The U.S. Preliminary Gross Domestic Product (GDP) rose at an annualized rate of 3.3% according to the Bureau of Economic Analysis report, representing a significant rebound from the first quarter’s 0.5% contraction and exceeding the advance estimate of 3.0%.

Key Takeaways from Q2 2025 GDP Report

- GDP Growth Revised Higher: Real GDP growth was upgraded to 3.3% from the initial 3.0% estimate, driven by upward revisions to investment and consumer spending

- Sharp Quarterly Turnaround: The economy pivoted from a -0.5% contraction in Q1 to robust 3.3% growth in Q2, marking one of the strongest quarterly reversals in recent years

- Import Decline Boosts GDP: The primary driver of growth was a decrease in imports, which mathematically adds to GDP calculations, alongside stronger consumer spending

- Investment Sees Mixed Results: While overall investment was revised upward, private inventory investment declined, partly offsetting gains in equipment and intellectual property

- Inflation Pressures Ease: The PCE price index rose 2.0% annually, down from previous estimates, while core PCE (excluding food and energy) held steady at 2.5%

- Corporate Profits Surge: Profits from current production jumped $65.5 billion in Q2, a stark contrast to the $90.6 billion decline in Q1

- Real GDI Outpaces GDP: Real gross domestic income (GDI) increased 4.8% versus GDP’s 3.3%, with the average of the two measures at 4.0%

Link to U.S. Preliminary GDP Report for Q2 2025

While the 3.3% growth rate significantly exceeded expectations and demonstrated the U.S. economy’s resilience, the primary contributor to the revisions – falling imports – reflected temporary adjustments rather than sustained overall strength.

Meanwhile, the modest increase in real final sales to private domestic purchasers (1.9%) suggests underlying domestic demand, while positive, remains more measured.

Corporate profit recovery appeared to signal improving business conditions ahead, particularly after the first quarter’s sharp decline. However, the disconnect between robust GDI growth (4.8%) and GDP (3.3%) suggested some volatility in income measurement that may normalize in coming quarters.

Market Reaction

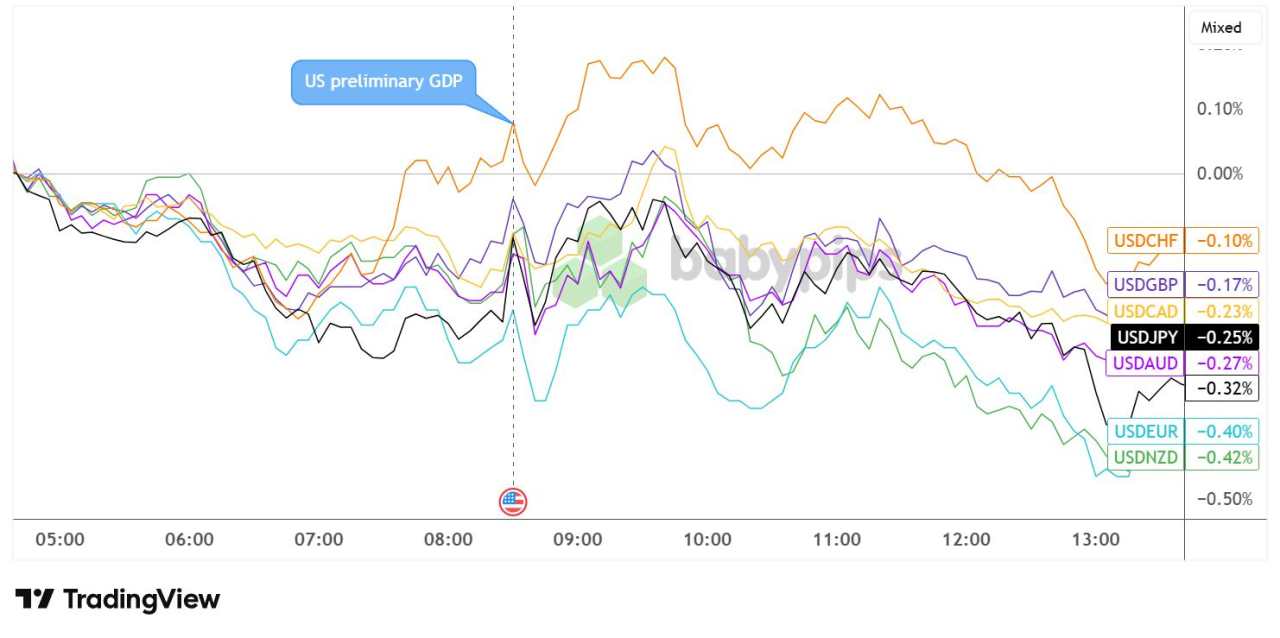

United States Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart by TradingView

Instead of rallying sharply on upbeat headline figures, the dollar dipped across the board as traders digested the temporary nature of the positive contributors to the growth revision. After the initial reaction, USD managed to pull up against its counterparts, possibly supported by other mid-tier data points (initial jobless claims, preliminary GDP price index) which came in line with expectations.

Still, the U.S. currency was unable to hold on to gains a few hours after the GDP release, as it staged a steady decline as the New York session went on. USD chalked up notable losses versus NZD (-0.42%) and EUR (-0.40%) halfway into the session while limiting declines against CHF (-0.10%) and GBP (-0.17%).

加载失败()