Canada’s annual inflation rate decelerated to 1.7% in July, down from 1.9% in June, as plummeting gasoline prices helped offset rising grocery and shelter costs, according to data from Statistics Canada.

While the headline deceleration was largely attributed to energy base effects from carbon tax removal, the 3-month annualized measures of core inflation that the central bank closely monitors slowed to 2.4% from 3.4%, suggesting some cooling in underlying trends.

Key Points from Canada’s July 2025 CPI Data:

- Headline inflation fell to 1.7% year-over-year in July from 1.9% in June, marking the lowest rate since early 2024

- Gasoline prices dropped 16.1% annually, following a 13.4% decline in June, primarily due to the removal of the consumer carbon levy

- Core inflation remains elevated with CPI-trim and CPI-median holding near 3.0%, well above the Bank of Canada’s 2% target

- Grocery price pressures intensified with food purchased from stores rising 3.4% year-over-year, up from 2.8% in June

- Shelter costs accelerated to 3.0% annually, the first increase since February 2024, driven by higher rent and smaller natural gas declines

- Monthly CPI rose 0.3% in July, with seasonally adjusted gains of just 0.1%

Link to Statistics Canada July 2025 CPI Report

Grocery inflation rose at its fastest pace since earlier in the year, as food price pressures were driven by unfavorable weather conditions affecting key growing regions, leading to higher prices for confectionery (+11.8%) and coffee (+28.6%). Fresh fruit prices surged 3.9% annually, largely due to a 29.7% spike in grape prices.

The shelter component’s acceleration to 3.0% annually marked the first uptick since February, driven primarily by faster rent growth of 5.1% year-over-year and smaller declines in natural gas prices.

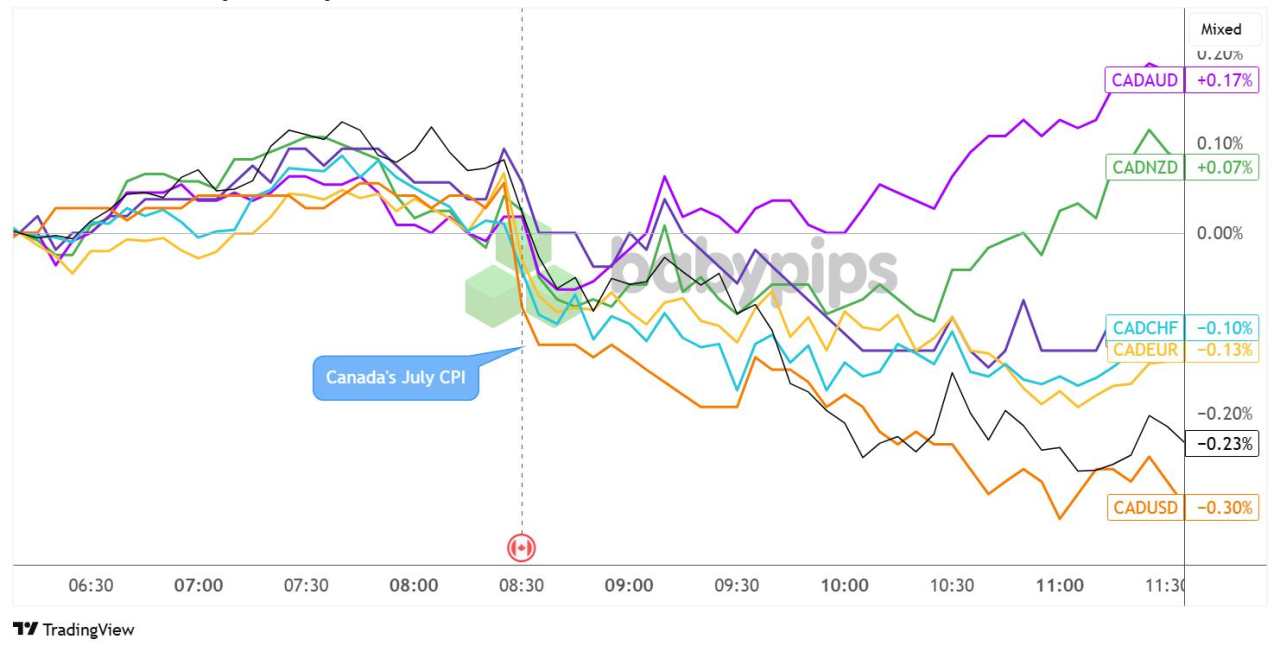

Market Reactions

Canadian Dollar vs. Major Currencies: 5-min

Overlay of CAD vs. Major Currencies Chart by TradingView

The Canadian dollar fell sharply following the inflation release, hitting its weakest level in nearly three weeks against the U.S. dollar (-0.30%) followed by the Japanese yen (-0.23%).

Meanwhile, EUR/CAD gained 0.13% and GBP/CAD advanced 0.10%. The broad-based selling reflected market expectations that cooler headline inflation could provide the central bank with additional room to ease monetary policy.

Interest rate swap markets now price in a 39% chance of a rate cut at the Bank of Canada’s September 17 meeting, up from 31% before the data was printed.

加载失败()