As expected, the European Central Bank (ECB) delivered its eighth consecutive rate cut since June 2024, this time reducing the deposit rate by 25 basis points to 2.0%.

The decision was virtually unanimous, with only one member (likely Austrian governor Robert Holzmann) dissenting.

However, the bigger story emerged from President Christine Lagarde’s press conference, where she signaled the central bank was “getting to the end of a monetary policy cycle” and described the current policy stance as being in a “good position to navigate uncertain conditions.”

Key points from the ECB:

- ECB cut deposit rate to 2.0% from 2.25%, main refinancing rate to 2.15%, and marginal lending facility rate to 2.40%

- The decision marks the eighth consecutive reduction since June 2024

- The vote was virtually unanimous, with only one member (likely Austrian governor Robert Holzmann) dissenting

- Updated economic forecasts:

- Inflation projections: 2.0% in 2025, 1.6% in 2026, returning to 2.0% in 2027

- Core inflation expected at 2.4% in 2025 and 1.9% in 2026-2027

- GDP growth forecasts: 0.9% in 2025, 1.1% in 2026, and 1.3% in 2027

- Trade uncertainty from US tariffs identified as primary downside risk

The ECB’s inflation projections were revised lower for both 2025 and 2026, primarily reflecting lower energy price assumptions and the stronger euro’s impact on import costs. The central bank now expects headline inflation to hit its 2% target this year before undershooting in 2026 at 1.6%, then returning to target in 2027.

Core inflation excluding food and energy is projected to remain more stable, averaging 2.4% in 2025 before moderating to 1.9% in subsequent years.

Growth forecasts remained largely unchanged, with the ECB maintaining its 0.9% projection for 2025 despite a stronger-than-expected first quarter. The bank expects gradual acceleration to 1.1% in 2026 and 1.3% in 2027, supported by rising government investment in defense and infrastructure.

However, the unrevised 2025 growth projection masks underlying weakness, combining stronger Q1 performance with weaker prospects for the remainder of the year due to trade policy uncertainty.

Link to ECB Monetary Policy Statement (June 2025)

In her presser, President Lagarde’s most significant comments centered on the central bank having “just nearly concluded” the monetary policy cycle, emphasizing that the ECB is in a “good place” after the latest rate cut. She maintained the bank’s data-dependent, meeting-by-meeting approach while explicitly stating she was “not confirming a pause,” keeping future policy options open.

Lagarde acknowledged that risks to growth remain “tilted to the downside” but noted that planned defense and infrastructure investment will provide medium-term support.

The ECB also presented alternative trade scenarios, showing that further escalation would push both growth and inflation below baseline projections, while a benign resolution would lift both metrics above current forecasts.

Link to ECB Press Conference (June 2025)

Market Reactions

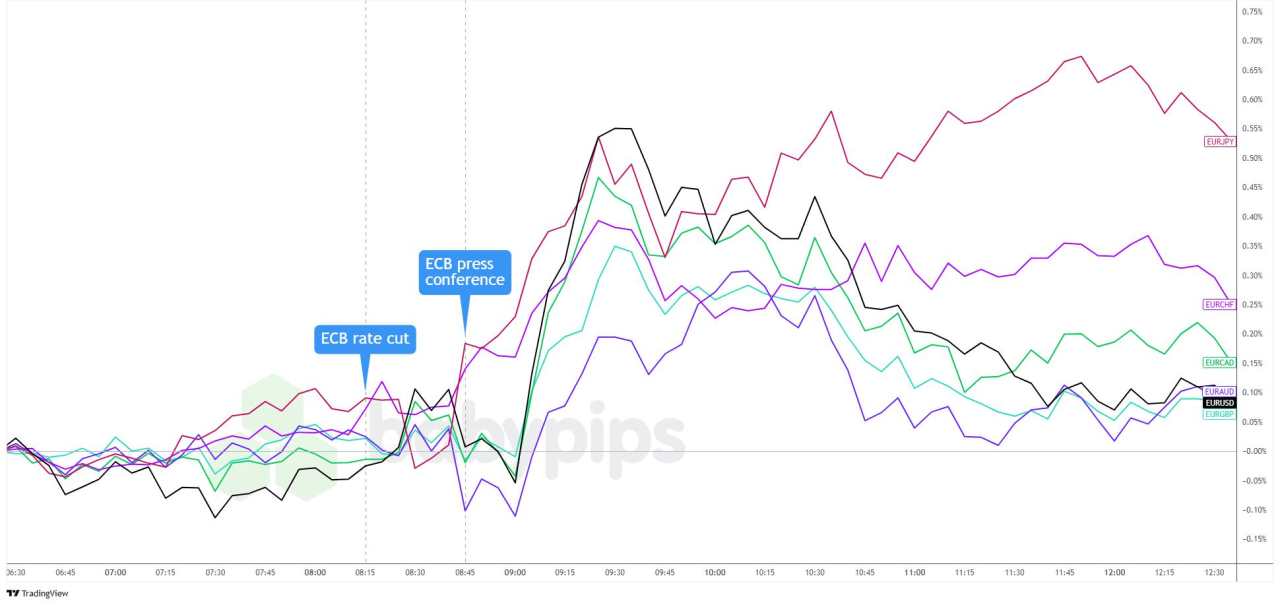

Euro vs. Major Currencies: 5-min

Overlay of EUR vs. Major Currencies Chart by TradingView

The euro spent most of the lead-up to the ECB decision trading in a tight range with a slight bullish lean. The currency also barely blinked after the expected 25 bps rate cut was announced.

It wasn’t until President Lagarde took the stage and delivered a hawkish message that the euro really found its legs. Her comments sparked a broad rally, helped along by fresh weakness in the dollar after soft U.S. weekly jobless claims data.

Later in the session, risk aversion from the Trump-Musk spat and some profit-taking ahead of the U.S. nonfarm payrolls report trimmed the euro’s gains. Still, the ECB’s hawkish tone and the euro’s relative safety compared to riskier currencies helped it close the day on positive footing against the other majors.

加载失败()