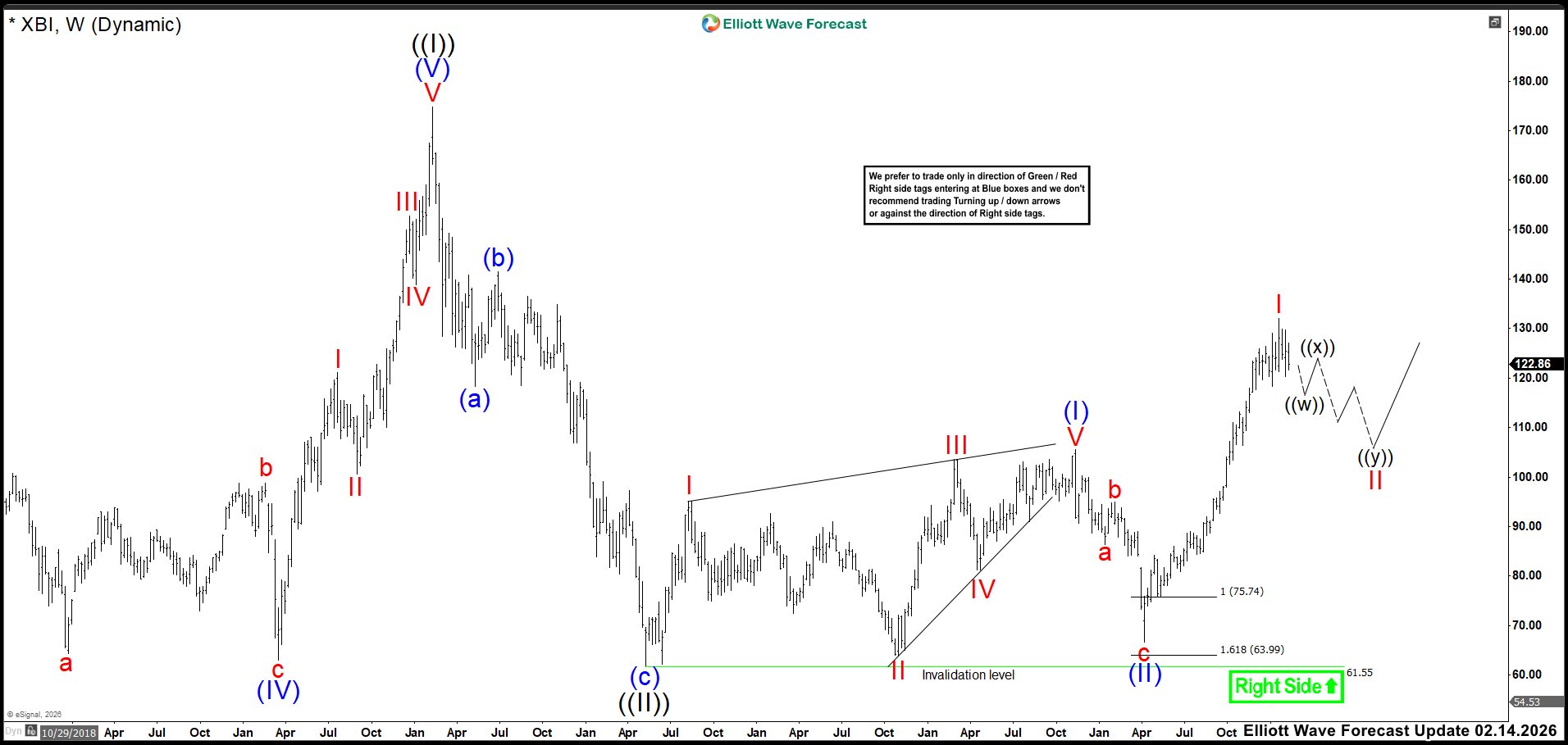

XBI Signals a Wave II Pullback After a 62% Rally

The XBI enters the first quarter of 2026 with a stable but cautious tone. Investors see improving liquidity, yet risk appetite remains selective. Moreover, late‑stage companies attract more attention as early‑stage names still face tighter funding. This dynamic creates a mixed environment across the

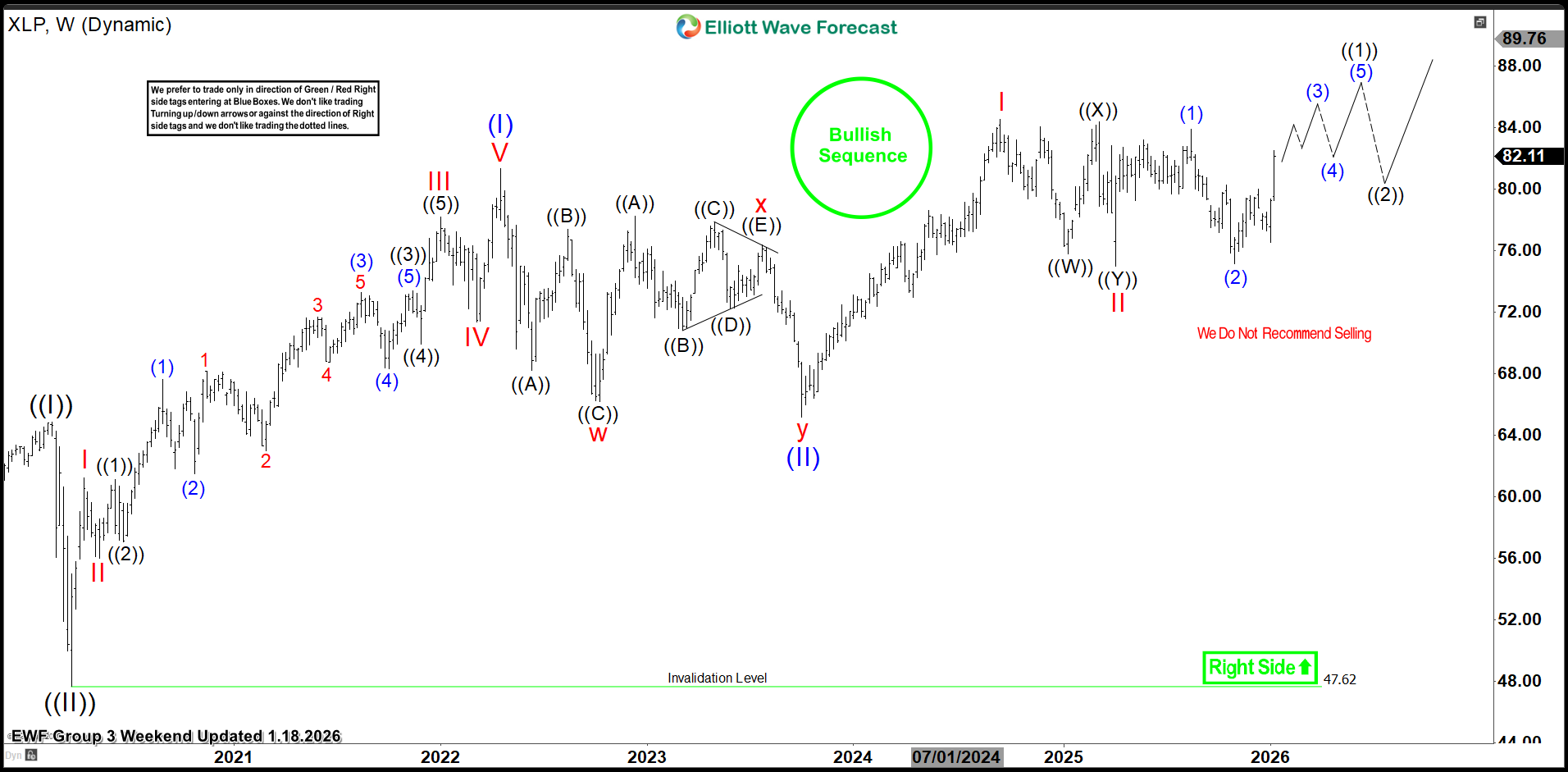

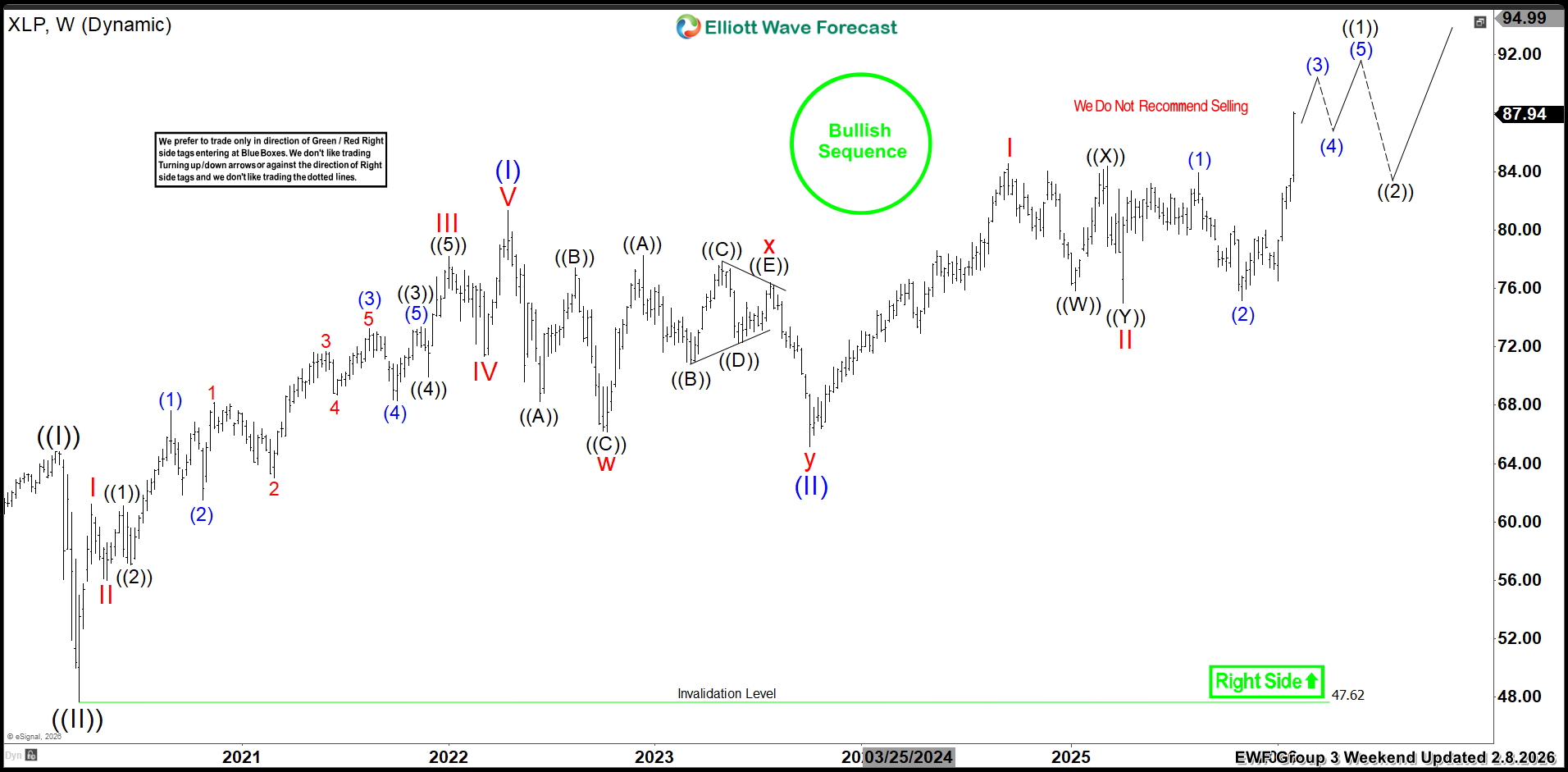

Consumer Staples ETF $XLP Incomplete Bullish Sequence, With $94 Target Still Ahead

Hello everyone! In today’s article, we’ll examine the recent performance of Consumer Staples ETF ($XLP) through the lens of Elliott Wave Theory. We’ll review how the rally from the October 06, 2023, low unfolded as a 5-wave impulse and discuss our forecast for the next move. Let’

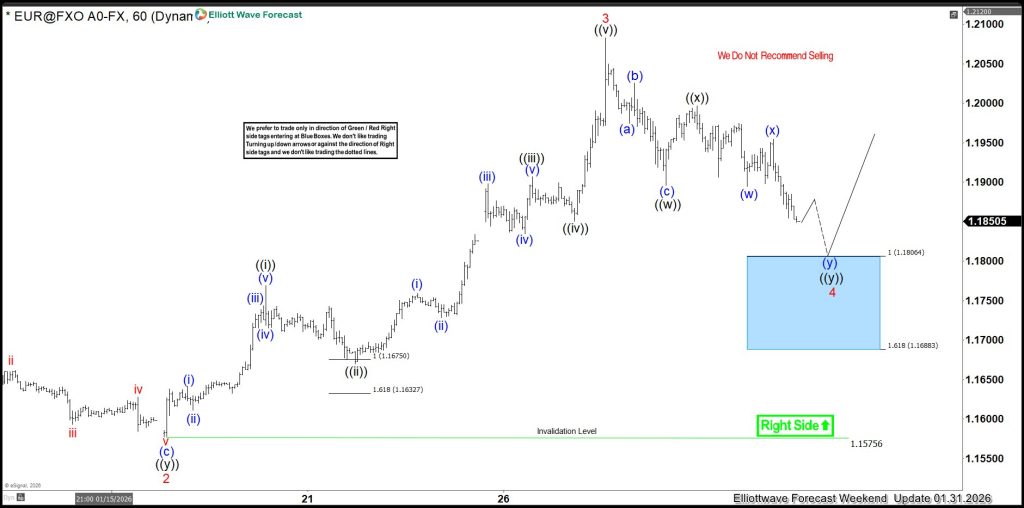

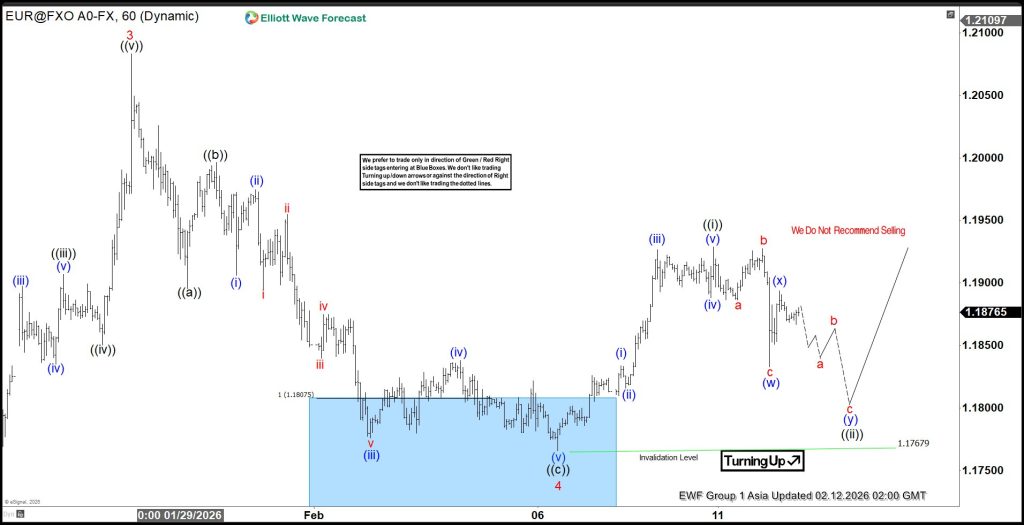

EURUSD Validates Elliott Wave with Perfect Blue Box Reaction

In this technical blog, we will look at the past performance of the 1-hour Elliott Wave Charts of EURUSD. In which, the rally from 05 November 2025 low is unfolding as a diagonal & showed a higher high sequence therefore, called for an extension higher to take place. We knew that the structure i

Metals & Mining ETF $XME Blue Box Area Offering a Buying Opportunity

Hello everyone! In today’s article, we’ll review the recent performance of Metals & Mining ETF ($XME) through the lens of Elliott Wave Theory. We’ll look at how the pullback from all-time highs unfolded as a textbook 3-swing correction and discuss what could come next. Let’s explore the structur

Elliott Wave Outlook Suggests More Gains Ahead for Pan American Silver (PAAS)

Pan American Silver Corp. (NYSE: PAAS, TSX: PAAS) is one of the world’s leading silver producers, operating mines and exploration projects across the Americas. The company also produces gold and other base metals, positioning itself as a diversified precious metals miner with a strong long-term grow

Vertiv Holdings (VRT): Diagonal Extends Into 215.5 -232.1 Area

Vertiv Holdings Co., is an American multinational provider of critical infrastructure & services for data centers, communication networks & commercial & industrial environments. It comes under Industrials sector & trades as “VRT” ticket for NYSE. VRT favors bullish sequence in weekly

TeraWulf WULF Bullish Surge Toward $20

TeraWulf (NASDAQ: WULF) operates as a key Bitcoin mining and technology firm. In this article, we analyze its weekly Elliott Wave structure, revealing the current bullish breakout path and key targets ahead of a potential pullback. Elliott Wave Analysis From its 2023 low, WULF created a three-wave i

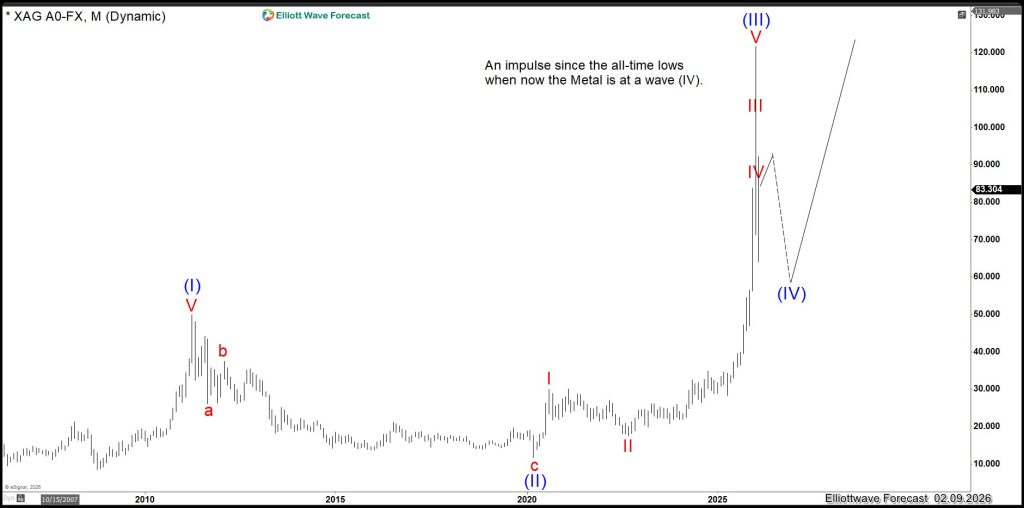

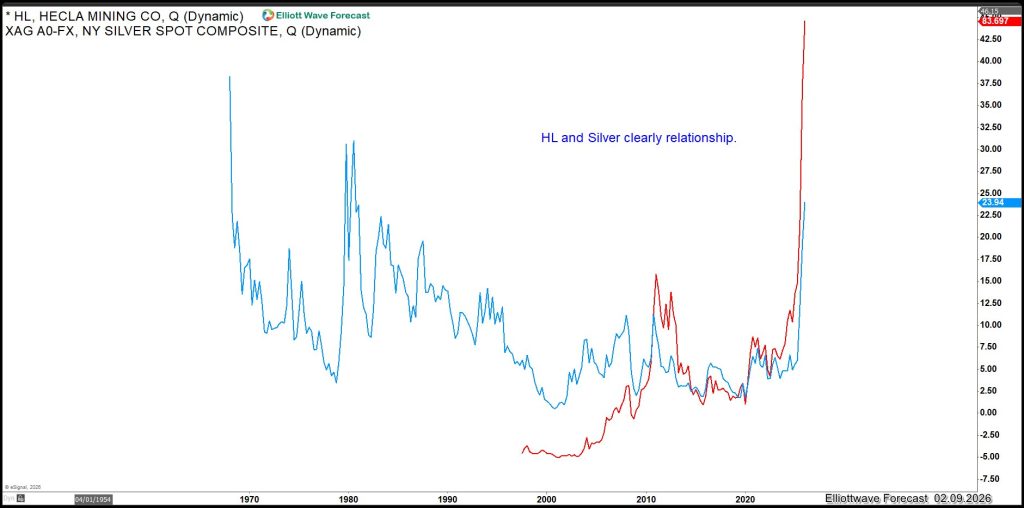

XAGUSD: The Case for Buying into a $250 Silver Price Target

Silver has historically been viewed as both a monetary metal and an industrial commodity. In recent years, structural changes in global debt, currency debasement, and industrial demand have led some analysts to project an extreme upside scenario for silver, with long-term targets as high as $250 per

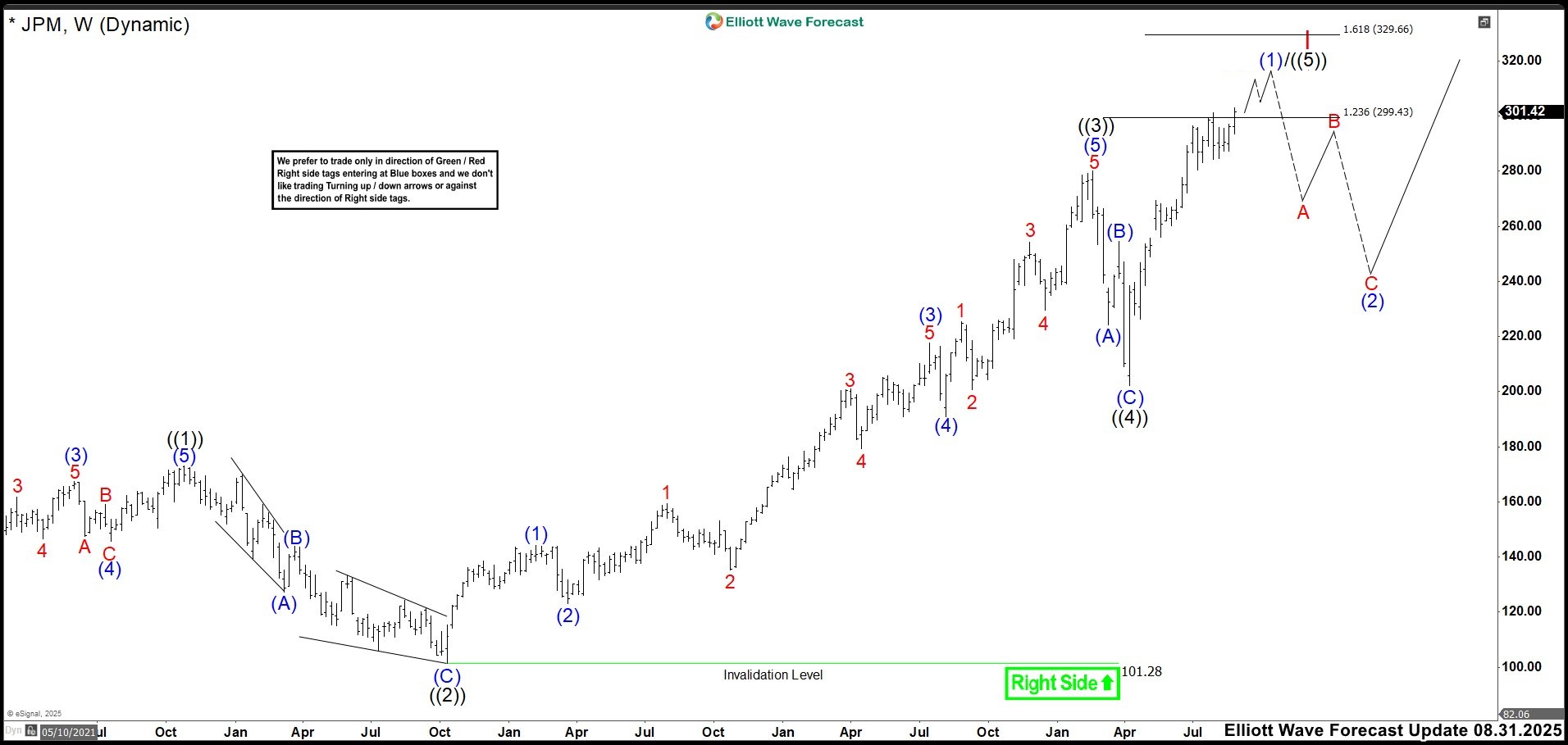

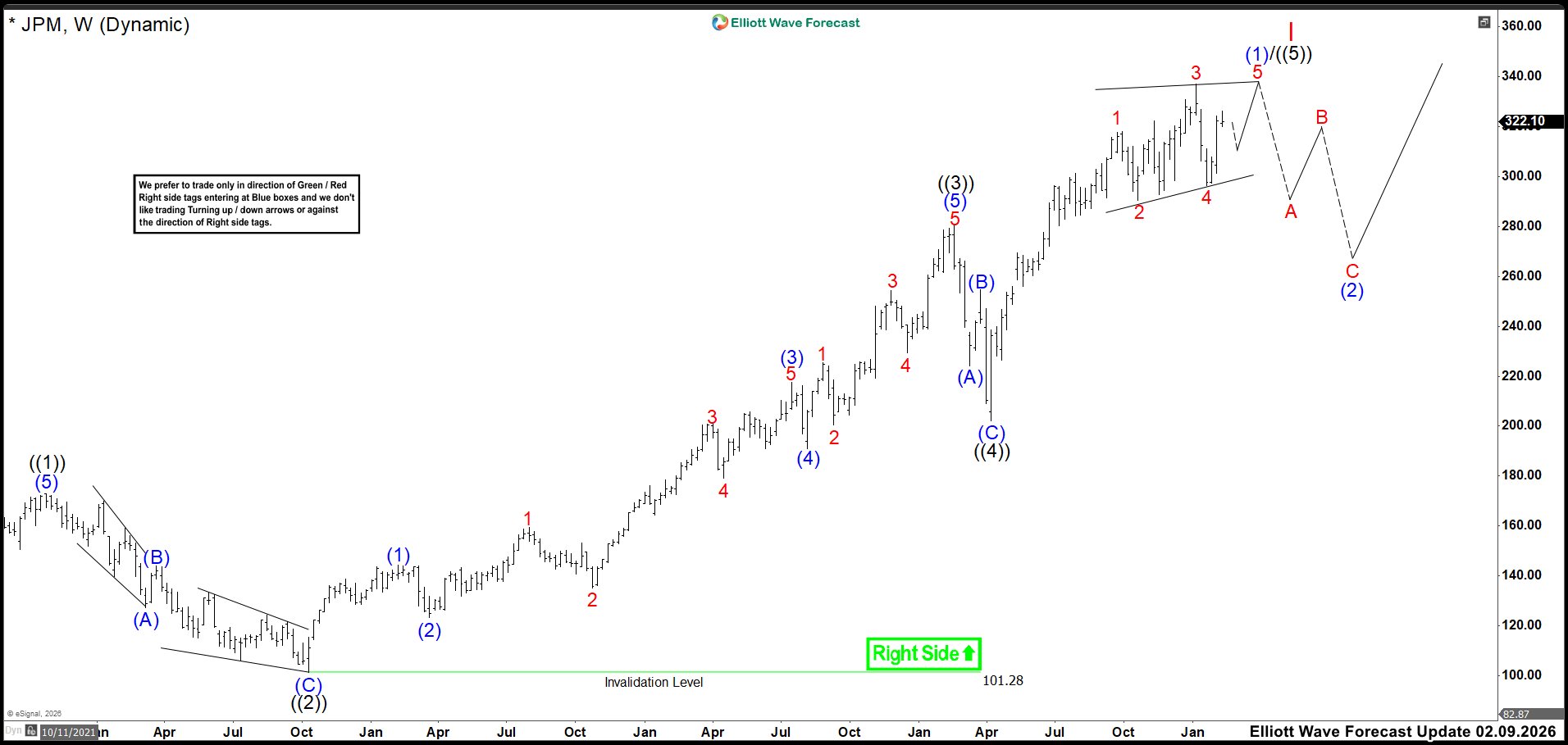

JPM may be ending its April cycle, signaling a correction

JPMorgan enters Q1 with strong capital, rising earnings, and steady loan growth. The bank beat expectations with net income of $14.6B, EPS above $5, and revenue near $46B, showing resilient consumer activity and solid trading performance. Credit costs increased, but capital ratios stayed strong, kee

正在加载中...