After Trump’s tariffs tantrum last Friday, markets welcomed news that the U.S. agreed to delay additional trade levies on the EU until July 9.

U.S. and U.K. banks were closed for the holidays, however, leading to thinner liquidity conditions.

Here are headlines you may have missed in the last trading sessions!

Headlines:

- Over the weekend, BOC Governor Macklem said that Trump’s tariffs are the “biggest headwind” and that it is imperative for Canada to reach a trade deal with U.S.

- Japanese PM Ishiba said on Sunday that they aim to reach a deal with U.S. by mid-June

- Chinese Premier Li Qiang says they are weighing new policy tools and “unconventional measures” amid international trade uncertainty

- U.S. markets closed for Memorial Day, U.K. banks closed for Spring Bank Holiday

- In an interview with CNN, U.S. Senator Johnson said that they have enough votes to block Trump’s tax bill in Senate as deficit projections are “unacceptable”

- Trump agreed to delay EU tariffs until July 9 after a phone call with European Commission President Ursula von der Leyen

- Trump also noted that they made some “real progress” in nuclear deal talks with Iran

- Japan Leading Indicators Index for March 2025: 108.1 (107.7 forecast; 107.9 previous)

- Swiss Non Farm Payrolls for March 31, 2025: 5.51M (5.5M forecast; 5.53M previous)

- ECB head Lagarde suggested that the euro could be a viable alternative to the U.S. dollar as global currency for international trade

- OPEC+ moved its June 1 meeting a day earlier to May 31

- Fed official Kashkari warned that trade policy could create uncertainty for rate decisions before September

- Canada Manufacturing Sales for April 2025: -2.0% m/m (0.2% m/m forecast; -1.4% m/m previous)

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Even though U.S. and U.K. markets were in holiday mode, risk assets cheered Trump’s announcement of a delay in EU tariffs until July 9, following his late Friday tirade about imposing additional 50% in trade levies on the region by July 1.

The agreement followed a phone call with European Commission President Ursula von der Leyen who also mentioned that “zero-for-zero” tariffs could still be on the table. European stock indices jumped on the news, with the German DAX closing 1.68% higher and the French CAC index up by 1.21%.

Gold shed more of its safe-haven gains as traders flocked to higher-yielding assets while bitcoin, which started on bullish footing, held on to the $109K area for the most part of the day.

Meanwhile, crude oil chopped around on reports that the U.S. made “real progress” in its nuclear deal talks with Iran which kept supply forecasts elevated, but the energy commodity also picked up on trash talking between Trump and Putin. In addition, news that the OPEC+ moved its meeting earlier to May 31 kept oil traders on edge.

FX Market Behavior: U.S. Dollar vs. Majors:

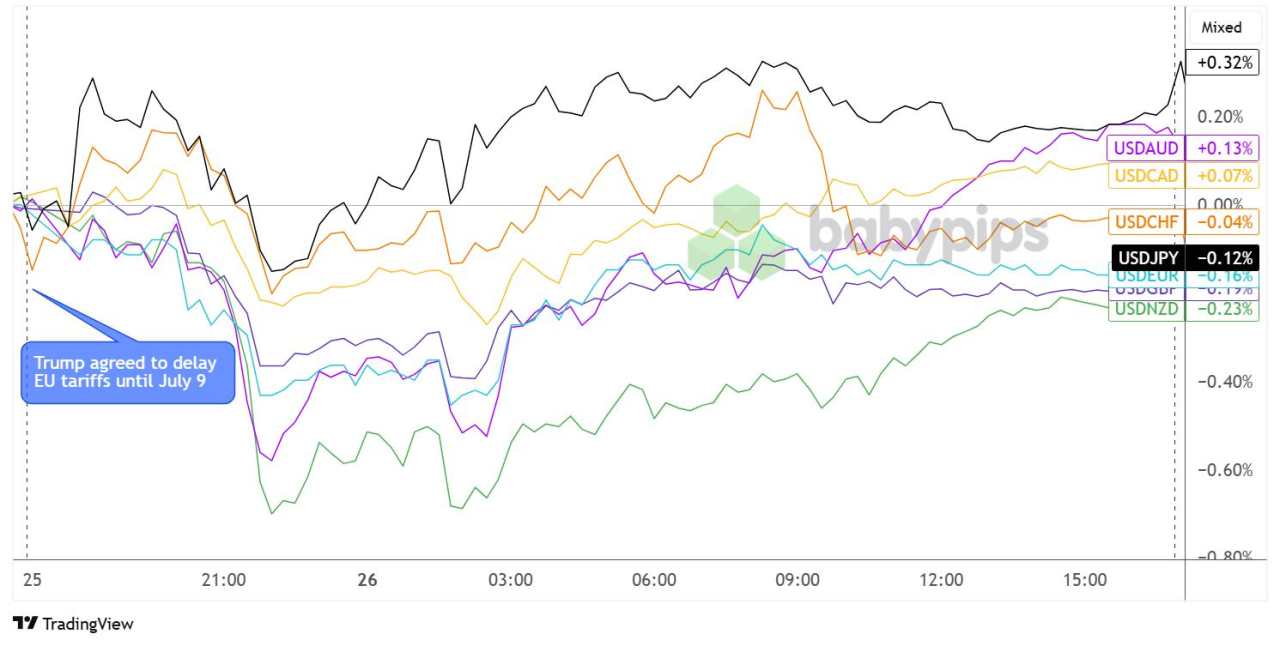

Overlay of USD vs. Major Currencies Chart by TradingView

Dollar pairs opened on a mixed note, following weekend developments that mostly focused on U.S. trade talks. The big news was Trump’s decision to delay EU tariffs, which he previously set to go up by 50% on June 1, while Japanese PM Ishiba also talked about the importance of reaching a U.S. trade deal.

USD turned broadly lower, particularly against AUD and NZD, a few hours into the Asian session likely due to risk-taking after Chinese Premier Li Qiang hinted at new policy tools to address international trade uncertainty.

Still, the dollar regained its footing as European session traders likely adjusted positions to account for positive U.S.-EU trade developments. The Greenback extended its gains throughout the New York session against majority of its counterparts, although USD/JPY and USD/CHF trimmed gains as the market attention also shifted to the looming Senate vote on Trump’s tax bill, which could potentially lead to a swelling government deficit.

Upcoming Potential Catalysts on the Economic Calendar:

- Swiss Balance of Trade at 6:00 am GMT

- Germany GfK Consumer Confidence at 6:00 am GMT

- France Consumer Prices Index growth rate for May 2025 at 6:45 am GMT

- BOE policymaker Hauser’s Speech at 8:00 am GMT

- Fed official Kashkari’s Speech at 8:00 am GMT

- Euro area Consumer Confidence at 9:00 am GMT

- U.K. CBI Distributive Trades at 10:00 am GMT

- Canada Wholesale Sales at 12:30 pm GMT

- U.S. Durable Goods Orders at 12:30 pm GMT

- U.S. House Price Index at 1:00 pm GMT

- U.S. S&P/Case-Shiller Home Price at 1:00 pm GMT

- U.S. CB Consumer Confidence for May 2025 at 2:00 pm GMT

- U.S. Dallas Fed Manufacturing Index at 2:30 pm GMT

- U.S. Money Supply at 5:00 pm GMT

- Fed official Williams’ Speech at 12:00 am GMT

It’s looking like a pretty light day in terms of economic releases since only mid-tier data like the German GfK consumer confidence data, U.S. durable goods orders report and CB consumer confidence index are lined up.

Still, keep your eyes and ears peeled for commentary from policymakers, including BOE official Hauser and Fed members Kashkari and Williams, as their remarks could influence the interest rate outlook.

As always, stay nimble and don’t forget to check out our Forex Correlation Calculator when taking any trades!

暂无评论,立马抢沙发