Federal Reserve Chair Jerome Powell delivered a dovish surprise at the Jackson Hole Economic Symposium on Friday, signaling that interest rate cuts may be warranted as economic risks shift, boosting expectations for September policy easing.

In his closely watched annual address, Powell stated that “with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance,” marking a significant pivot away from his usual cautious approach.

Key Takeaways from Powell’s Jackson Hole Speech

- Policy pivot signals: Powell indicated the Fed may need to adjust its restrictive policy stance, with the “shifting balance of risks” now tilting toward employment concerns rather than inflation fears

- Labor market concerns: Job growth has slowed dramatically to just 35,000 per month over the past three months, down from 168,000 monthly in 2024, raising downside risks to employment

- Tariff inflation assessment: While acknowledging tariffs are pushing up goods prices, Powell suggested the effects will likely be “relatively short-lived” – a one-time price level shift rather than persistent inflation

- Framework overhaul: The Fed released a revised monetary policy framework, removing language about the effective lower bound as a defining feature and eliminating the “makeup strategy” for inflation targeting

- Independence emphasized: Powell stressed that FOMC decisions will be “based solely on their assessment of the data,” maintaining Fed independence amid political pressures

Link to Fed Chairperson Powell’s Speech in Jackson Hole Symposium

The Fed chair’s assessment that tariff-induced inflation pressures will prove temporary appears to have given policymakers confidence to prioritize employment concerns over price stability risks. This marks a significant evolution from earlier this year when officials remained focused primarily on bringing inflation back to the 2% target.

Market Reaction

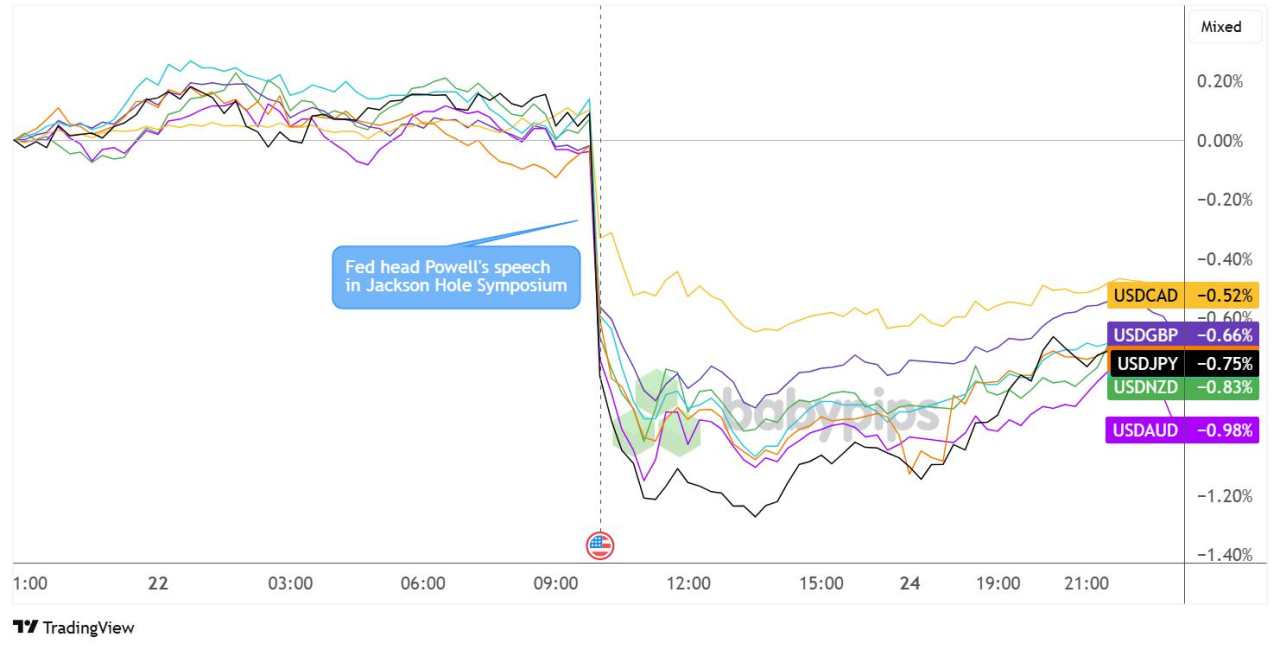

U.S. Dollar vs. Major Currencies: 15-min

Overlay of USD vs. Major Currencies Chart by TradingView

The immediate market response was swift and decisive, with the dollar suffering broad-based losses as traders repositioned for an increasingly dovish Fed trajectory.

The greenback plunged nearly 1% against major trading partners within minutes of Powell’s key remarks. The sharp selloff accelerated following his specific mention of “adjusting our policy stance,” with currency markets interpreting this as a clear signal that September rate cuts are now highly probable.

USD chalked up its steepest initial decline versus JPY (-0.75%) before pulling higher ahead of this week’s open, followed by notable losses versus AUD (-0.98%) and NZD (-0.83%).

加载失败()