U.K. inflation surprised to the upside in April, with consumer prices rising at their fastest annual pace since March 2024, driven by higher energy bills and water rates. The headline CPI figure of 3.5% came in above economists’ expectations, who had predicted a rise to 3.3% for the month.

The largest upward contributions to the monthly change came from housing and household services, transport, and recreation and culture. This was partially offset by a downward contribution from clothing and footwear.

Key Takeaways:

- Headline CPI rose to 3.5% year-on-year in April, up from 2.6% in March

- Core inflation (excluding food, energy, alcohol and tobacco) increased to 3.8% from 3.4%

- Housing and household services contributed most to the rise, with water and sewerage prices jumping 26.1%

- Electricity and gas prices rose after the Ofgem price cap increase took effect in April

Housing costs saw significant increases, with prices of electricity, gas and other fuels rising by 6.7% year-on-year. Water and sewerage charges surged by 26.1% month-on-month, marking the largest monthly increase since records began in February 1988.

Link to Office of National Statistics U.K. April CPI Report

The Bank of England (BOE) had anticipated this temporary rise in inflation, projecting it would reach 3.7% in the third quarter of 2025 due to higher energy prices and regulated price changes.

Market Reaction

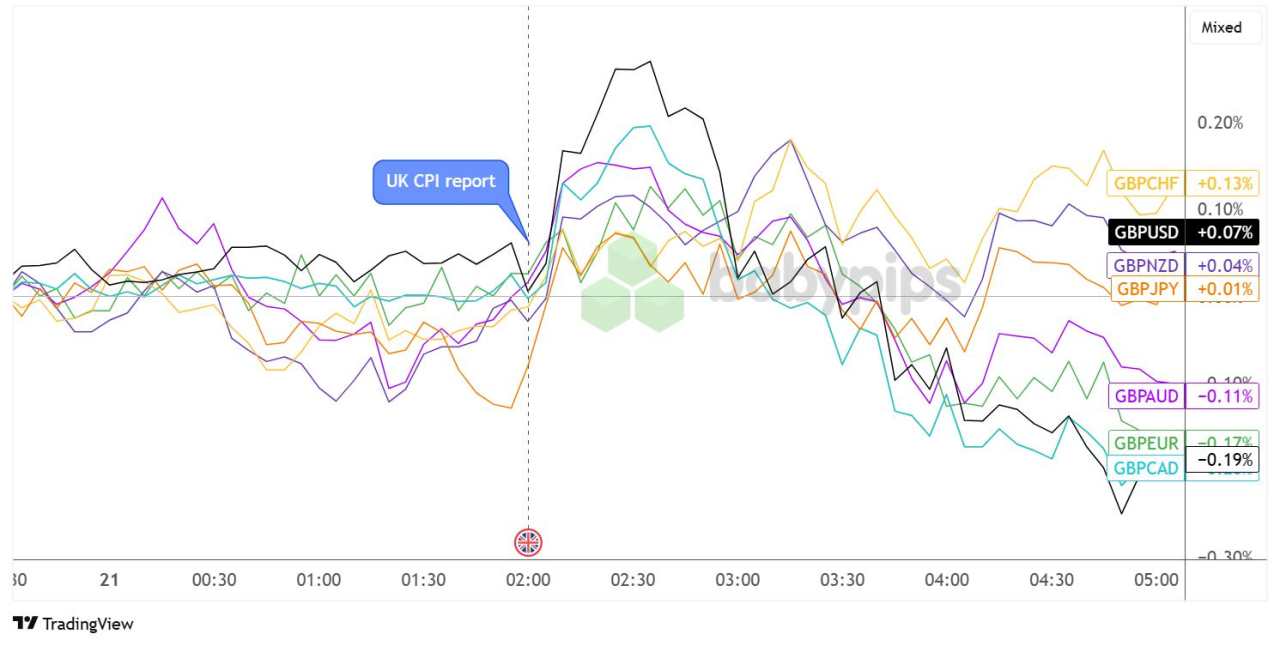

British Pound vs. Major Currencies: 5-min

Overlay of GBP vs. Major Currencies Chart by TradingView

The British pound, which had been moving mostly sideways ahead of the U.K. CPI report, staged a broad rally in reaction to hotter than expected inflation figures. GBP raked in sharp gains versus USD, JPY and CHF but struggled to hold on to its winnings roughly an hour after the release.

Profit-taking kept bearish pressure in play for much longer on GBP/AUD, GBP/USD, GBP/CAD and GBP/EUR, keeping these pairs in the red while the rest managed to pull back up later on.

The mixed market reaction suggests traders are weighing the higher inflation print against the Bank of England’s recent messaging that the spike would be temporary. While the April data exceeded expectations, it still came in below the BOE’s projected peak of 3.7% for later this year.

加载失败()