The tariffs drama appeared to take a back seat at the start of this trading week, as traders turned their attention to geopolitical developments.

Still, risk assets had a mixed run on Monday, with crypto pulling back from record highs and gold staying elevated on safe-haven support.

Here are headlines you may have missed in the last trading sessions!

Headlines:

- Over the weekend, Russia called for security guarantees in any Ukraine deal while Trump said Zelensky has the option to end the war immediately

- New Zealand Services NZ PSI for July 2025: 48.9 (48.2 forecast; 47.3 previous)

- New Zealand Composite NZ PCI for July 2025: 50.5 (49.4 forecast; 48.3 previous)

- Japan Tertiary Industry Activity Index for June 2025: 0.5% (0.3% forecast; 0.6% previous)

- White House advisor Navarro criticized India’s buying of Russia’s oil, questioning their strategic alignment and prompting sanctions fears

- Swiss Industrial Production YoY for June 30, 2025: -0.1% (-2.3% forecast; 8.5% previous)

- Euro area Trade Balance for June 2025: 7.0B (14.7B forecast; 16.2B previous)

- Ukranian President Zelensky said that giving up territory to Russia would be impossible and that peace can only be forced through strength

- Canada Housing Starts for July 2025: 294.1k (281.0k forecast; 283.7k previous)

- Canada Foreign Securities Purchases for June 2025: 0.71B (-2.79B previous)

- U.S. President Trump noted that they are working on trilateral deal between the U.S., EU and Russia

- U.S. NAHB Housing Market Index for August 2025: 32.0 (34.0 forecast; 33.0 previous)

- New Zealand PPI Output QoQ for June 30, 2025: 0.6% (0.7% forecast; 2.1% previous); PPI Input QoQ for June 30, 2025: 0.6% (0.4% forecast; 2.9% previous

Broad Market Price Action:

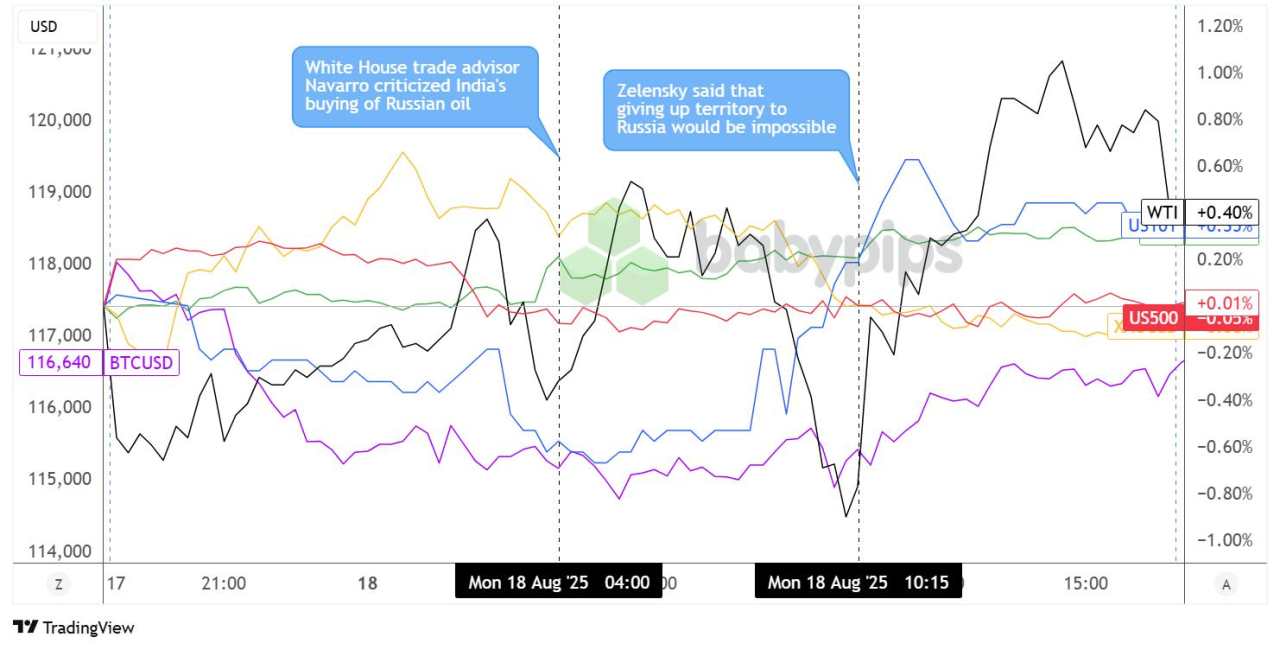

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Market correlations were all over the place at the beginning of the week, as investors digested the implications of the Trump-Putin meeting while profit-taking from Friday rallies also took place.

WTI crude oil started on bearish footing, as geopolitical tensions were kept in check and traders looked ahead to talks between Ukranian President Zelensky, EU leaders and U.S. President Trump in an attempt to strike a trilateral deal.

However, the energy commodity popped back up on sanctions jitters when White House trade advisor Navarro criticized India’s purchases of Russian oil. Although price retreated to intraday lows ahead of the U.S. session, crude oil rallied sharply once again when Zelensky reiterated that giving up territory to Russia would be impossible, crushing hopes of an immediate ceasefire.

Gold remained supported by safe-haven flows on market anxiety throughout most of the Asian and London sessions, before the precious metal retreated to negative territory as dollar strength picked up on rising Treasury yields during U.S. market hours.

Bitcoin struggled to hold on to the $118K handle from the get-go, tumbling to the $115K support zone before rebounding slightly to $116K levels by session’s end.

FX Market Behavior: U.S. Dollar vs. Majors:

Overlay of USD vs. Majors Chart by TradingView

Dollar pairs struggled to find direction during the early Asian session, as economic reports printed over the weekend sparked counter currency flows.

The Kiwi and Australian dollar drew some support from improvements in New Zealand’s BusinessNZ services index from 47.6 to 48.9, reflecting a slower pace of industry contraction in July, while the yen was on the back foot until the upbeat Japanese tertiary industry activity index was printed.

USD seemed to find a bottom a few hours into the London session, as the market spotlight shifted to the upcoming meeting between officials from Ukraine, the EU, and the U.S. in an attempt to broker a peace agreement.

The U.S. currency held on to its gains as U.S. markets opened, before moving mostly sideways for the remainder of the session, except against the Canadian dollar which drew strength from rising oil prices then.

Upcoming Potential Catalysts on the Economic Calendar

- Euro area Current Account at 8:00 am GMT

- Canada Consumer Price Inflation at 12:30 pm GMT

- U.S. Housing Starts at 12:30 pm GMT

- U.S. Building Permits at 12:30 pm GMT

- U.S. Fed official Bowman’s Speech at 6:10 pm GMT

- U.S. API Crude Oil Stock Change at 8:30 pm GMT

- Japan Machinery Orders at 11:50 pm GMT

- Japan Balance of Trade at 11:50 pm GMT

The main event on today’s forex schedule is Canada’s July CPI report, which is likely to influence monetary policy expectations for the BOC and therefore Loonie price action.

Do keep your eyes and ears peeled for Fed official Bowman’s speech also, as his remarks could contain more insights on the U.S. central bank’s next moves.

As always, look out for global trade developments and geopolitical headlines that could influence overall market sentiment. Stay nimble and don’t forget to check out our Forex Correlation Calculator when taking any trades!

加载失败()