The Federal Reserve via the Federal Open Market Committee (FOMC) met for its Monetary Policy Meeting on Wednesday 2nd November and delivered yet another rate increase, showing its continued resolve in its attempts to bring inflation back to its target of around 2%.

The fourth straight 75 basis point bump takes the headline rate to the target range of 3.75% to 4.00%, from a target range of 3.00% to 3.25%. For 2022 so far that's an increase of 375 basis points in total and the fastest pace of tightening in the US in 4 decades.

The increase itself was not surprising at all to economists or market participants, as it had been widely expected and priced-in for weeks based on recent economic data and previous statements from the Board. Instead, many were hanging out for any hint of a pivot that might come from either the language in the statement or from Jerome Powell’s press conference.

The statement

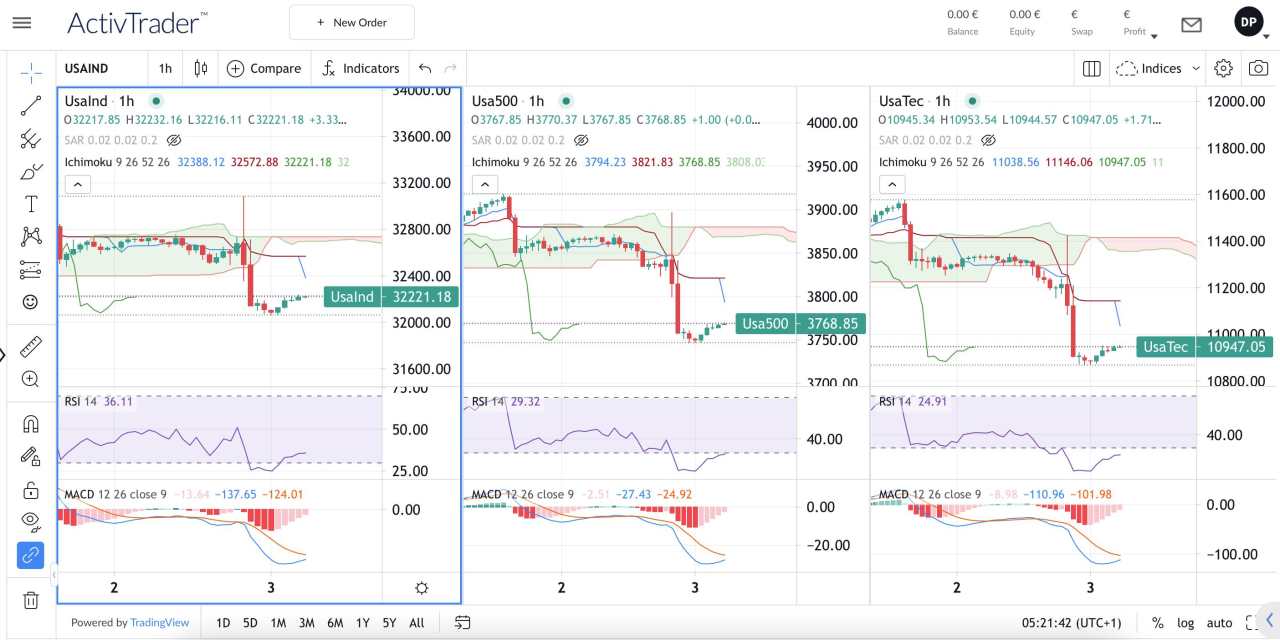

The softer tone of the statement from the FOMC initially had markets buzzing, the American indices picked up on the back of its release before heading back down (a lot of trading opportunities for active traders to profit from according to the CFD broker ActivTrades).

“In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.” It read.

The talk of ‘lags’ and ‘cumulative tightening’ gave way for a positive bump in sentiment for investors. Then, Chair Powell faced the media at his press conference and showed just how much influence he has over the market when he speaks.

Strong stance from Fed chair sparks volatility

His demeanor towards future monetary policy was somewhat direct and unexpected by the market. Many experts were looking for a more dovish tone and some reassurance that the tightening of policy was coming to an end soon, but they were soon disappointed.

Powell indicated that he did not want any misunderstanding on the direction of future monetary policy. Even if policymakers do pare down future rises, he commented, they are still unsure about how high rates must climb to limit inflation.

With regard to a slowdown of hikes or a pause in the cycle, he said, “It is very premature to be thinking about pausing. People when they hear ‘lags’ think about a pause. It is very premature, in my view, to think about or be talking about pausing our rate hikes. We have a ways to go.”

On the possibility that rate increases would be less aggressive in the coming meetings, he said, “At some point, it will be important to slow the pace of increases. So that time is coming, and it may come as soon as the next meeting or the one after that. No decision has been made,” he said.

After a strong jump immediately following the release of the Bank’s statement, Powell’s press conference brought the market back down to earth. The Dow eventually closed the day down 505.44 points, or 1.55%. The S&P 500 ended the day down 2.5% at 3,759.69, while the Nasdaq fell 3.6% to end at 10,524.80.

Hourly charts of the Dow Jones, the S&P500, and the Nasdaq - Source: ActivTrader platform from ActivTrades

CNBC reported a couple of days ago that markets were expecting the Federal Reserve to put an end to the increases by March 2023, with a peak of around 5%. This would mean the last increase of the year in December would have to be smaller than the trend of 75 basis point hikes.

With this latest news now it seems that 5% figure could be on the lower side, as Powell looks to be more in favor of over-tightening rather than there being any chance of leaving the job of returning to price stability half done.

What's been the impact so far of rapid tightening of policy?

The Board’s rate rise pace has sparked widespread concern that the Fed is pushing the global economy toward a deep recession, with the dollar's strength versus foreign currencies affecting US exports and pressuring financial markets from London to Tokyo.

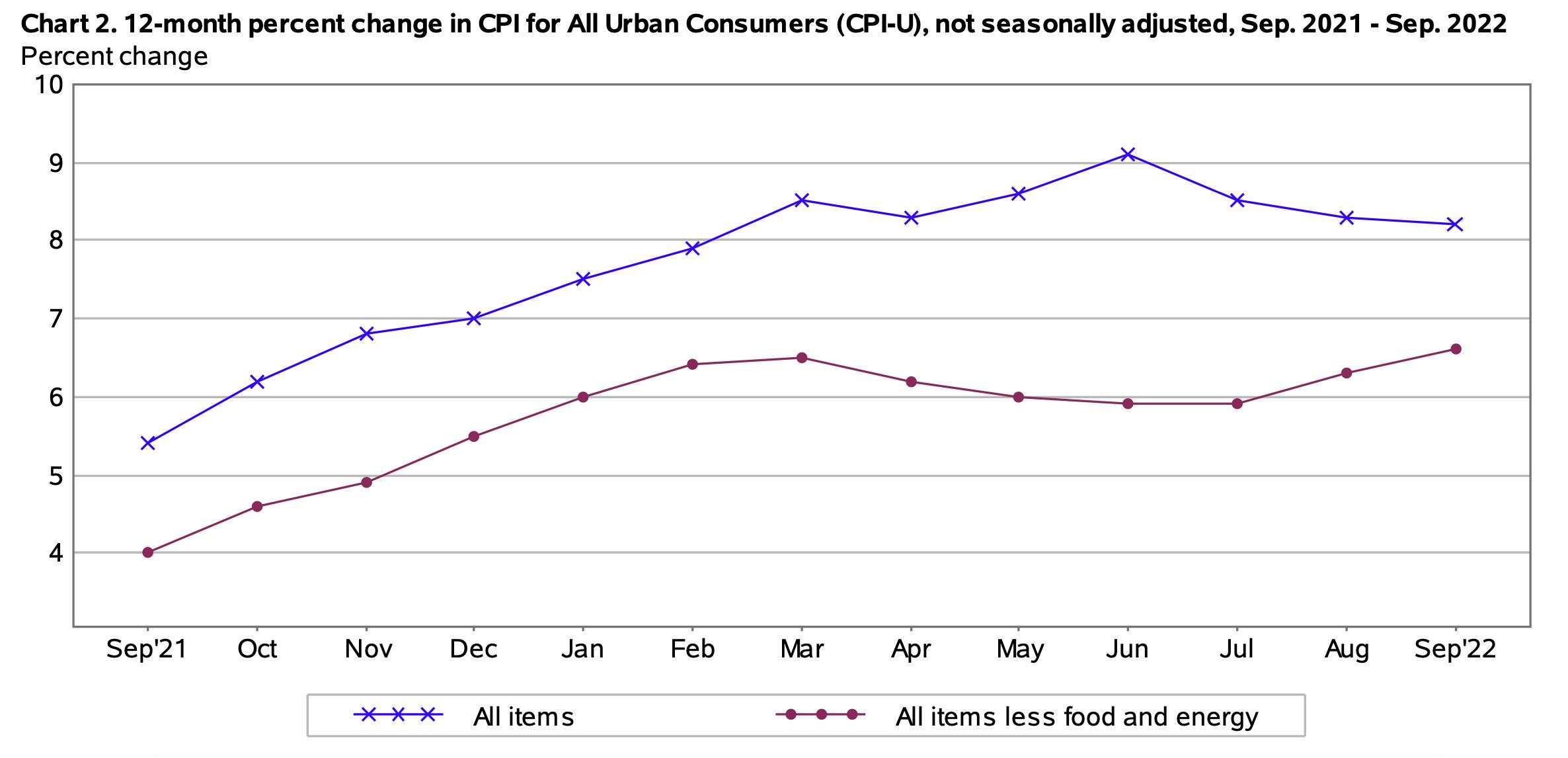

Annual CPI is finally starting to trend downwards though, with recent forecasts putting the November number at 8.1%, from the peak of 9.1% earlier in the year. The ultimate hope is that inflation does not become entrenched into less fluctuating sections of the economy, such as healthcare and rental housing.

In the process though, the economic situation for millions of American consumers and companies will be threatened by raising their borrowing costs at a time when they’re already battling the rising cost of living.

Powell further acknowledged in his press conference that the possibility of a soft landing that would avoid a recession and get inflation under control, was still an outside chance, but it had definitely narrowed.

“The inflation picture has become more and more challenging over the course of this year,” he commented. “That means we have to have policy be more restrictive, and that narrows the path to a soft landing.”

This Friday, the nonfarm payrolls (NFP) will be published and should show a job creation number that slowed down to 200,000 in October, compared to the 263,000 that was recorded in September. Markets also expect that the unemployment rate rose to 3.6%, up from 3.5% in September. Traders will also closely watch the rate of wage growth to see any acceleration in wage inflation.

作者:Carolane de Palmas,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发