Trade tensions heated up after Trump doubled steel and aluminum tariffs to 50%, and China fired back, accusing the U.S. of breaking their agreement.

Markets reacted in mixed fashion. Gold jumped 2.8%, oil rallied on supply concerns, and stocks finished higher even as the dollar slid to six-week lows.

Here are headlines you may have missed in the last trading sessions!

Headlines:

- Late Friday, President Trump doubled tariffs on steel and aluminum imports from 25% to 50% starting June 4

- Over the weekend, Ukraine used drones to attack around 40 Russian war planes at 4 military bases

- Over the weekend, OPEC+ announced a 411,000 output increase by July, the same level announced in the previous two months

- Chinese and New Zealand markets are closed today for holidays

- China accused the US of undermining the temporary May 12 trade agreement by issuing AI chip export control guidelines, stopping the sale of chip design software to China and by planning to revoke Chinese student visas

- FOMC voting member Waller supports “looking through any tariff effects on short-term inflation” when setting policies

- Australia S&P Global manufacturing PMI final for May: 51.0 (51.7 forecast; 51.7 previous)

- Japan Jibun Bank manufacturing PMI final for May: 49.4 (49.0 forecast; 48.7 previous)

- BOJ has set aside the maximum provision for losses on bond transactions, a move seen as preparation for higher interest rates

- Australia ANZ-Indeed job ads for May: -1.2% m/m (0.4% m/m forecast; 0.5% m/m previous)

- Australia TD-MI inflation gauge for May: -0.4% m/m (0.5% m/m forecast; 0.6% m/m previous)

-

Swiss GDP for Q1 2025: 2.0% y/y (1.5% y/y forecast; 1.5% y/y previous); 0.5% q/q (0.7% q/q

forecast; 0.5% q/q previous) - Swiss Procure.ch manufacturing PMI for May: 42.1 (46.5 forecast; 45.8 previous)

- Germany HCOB manufacturing PMI final for May: 48.3 (48.8 forecast; 48.4 previous)

- Euro area HCOB manufacturing PMI final for May: 49.4 (49.4 forecast; 49.0 previous)

- S&P Global U.K. manufacturing PMI final for May: 46.4 (45.1 forecast; 45.4 previous)

- Canada S&P Global manufacturing PMI for May: 46.1 (45.8 forecast; 45.3 previous)

- U.S. S&P Global manufacturing PMI final for May: 52.0 (52.3 forecast; 50.2 previous)

- U.S. ISM manufacturing PMI for May: 48.5 (49.0 forecast; 48.7 previous); Prices index was 69.4 (71.0 forecast; 69.8 previous); Employment index was 46.8 (47.0 forecast; 46.5 previous)

- CNBC reported that Presidents Trump and Xi will hold a phone call “very soon.”

Broad Market Price Action:

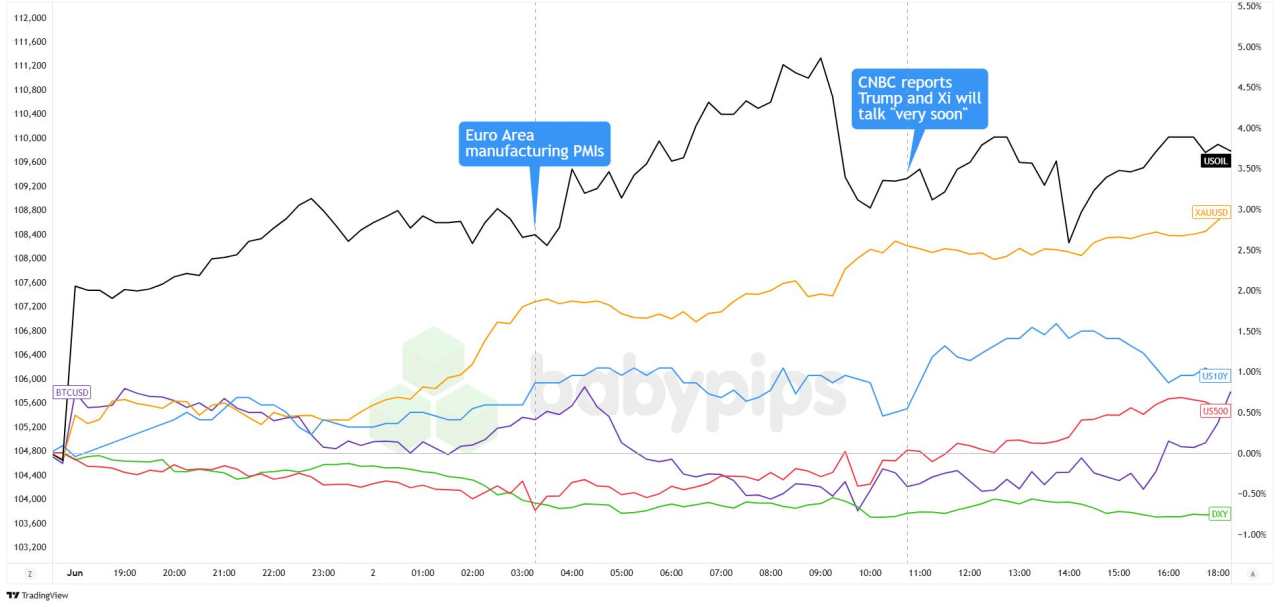

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Tensions between the U.S. and China kicked off the month with a risk-off mood after Trump doubled tariffs on steel and aluminum imports to 50%. China fired back, accusing the U.S. of violating the Geneva trade agreement and warning of “forceful measures” to defend its interests.

WTI crude oil surged to $63.00, boosted by OPEC+ sticking to a modest 411K bpd output increase instead of the bigger hike markets feared. Fresh supply worries also came from Ukraine’s drone strikes that destroyed 40 Russian aircraft and a bipartisan push in Congress for tougher sanctions on Russia’s oil sector. Meanwhile, wildfires in Canada shut down 350,000 barrels a day in production, adding more support for prices.

Gold jumped 2.8% to $3,380 per ounce, posting its biggest daily gain in four weeks as safe-haven demand picked up and the dollar weakened on trade uncertainty. Treasury yields pushed higher across the curve, with the 10-year yield hitting 4.45% as longer-dated bonds faced selling pressure on tariff and fiscal worries. Bitcoin gained 1.4% to $106,000, likely on the back of a softer dollar.

After a rocky start, U.S. stocks shook off trade war jitters and ended higher, with the S&P 500 up 0.4% and the Nasdaq rising 0.7%, helped by late-session optimism on reports that Trump and Xi could talk “very soon.” Over in Europe, stocks struggled, weighed down by tariff risks and rising geopolitical tensions.

FX Market Behavior: U.S. Dollar vs. Majors:

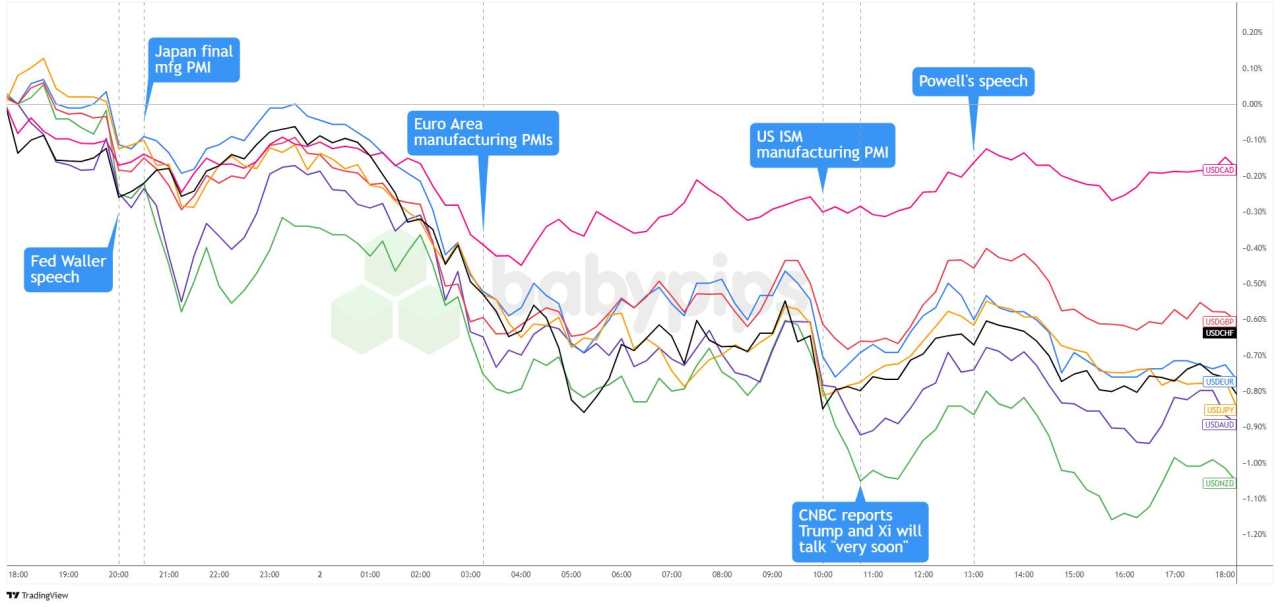

Overlay of USD vs. Major Chart by TradingView

The dollar came under renewed pressure as trade tensions flared up again. President Trump announced plans to double steel and aluminum tariffs to 50% starting Wednesday, and China hit back, accusing the U.S. of violating their recent trade deal and promising to defend its interests, fueling uncertainty across currency markets.

The Greenback weakened early in Asia, with the dollar index sliding to its lowest level since 2023. It didn’t help that the Bank of Japan (BOJ) also sharply boosted its provisions for potential losses on Japanese Government Bonds, a move seen as preparing for higher interest rates ahead.

Manufacturing data globally painted a mixed picture. U.S. ISM manufacturing PMI slipped to 48.5 in May from 48.7, signaling a third straight month of contraction. Japan’s final PMI ticked up to 49.4 from 48.7 but stayed below the key 50 mark. Over in Europe, factory activity showed some signs of life, with the final euro area PMI improving to 49.4, the slowest pace of decline in more than two years. Australia’s PMI stayed in growth mode at 51.0, though it cooled from 51.7.

Some relief came when CNBC reported Trump and Xi could talk this week, lifting market spirits briefly. Still, the dollar fell again toward the London close as traders grappled with lingering uncertainty and mixed signals on Trump’s tariff plans.

Upcoming Potential Catalysts on the Economic Calendar:

- Swiss consumer prices for May at 6:30 am GMT

- Euro area unemployment rate for April at 9:00 am GMT

- Euro area consumer prices flash for May at 9:00 am GMT

- New Zealand global dairy trade price index for June 3

- U.S. factory orders ex transportation for April at 2:00 pm GMT

- U.S. JOLTs job openings & quits for April at 2:00 pm GMT

- U.S. factory orders for April at 2:00 pm GMT

- U.S. Fed Goolsbee speech at 4:45 pm GMT

- U.S. Fed Cook speech at 5:00 pm GMT

- U.S. Fed Logan speech at 7:30 pm GMT

- U.S. API crude oil stock change for May 30 at 8:30 pm GMT

- Australia S&P Global services PMI final for May at 11:00 pm GMT

- Australia AIG manufacturing and construction indices for May at 11:00 pm GMT

Big economic reports are coming up with Switzerland and the Euro Area dropping CPI reports while the U.S. prints employment-related numbers.

Aside from that, keep your eyes peeled for geopolitical and trade-related headlines that may influence the major currencies and the closely-watched financial assets!

As always, stay nimble and don’t forget to check out our Forex Correlation Calculator when taking any trades!

加载失败()