After months of political uncertainty and rising prices straining voters, Japan’s ruling coalition has officially lost its majority in the upper house election, marking the first time since 1955 that the LDP has lost control of both parliamentary chambers.

For traders out there who need a quick 411 on what’s been happening, here are four things you need to know about the historic election results.

The ruling coalition suffered a historic defeat

Prime Minister Shigeru Ishiba’s Liberal Democratic Party and coalition partner Komeito won only 47 seats, falling short of the 50 needed to retain their majority in the 248-seat upper house. This marks the first time the LDP-led coalition has lost a majority in both houses of parliament since the party’s formation in 1955.

The opposition Constitutional Democratic Party finished second with 22 seats, while the far-right populist Sanseito party emerged as one of the biggest winners, surging from just one seat to 14 seats. Launched on YouTube during the pandemic by spreading conspiracy theories, Sanseito found wider appeal with its “Japanese First” campaign and warnings about a “silent invasion” of foreigners.

The election was driven primarily by voter frustration over rising prices, particularly rice costs that have doubled in the past year, rather than foreign policy concerns.

Japan’s bond markets may have already priced in fiscal concerns

Japanese government bonds plunged last week, sending yields on 30-year debt to an all-time high, while the yen slid to multi-month lows against the U.S. dollar and the euro. Japanese government 30-year yields are up 80 basis points this year, and the yield curve is at its steepest in years, with the spread between 10-year and 30-year bonds above 150 bps.

Investors expect opposition parties to push for tax cuts and increased government spending, with all three leading opposition parties backing some form of consumption tax cuts. Barclays analysts estimate a 5 percentage point cut to Japan’s sales tax, currently at 10%, would lead to a 15-20 basis point increase in the 30-year yield.

However, analysts noted that prospects for aggressive fiscal stimulus are limited, with any meaningful supplementary budget unlikely to be debated until the autumn Diet session at the earliest.

The BOJ’s rate hike path is now in question

The increased political fragility is likely to constrain the Bank of Japan’s (BOJ) ability to tighten monetary policy in the near term, with the central bank potentially reluctant to add further pressure to an already volatile landscape. Some analysts believe the BOJ could come under pressure to go slow on rate hikes if smaller opposition parties increase their clout.

While some analysts hadn’t completely ruled out one BOJ hike within the year, the possibility of no hike has now emerged following the election results.

The central bank’s July 31 meeting is likely to keep policy unchanged amid uncertainties over trade talks and the new political landscape.

Ishiba vows to stay but faces mounting pressure

Despite the loss, Ishiba expressed determination to stay on to tackle challenges such as U.S. tariff threats, citing the need to avoid creating a political vacuum. However, some senior LDP lawmakers, including former prime minister Taro Aso, were quietly voicing doubts over whether Ishiba should stay, according to local media reports.

The election result comes at a tricky time as Japan tries to negotiate a tariff deal with U.S. President Donald Trump before an Aug. 1 deadline. Japan’s chief tariff negotiator departed for Washington on Monday morning for his eighth visit in three months.

The political uncertainty could complicate Japan’s negotiating position as it faces potential 25% tariffs on its exports to the U.S.

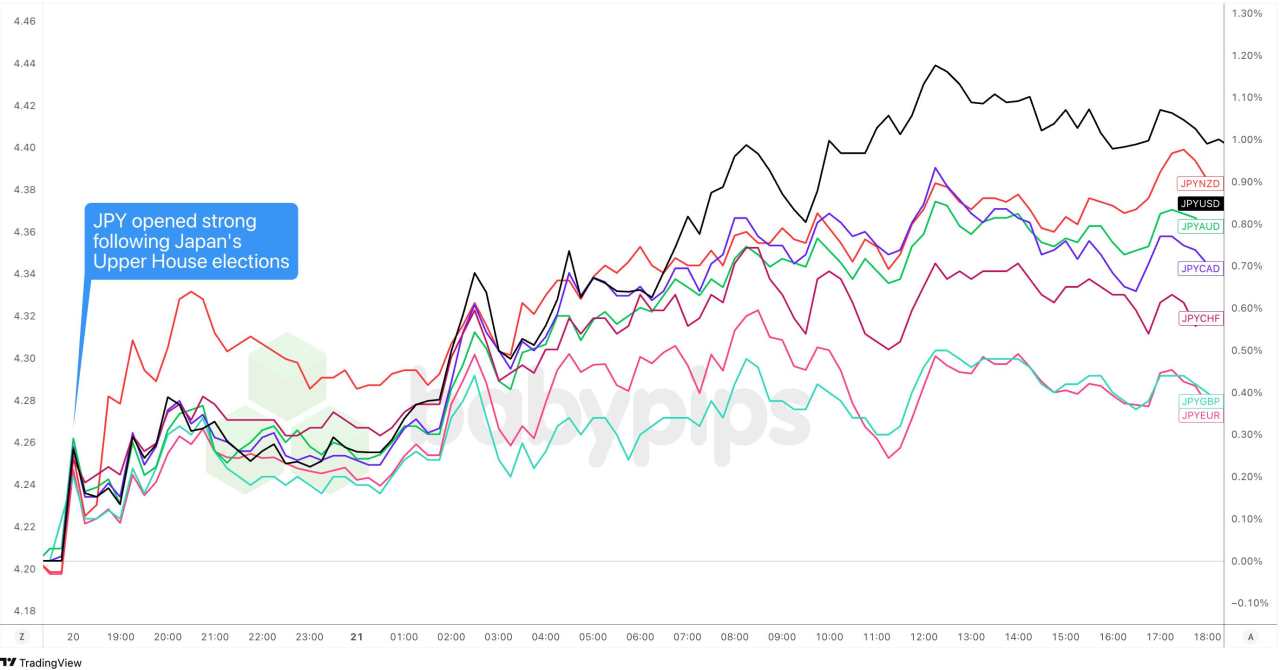

The yen mostly shrugged off the election results

The yen actually pushed higher after Japan’s election results, climbing as much as 1% against the dollar during Monday’s Asian session. Most of the outcome had already been priced in, but with the results landing within expectations, the yen still found room to firm up.

Later in the day, a combo of ongoing tariff jitters, a softer U.S. dollar, and safe haven flows gave the yen another leg up during the London and late U.S. sessions.

Japanese Yen vs. Major Currencies: 15-min

Overlay of JPY vs. Major Currencies Chart by TradingView

Several analysts also noted that some investors had positioned for a larger setback for the coalition and even anticipated Ishiba’s resignation, with the unwinding of such positions contributing to the initial yen rebound.

However, currency strategists warned that prolonged political uncertainty will be negative for Japanese assets, including the yen, and doubted the currency could sustain its strength.

加载失败()