Dollar bears painted the town red almost the entire day while risk assets tossed and turned, as markets awaited the August 1 tariffs deadline.

Here are headlines you may have missed in the last trading sessions!

Headlines:

- Japan’s Upper House elections led to loss of majority for ruling coalition

- New Zealand Inflation Rate for Q2 2025: 0.5% q/q (0.3% q/q forecast; 0.9% q/q previous); 2.7% y/y (2.1% y/y forecast; 2.5% y/y previous)

- U.S. Treasury Secretary Bessent said that it’s the quality of the trade deals that matter, not the timing

- Canada PPI for June 2025: 1.7% y/y (2.5% y/y forecast; 1.2% y/y previous); 0.4% m/m (0.3% m/m forecast; -0.5% m/m previous)

- Canada Raw Materials Prices for June 2025: 2.7% m/m (0.8% m/m forecast; -0.4% m/m previous); 1.1% y/y (-2.0% y/y forecast; -2.8% y/y previous)

- U.S. CB Leading Index MoM for June 2025: -0.3% (-0.1% forecast; -0.1% previous)

- BOC Survey: Tariffs and trade uncertainty continue to have an impact on business outlook

Broad Market Price Action:

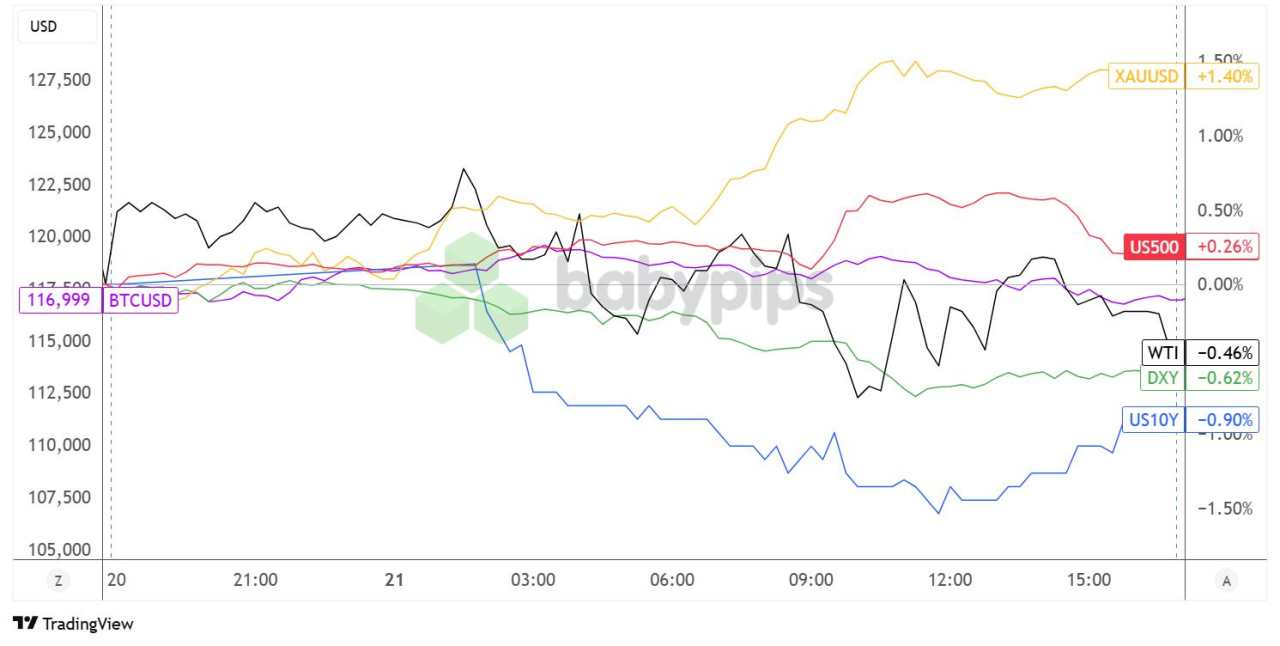

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Risk assets seemed to be struggling to find their groove since there were no major reports or headlines that nudged overall sentiment in a particular direction. Some risk-on vibes came from U.S. Treasury Secretary Bessent’s remarks suggesting that the August 1 deadline might still be pushed back, as he mentioned that it’s the quality of the trade deals that matters and not so much the timing.

WTI crude oil started off on positive ground, holding on to its gains for the most part of the Asian session before gradually unwinding its rally for the remainder of the day. Gold also found support early in the day, before accelerating its climb spurred mostly by USD weakness and a steady decline in Treasury yields.

Meanwhile, European equities were on wobbly ground while investors grew anxious over the lack developments in EU-US trade negotiations, but U.S. stock indices managed to finish off strong, with the Nasdaq and S&P 500 closing at record levels thanks to optimism for big tech earnings data due later in the week.

FX Market Behavior: U.S. Dollar vs. Majors:

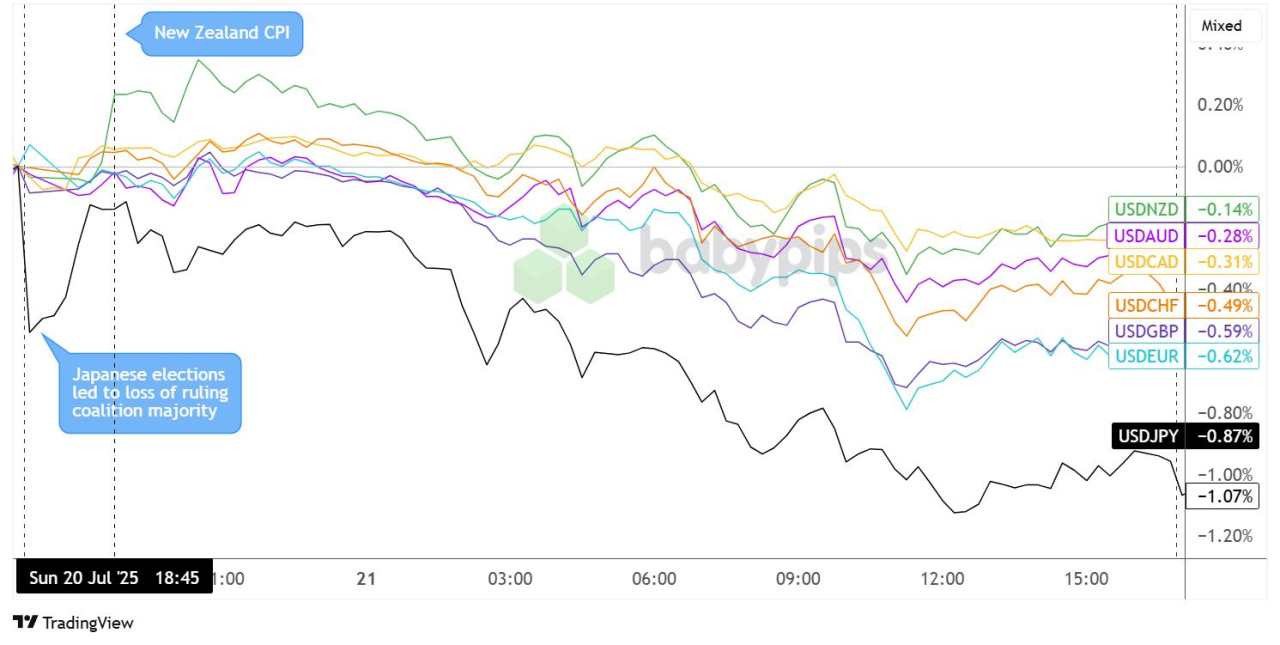

Overlay of USD vs. Majors Chart by TradingView

Majority of dollar pairs cruised in tight ranges during the Asian session, with the exception of USD/JPY which gapped lower after Japan’s weekend election results led to a loss of majority for the ruling coalition and NZD/USD which dipped upon seeing weaker than expected CPI data.

It wasn’t long before these pairs joined the rest of the dollar gang in edging gradually lower during the European and U.S. sessions while markets appeared to be pricing in an extension of the August 1 tariffs deadline.

The dollar closed lower across the board, most notably against the stronger yen which appeared to shrug off the additional political uncertainty in the country, while minimizing losses against the commodity currencies.

Upcoming Potential Catalysts on the Economic Calendar

- U.K. Public Sector Net Borrowing Ex Banks at 6:00 am GMT

- Euro area ECB Bank Lending Survey at 8:00 am GMT

- U.S. Fed Chair Powell Speech at 12:30 pm GMT

- U.S. Richmond Fed Manufacturing Index at 2:00 pm GMT

- Euro area ECB President Lagarde Speech at 5:00 pm GMT

- U.S. Money Supply at 5:00 pm GMT

- U.S. Fed Bowman Speech at 5:00 pm GMT

- U.S. API Crude Oil Stock Change at 8:30 pm GMT

Additional USD volatility could come in play since Fed Chairperson Powell has a testimony coming up, followed by Fed official Bowman’s speech later in the New York session. Stay on your toes during ECB head Lagarde’s testimony as well since she could have some policy insights related to trade development.

As always, stay nimble and don’t forget to check out our Forex Correlation Calculator when taking any trades!

加载失败()