Markets appeared less enthusiastic about trade negotiations between the U.S. and China while turning their attention to the U.S. inflation report for May.

Meanwhile, worsening geopolitical tensions in Iran sparked a huge rally for crude oil later in the day.

Here are headlines you may have missed in the last trading sessions!

Headlines:

- Japan’s PPI slumped from 4.1% to 3.2% y/y in May vs. 3.5% forecast

- API reported reduction of 370K barrels of oil vs. estimated 700K increase

- U.S. and Mexico reportedly nearing a deal on tariffs and steel imports

- U.S. Commerce Secretary Lutnick said that they achieved “a handshake for a framework” with China in latest talks

- U.S. appeals court allowed Trump’s tariffs to stay in place at least until July 31 amid ongoing legal challenge

- Japanese PM Ishiba said that they are making steady progress in tariffs talks with U.S.

- OPEC Secretary General Haitham Al Ghais reiterated optimistic demand growth forecast of 24% by 2050

- Trump noted that he is less confident about reaching a deal with Iran

- Trump posted that magnets and rare earths materials will be supplied up front by China while U.S. would allow Chinese students in local colleges and universities

- ECB official Lane explained that latest interest rate cut could keep inflation undershoot temporary

- ECB official Kazaks suggested that further cuts could be required to keep inflation at 2%

- Canada Building Permits for April 2025: -6.6% m/m (-0.4% m/m forecast; -4.1% m/m previous)

-

U.S. Consumer Price Index growth rate for May 2025: 2.4% y/y (2.5% y/y forecast; 2.3% y/y previous); 0.1% m/m (0.2% m/m forecast; 0.2% m/m previous)

- Core Consumer Price Index growth rate for May 2025: 0.1% m/m (0.3% m/m forecast; 0.2% m/m previous); 2.8% y/y (2.9% y/y forecast; 2.8% y/y previous)

- U.S. EIA Crude Oil Stocks Change for June 6, 2025: -3.64M (-4.3M previous)

- U.S. State Department called for evacuation of staff in Middle East as Naval Support activity in Bahrain has been placed on ‘high alert’

Broad Market Price Action:

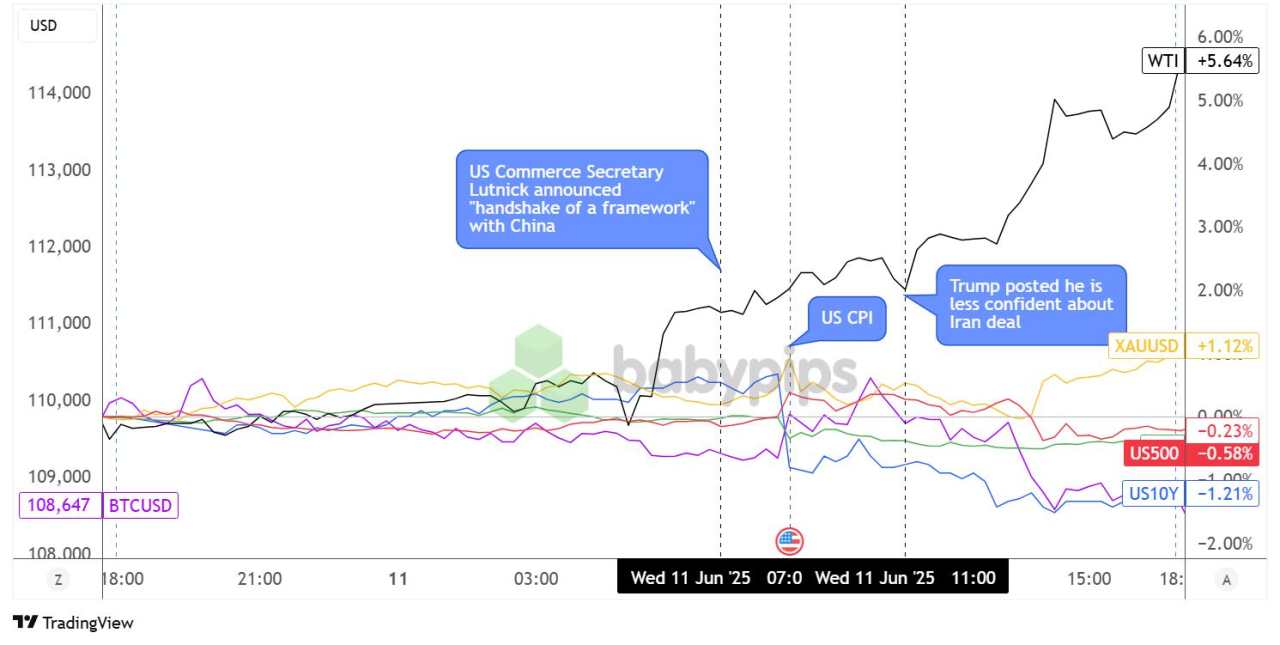

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Another day, another round of US-China trade talks… Investors seemed unimpressed with the latest set of developments, even though Commerce Secretary announced that they reached a “handshake of a framework” which many interpreted to just be a “plan to make a plan.”

Major asset classes moved in tight ranges throughout the Asian session and the first half of the London session while waiting for the May U.S. CPI report, which turned out weaker than expected and triggered a steep drop for Treasury yields.

On the flip side, higher-yielding assets like bitcoin and U.S. equities cheered the results since the downbeat numbers supported the odds of a more dovish Fed. Gold still managed to hold its ground, as the safe-haven metal appeared to be taking advantage of risk-off flows from geopolitical tensions.

As it turned out, Trump had talked about being “less confident” when it comes to reaching a deal with Iran, spurring speculations of additional oil sanctions on the nation. WTI crude oil extended its surge on reports that the U.S. State Department authorized the departure of staff in the Middle East on security concerns, triggering a fresh set of risk-off flows late in the day.

FX Market Behavior: U.S. Dollar vs. Majors:

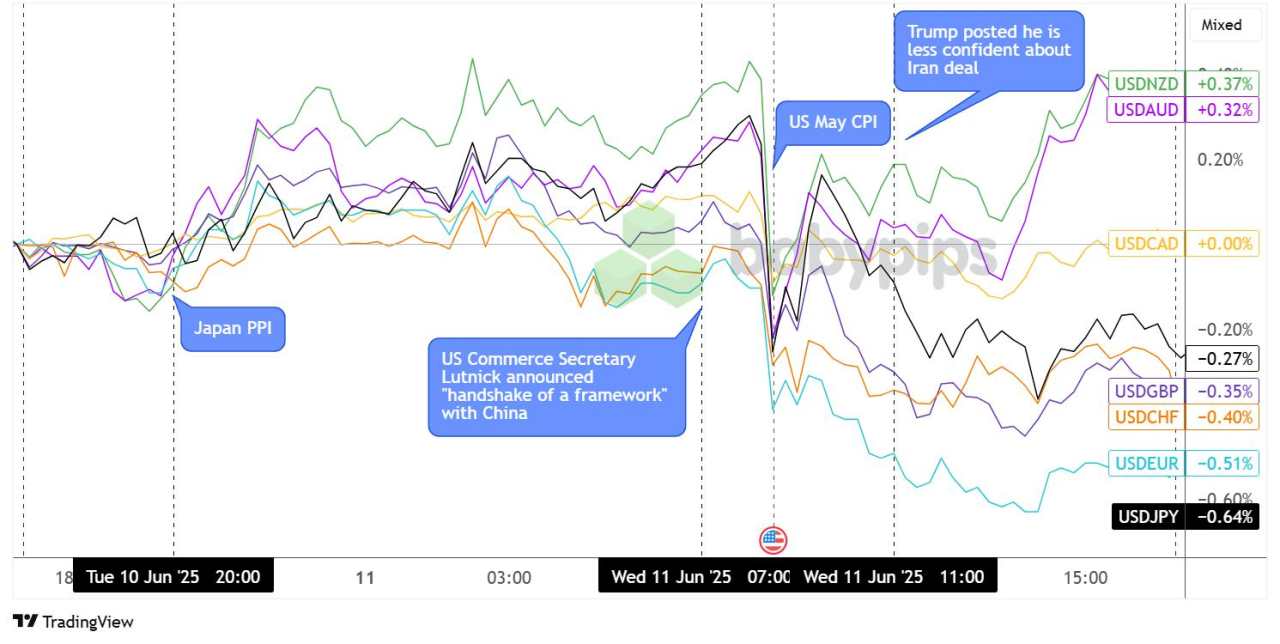

Overlay of USD vs. Majors Chart by TradingView

A bit of trade-related optimism still lifted the dollar ahead of the highly-anticipated CPI release, as traders seemed to focus on US-Mexico talks going well and the decision of the federal Court of Appeals to keep Trump’s tariffs in force despite the ongoing legal challenge.

Although USD strength appeared to fade around the start of the London session, the currency got another quick boost from US Commerce Secretary’s announcement of a “handshake of a framework” with China. After all, this was backed by Trump’s Truth Social post on China supplying magnets and rare earths materials up front while they allow Chinese students in US colleges and universities.

However, the Greenback’s gains were wiped out after the May CPI report came in the red, with weaker price pressures downplaying the tariffs impact and underscoring expectations for further Fed rate cuts later in the year.

From there, dollar price action became mixed, as the currency quickly recovered versus the commodity currencies when risk-off flows on Middle East geopolitical tensions picked up. On the other hand, USD sustained its drop versus European currencies and the yen, closing 0.51% lower against EUR and 0.27% in the red against JPY.

Upcoming Potential Catalysts on the Economic Calendar

- U.K. Manufacturing & Industrial Production at 6:00 am GMT

- U.K. GDP at 6:00 am GMT

- U.K. Balance of Trade at 6:00 am GMT

- ECB official Guindos’ Speech GMT

- ECB official Schnabel’s Speech at 12:20 pm GMT

- U.S. Producer Price Index at 12:30 pm GMT

- U.S. Initial Jobless Claims at 12:30 pm GMT

- Germany Current Account at 12:45 pm GMT

- U.S. Fed Balance Sheet at 8:30 pm GMT

- New Zealand Business NZ PMI at 10:30 pm GMT

After yesterday’s CPI miss, traders could now turn their attention to the U.S. PPI report to gauge if underlying price pressures are picking up on tariffs uncertainty. Better keep an eye out for another set of downbeat figures that could continue to support dovish Fed expectations.

Before that, the U.K. GDP release could also stir some pound volatility, as the results could either support or undermine the economy’s resilience to the global trade drama.

As always, stay nimble and don’t forget to check out our Forex Correlation Calculator when taking any trades!

加载失败()