Markets were jittery on Monday as traders reacted to the US-EU trade framework and a potential US-China tariff extension, sending the dollar soaring while European stocks sank.

Wall Street hit new highs, gold fell again, and oil rallied on geopolitical jitters, while upcoming UK data and the JOLTs report are set to drive the next moves.

Here are headlines you may have missed in the last trading sessions!

Headlines:

- U.S. and EU agreed on a framework for a trade deal on Sunday

- China industrial profits for June: -1.8% ytd/y (-0.5% forecast; -1.1% previous)

- China foreign direct investment for June: -15.2% ytd/y (-14.0% forecast; -13.2% previous)

- South China Morning Post reported that China and the U.S. could extend their tariff truce by another 90 days

- Some EU officials criticized U.S.-EU trade deal framework

- U.K. CBI distributive trades for July: -34.0 (-30.0 forecast; -46.0 previous)

- Canada wholesale sales (preliminary) for June: 0.7% m/m (-0.2% forecast; 0.1% previous)

- OPEC+ panel stressed the need for full compliance with output limits

- U.S. Dallas Fed manufacturing index for July: 0.9 (-8.0 forecast; -12.7 previous)

- U.S. President Trump shortened Russia’s 50-day peace deal deadline to “10 or 12 days,” said he was “no longer interested in talks”

- Trump said he plans to announce pharmaceutical tariffs “in the near future.”

Broad Market Price Action:

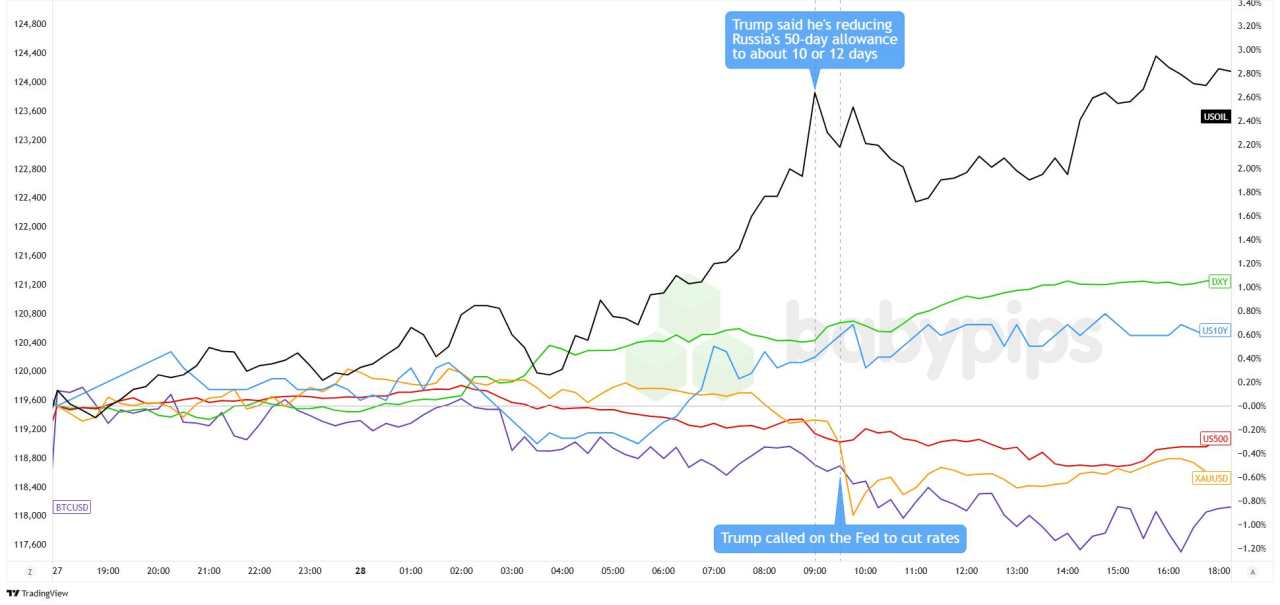

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

The major assets were all over the charts Monday as investors tried to make sense of the US-EU trade deal announced over the weekend. The framework of the possible deal includes a 15% tariff on EU goods, which is a relief compared to the 30% that was on the table. The EU could also buy $750 billion in U.S. energy and pledged another $600 billion for U.S. investments.

European stocks popped at the open but quickly lost steam. Germany’s DAX slid over 1% after officials warned the deal could still bring serious economic pain. France’s CAC 40 and the FTSE 100 both dropped around 0.4%.

Wall Street fared better. The S&P 500 and Nasdaq both posted fresh record closes, with modest gains. Gold fell for the fourth day in a row as the dollar stayed strong. The 10-year Treasury yield climbed to 4.42% as traders stayed cautious ahead of this week’s FOMC event. WTI oil shot higher after Trump announced he might tighten the deadline for Russia and Ukraine to make peace deal progress and OPEC reminded everyone to stick to their production quotas. Bitcoin slipped to around 118,600 after hitting highs near 119,800.

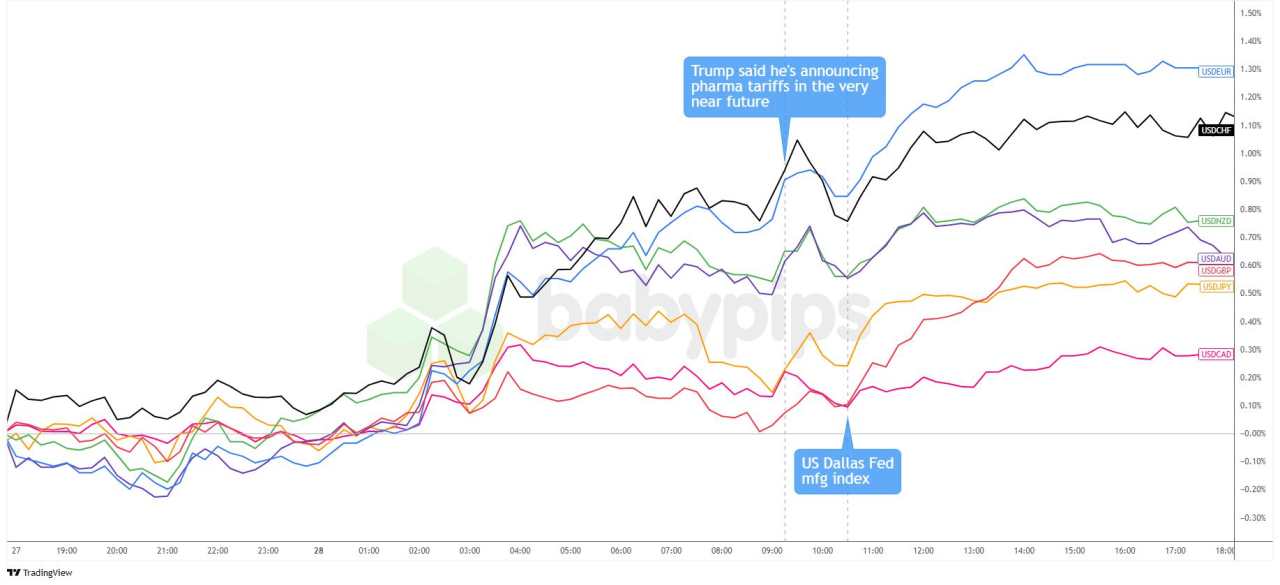

FX Market Behavior: U.S. Dollar vs. Majors:

Overlay of USD vs. Majors Chart by TradingView

The dollar came out swinging Monday and logged its strongest day since May as traders sized up the US-EU trade deal and started pricing in a possible US-China tariff extension. The Greenback got love across the board, gaining ground in Asia, London, and the U.S. sessions as optimism spread and markets digested the weekend headlines.

EUR/USD took the biggest hit, sliding 1.3% to 1.1650 after European officials pushed back on the terms of the deal. That marked the euro’s worst day in more than two months. The dollar index popped 1%, showing broad strength. USD/CHF punched through 0.8000 for the first time in a week, while the pound dipped to 1.3407, its lowest since last Monday.

The dollar briefly lost steam at the New York open but got a second wind after the Dallas Fed index came in better than expected. Commodity currencies were on the back foot all day, with both the Aussie and Kiwi shedding 0.75%. Traders leaned into the dollar on relief that a full-blown trade war was dodged and on hopes that the EU energy deal might help narrow the U.S. trade gap.

Upcoming Potential Catalysts on the Economic Calendar

- Euro Area ECB consumer inflation expectations for June at 8:00 am GMT

- U.K. mortgage lending for June at 8:30 am GMT

- U.K. M4 money supply for June at 8:30 am GMT

- U.K. BoE consumer credit for June at 8:30 am GMT

- U.K. mortgage approvals for June at 8:30 am GMT

- U.K. net lending to individuals for June at 8:30 am GMT

- U.S. wholesale inventories adv for June at 12:30 pm GMT

- U.S. retail inventories ex autos adv for June at 12:30 pm GMT

- U.S. goods trade balance adv for June at 12:30 pm GMT

- U.S. S&P/Case-Shiller home price for May at 1:00 pm GMT

- U.S. house price index for May at 1:00 pm GMT

- U.S. JOLTs job openings for June at 2:00 pm GMT

- U.S. CB consumer confidence for July at 2:00 pm GMT

- U.S. Dallas Fed services index for July at 2:30 pm GMT

- U.S. API crude oil stock change for July 25 at 8:30 pm GMT

A batch of U.K. credit and lending figures could stir GBP pairs if they influence BoE rate expectations. In the U.S. session, housing data and the JOLTs report take the spotlight, with job openings likely to shape NFP forecasts and Fed rate speculation.

Meanwhile, oil traders watch the API stock change in the absence of fresh geopolitical or risk sentiment catalysts.

As always, stay nimble and don’t forget to check out our Forex Correlation Calculator when taking any trades!

加载失败()