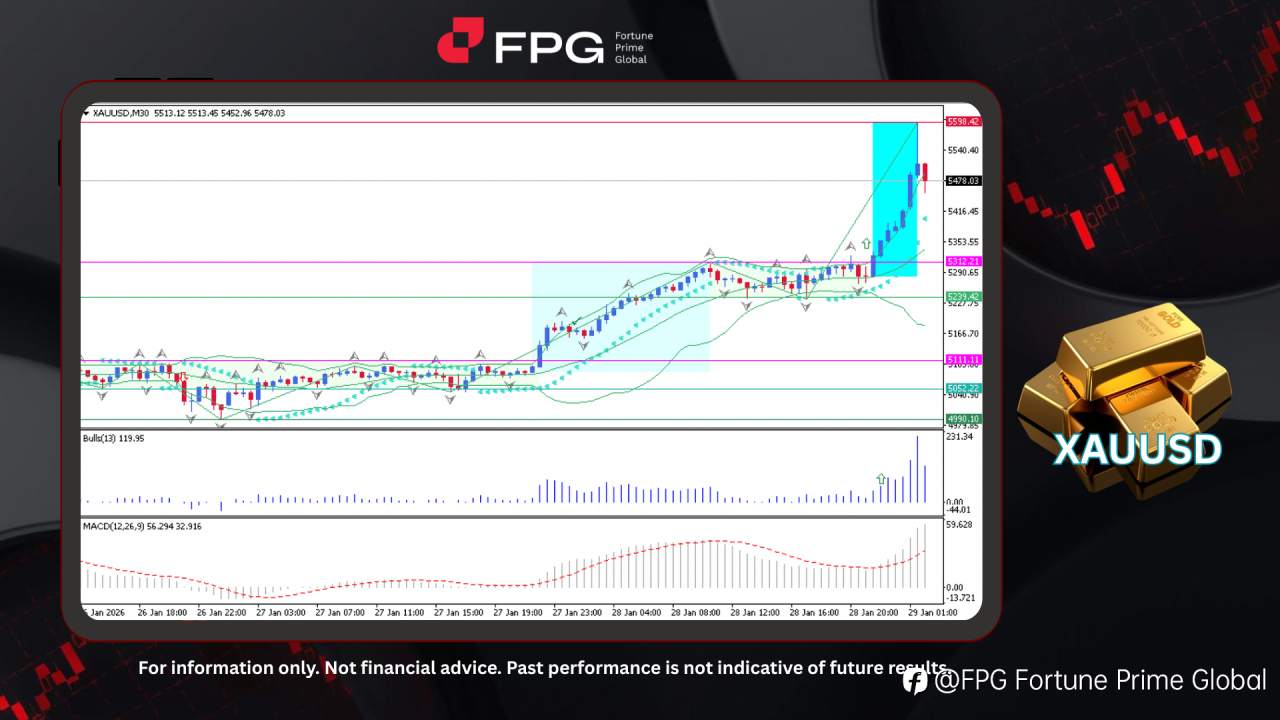

On the M30 timeframe, XAUUSD (Gold) has skyrocketed to a new all-time high of 5598, marking a very aggressive bullish expansion compared to yesterday’s ATH, with gains exceeding 5% within a single trading day. After spending a significant portion of the previous session moving sideways, Gold surged sharply during the Asian session, accelerating strongly toward the 5598 peak. At the time of analysis, price is trading around 5478, while volatility remains extremely elevated, reflecting unstable market conditions and aggressive participation from both retail and institutional traders.

Technically, Gold remains firmly within a strong bullish structure, with price expanding well above the upper Bollinger Band, highlighting an overstretched but still powerful upside momentum. The steep bullish slope confirms that buying pressure continues to dominate despite short-term pullbacks. MACD (12,26,9) is firmly positive, with a widening histogram and an upward-sloping signal line, indicating strong bullish momentum and continuation potential. Meanwhile, Bulls Power (13) has surged to around 119.95, signaling extremely strong buying pressure and confirming the presence of aggressive demand. However, such elevated indicator readings also suggest that short-term corrective pullbacks remain possible due to profit-taking.

In the midst of rising global uncertainty, especially rising geopolitical tensions between the US, the European Union, and other major countries, most investors and traders appear to be rushing into Gold in a wave of panic buying. Activity from institutional traders is also boosting market liquidity, which is adding to the sharp price swings. Keep a close watch on international political developments and today’s key economic news, as these will play a major role in driving Gold’s price movements.

Market Observation & Strategy Advice

1. Current Position: XAUUSD is trading around 5478, pulling back after reaching the 5598 All-Time High.

2. Resistance Zone: Immediate resistance remains near 5598, with no historical resistance beyond this level.

3. Support Zone: Key support is located around 5312, followed by deeper support near 5111 if volatility expands.

4. Indicator Observation: MACD (12,26,9) remains strongly bullish, while Bulls Power (13) at 119.95 reflects extreme buying pressure. Panic buying behavior and institutional liquidity flows are driving abnormal volatility.

5. Trading Strategy Suggestions:

- Trend-Following Bias: Bullish continuation strategies remain valid on pullbacks toward key support zones.

- Volatility Management: Use reduced position sizing and wider stops due to extreme intraday volatility.

- Breakout Monitoring: A clean consolidation above 5598 could open the path for another explosive upside leg.

Market Performance:

Precious Metals Last Price % Change

XPTUSD 2,669.77 +0.28%

XAGUSD 118.1050 +1.07%

Today’s Key Economic Calendar:

US: Fed Interest Rate Decision

US: Fed Press Conference

JP: Consumer Confidence

EU: Economic Sentiment

US: Balance of Trade

CA: Balance of Trade

US: Exports & Imports

US: Initial Jobless Claims

US: Factory Orders MoM

Risk Disclaimer: This report is for informational purposes only and does not constitute financial advice. Investments involve risks, and past performance does not guarantee future results. Consult your financial advisor for personalized investment strategies.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发