The UK jobs market showed clear signs of weakening in May, with unemployment hitting 4.6% – its highest level in nearly four years – while job vacancies fell sharply and wage growth decelerated, according to the latest Office for National Statistics data.

Key Takeaways:

- Unemployment rate increased to 4.6% in February-April 2025, up from 4.5% in the previous quarter

- Annual growth in regular earnings (excluding bonuses) slowed to 5.2% in February-April 2025, down from 5.6% in the previous period

- Job vacancies fell dramatically to 736,000 in March-May 2025, down 63,000 from the previous quarter

Underlying metrics also revealed that payroll employee numbers continued to decline, reflecting ongoing workforce adjustments, bringing the jobless rate to its highest point since April-June 2021 when it reached 4.7%.

Link to U.K. ONS Labour Market Overview (May 2025)

Market participants also took note of the rapid 16.9% year-on-year decline in hiring opportunities, as the ratio of unemployed people per vacancy worsened to 2.2, up from 1.7 a year earlier.

Analysts noted that the employment cost increases implemented in April – including higher National Insurance contributions for employers and minimum wage rises – likely contributed to reduced hiring appetite among UK businesses. Many firms appear to be holding back on recruitment or choosing not to replace departing workers.

Market Reaction

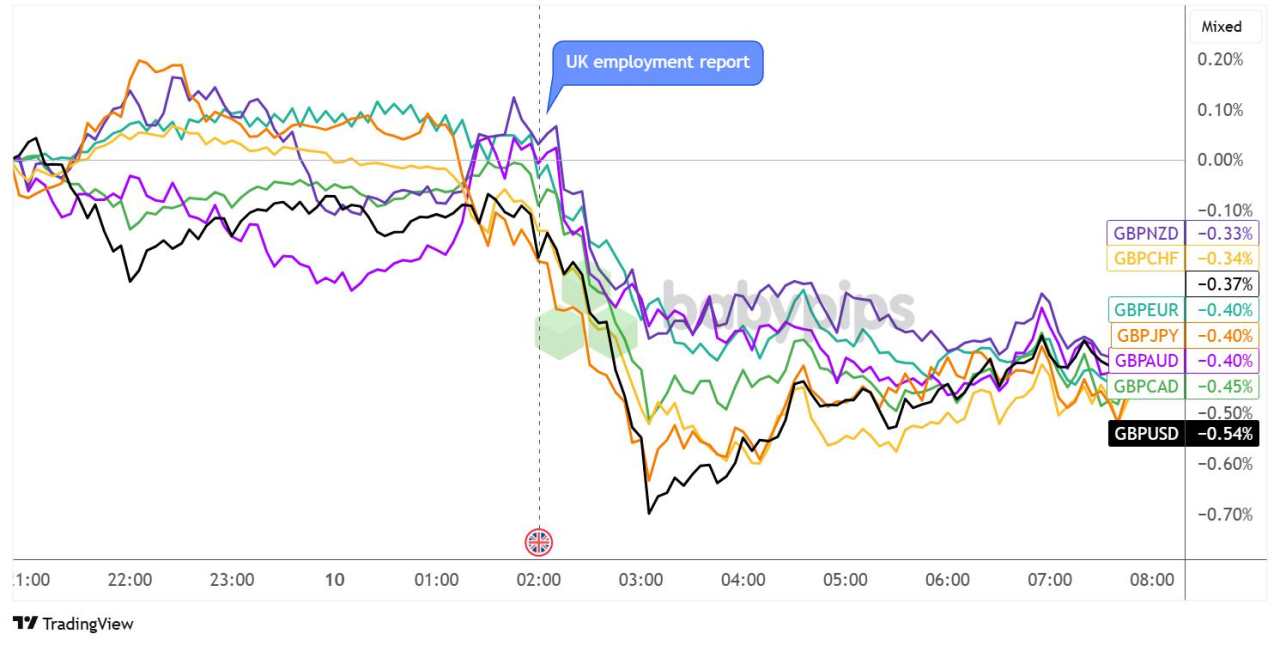

British Pound vs. Major Currencies: 5-min

Overlay of GBP vs. Major Currencies Chart by TradingView

The pound experienced significant weakness following the employment data release, with sterling declining against all major trading partners.

Currency traders likely interpreted the deteriorating jobs conditions as likely to prompt more aggressive monetary easing from the Bank of England while futures markets priced in increased probability of more rate cuts before year-end.

The most pronounced selling pressure was seen in GBPUSD, which fell 0.54%, while sterling also tumbled against comdolls, with GBPCAD declining 0.45% and GBPAUD down 0.40%. European currency pairs showed similar weakness, with GBPEUR falling 0.40% and GBPCHF tumbling 0.34%.

加载失败()