As expected, the Bank of Canada (BOC) kept interest rates unchanged for the at 2.75% in June, citing trade uncertainty and mixed economic signals.

This marked the second consecutive meeting without a rate change, as policymakers grappled with heightened trade uncertainty and mixed signals from the domestic economy.

Key points from the June BOC decision:

- Rate unchanged: Overnight rate held at 2.75%, with Bank Rate at 3% and deposit rate at 2.70%

- Trade uncertainty remains elevated: Despite some moderation in US-China tensions, tariff rates remain well above early 2025 levels with ongoing threats of new trade actions

- Economic resilience with caveats: Canada’s Q1 GDP growth of 2.2% slightly exceeded forecasts, but was driven by temporary factors including export pull-forward and inventory accumulation

- Labor market weakening: Unemployment rose to 6.9% in April, with job losses concentrated in trade-intensive sectors

- Inflation pressures mixed: Headline CPI fell to 1.7% in April due to carbon tax elimination, but core measures firmed to 2.3%, slightly above Bank expectations

- Cautious forward guidance: BOC emphasized proceeding “carefully” with particular attention to trade-related risks and their economic spillovers

Link to Bank of Canada Policy Statement (June 2025)

With early indicators suggesting Q2 growth will be considerably weaker as the temporary boost from export pull-forward reverses, officials are facing a complex balancing act between supporting growth in a softening economy and managing potential inflationary pressures from trade disruptions.

In particular, businesses continued reporting higher costs related to supply chain disruptions and alternative sourcing, with many indicating intentions to pass these costs to consumers, posing an upside risk to inflation while growth remains shaky.

During the press conference, Governor Tiff Macklem’s remarks revealed a governing council less unified on the path forward than in previous meetings. While there was consensus on holding rates steady, members expressed “more diversity of views” regarding future policy direction.

Link to BOC Governor Macklem’s Press Conference Opening Remarks

Market Reaction

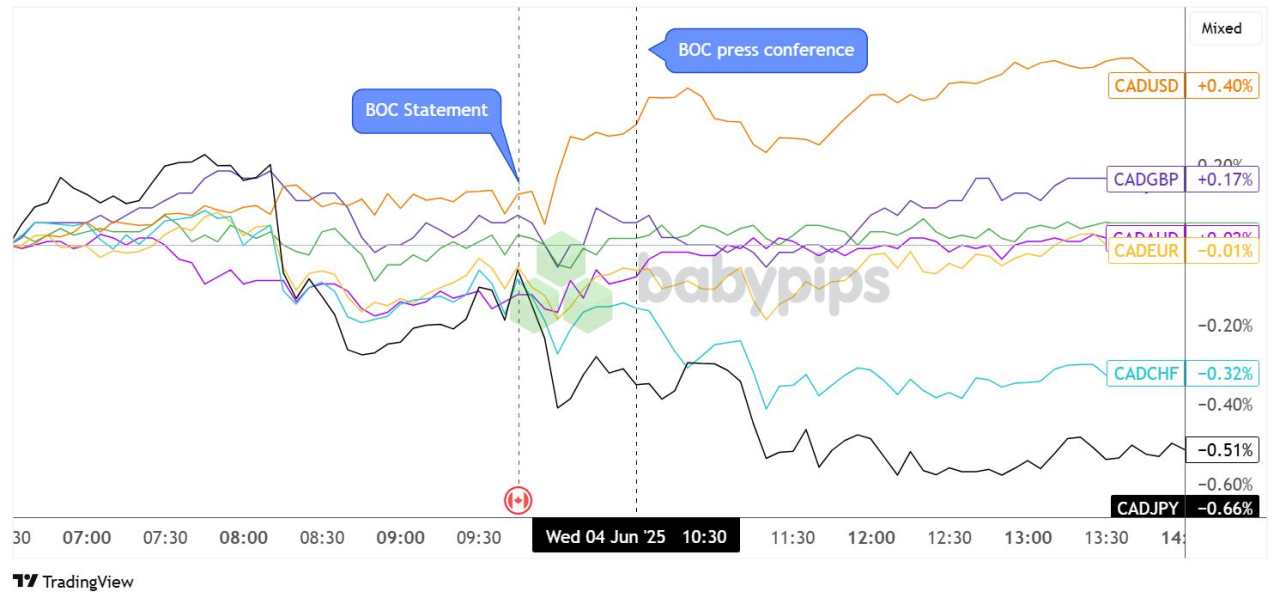

Canadian Dollar vs. Major Currencies: 5-min

Overlay of CAD vs. Major Currencies Chart by TradingView

The Canadian dollar, which had been moving cautiously mixed against its counterparts ahead of the BOC announcement, had a brief bearish reaction to the central bank’s decision to keep rates on hold. Still, CAD quickly trimmed losses against the weaker USD while also recovering to pre-event levels against GBP, AUD and NZD before the press conference.

With BOC head Macklem reinforcing their data-dependent approach during the presser, the Loonie struggled to find direction for the remainder of the session, extending its climb versus the U.S. dollar (+0.40%) but losing ground to other safe-havens like the Japanese yen (-0.51%) and Swiss franc (-0.32%) in the hours that followed.

With the BOC reiterating plans to be “less forward-looking than usual” traders appeared to be holding out for clearer evidence of either sustained economic weakness or contained cost pressures before positioning for policy expectations.

加载失败()