The UK’s consumer price inflation accelerated to 3.6% year-on-year in June, up from 3.4% in May, marking the highest reading since January 2024 and potentially dampening expectations for aggressive Bank of England rate cuts in the near term.

Key Points from the June CPI Report

- Headline CPI rose to 3.6% annually, above the 3.4% consensus forecast, with monthly inflation climbing 0.3% versus 0.1% in June 2024

- Core CPI (excluding energy, food, alcohol, and tobacco) increased to 3.7% from 3.5% in May, signaling persistent underlying price pressures

- CPIH (including owner occupiers’ housing costs) climbed to 4.1% from 4.0%, remaining well above the Bank of England’s 2% target

- Transport costs, particularly motor fuels, provided the largest upward contribution to the monthly change, while housing and household services offered some offset

- Services inflation held steady at 4.7%, while goods inflation accelerated from 2.0% to 2.4%, marking the highest goods inflation since October 2023

- Food and non-alcoholic beverages inflation edged up to 4.5% from 4.4%, continuing a third consecutive monthly increase

Link to official ONS release on Consumer price inflation

These readings reinforced the challenge facing the Bank of England as it balances controlling persistent price pressures against supporting economic growth. An argument can be made that the central bank may still proceed with rate cuts given broader economic weakness, but the inflation uptick provides ammunition for those favoring a more cautious approach.

The data showed that the UK’s disinflation process remains uneven, with services inflation proving particularly stubborn at 4.7% – more than double the BoE’s target. Markets will likely scrutinize upcoming UK labor market data and economic indicators to gauge whether this inflation acceleration represents a temporary blip or a more concerning trend that could alter the BoE’s policy trajectory.

Market Reactions

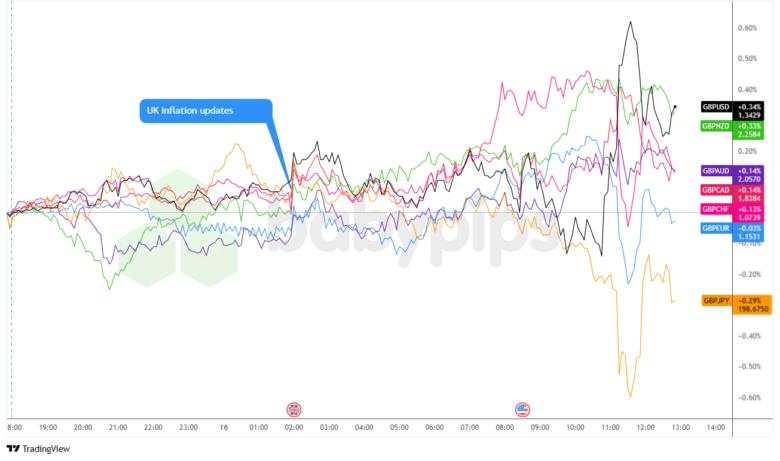

British pound vs. Major Currencies: 5-min

Overlay of GBP vs. Major Currencies Chart by TradingView

The British pound showed mixed reactions across major currency pairs following the inflation release. Initial strength was observed against its major counterparts as markets interpreted the higher-than-expected reading as reducing the likelihood of aggressive BoE easing.

However, the initial response was relatively muted and capped throughout the morning London session, suggesting traders had already positioned for the possibility of sticky inflation. Through the remainder of the Wednesday session, GBP continued to lean net bullish against the majors.

The overall muted, mixed response may be a signal that currency traders are still balancing the signs of sticky inflation conditions against ongoing concerns about UK economic growth, and elevated uncertainty about whether the BoE will proceed with the widely anticipated rate cut at the August meeting.

加载失败()