With traders from the U.S. and Canada out enjoying the Labor Day holiday, how did financial markets fare during the first day of this brand new month?

Check out the headlines and economic updates you may have missed in the latest trading sessions!

Headlines:

- U.S. Federal Appeals Court ruled that most of Trump’s tariffs are illegal, decision to be made by U.S. Supreme Court by October 14

- China NBS Manufacturing PMI for August 2025: 49.4 (49.7 forecast; 49.3 previous)

- China NBS Non Manufacturing PMI for August 2025: 50.3 (50.4 forecast; 50.1 previous)

- New Zealand Building Permits for July 2025: 5.4% m/m (4.5% m/m forecast; -6.4% m/m previous)

- Australia S&P Global Manufacturing PMI Final for August 2025: 53.0 (52.9 forecast; 51.3 previous)

- Japan Capital Spending for June 30, 2025: 7.6% y/y (6.0% y/y forecast; 6.4% y/y previous)

- Japan S&P Global Manufacturing PMI Final for August 2025: 49.7 (49.9 forecast; 48.9 previous)

- Australia TD-MI Inflation Gauge for August 2025: -0.3% m/m (0.2% m/m forecast; 0.9% m/m previous)

- Australia Business Inventories for June 30, 2025: 0.1% q/q (0.4% q/q forecast; 0.8% q/q previous)

- Australia Private House Approvals for July 2025: 1.1% m/m (0.8% m/m forecast; -2.0% m/m previous)

- Australia Building Permits Prel for July 2025: -8.2% (-4.0% forecast; 11.9% previous)

- Australia ANZ-Indeed Job Ads for August 2025: 0.1% m/m (0.5% m/m forecast; -1.0% m/m previous)

- China Manufacturing PMI for August 2025: 50.5 (49.7 forecast; 49.5 previous)

- U.K. Nationwide Housing Prices for August 2025: 2.1% y/y (4.2% y/y forecast; 2.4% y/y previous); -0.1% m/m (0.5% m/m forecast; 0.6% m/m previous)

- Australia Commodity Prices for August 2025: -4.3% y/y (-9.2% y/y forecast; -9.0% y/y previous)

- Swiss Retail Sales growth rate for July 2025: -0.5% m/m (1.0% m/m forecast; 1.6% m/m previous); 0.7% y/y (2.0% y/y forecast; 3.8% y/y previous)

- Swiss procure.ch Manufacturing PMI for August 2025: 49.0 (48.0 forecast; 48.8 previous)

- ECB Chairperson Lagarde noted that U.S. court challenge to Trump’s tariffs adds another layer of uncertainty

- Euro area HCOB Manufacturing PMI Final for August 2025: 50.7 (50.5 forecast; 49.8 previous)

- France HCOB Manufacturing PMI Final for August 2025: 50.4 (49.9 forecast; 48.2 previous)

- Germany HCOB Manufacturing PMI Final for August 2025: 49.8 (49.9 forecast; 49.1 previous)

- U.K. S&P Global Manufacturing PMI Final for August 2025: 47.0 (47.3 forecast; 48.0 previous)

- U.K. Mortgage Lending for July 2025: 4.52B (2.5B forecast; 5.34B previous); U.K. Mortgage Approvals for July 2025: 65.35k (64.0k forecast; 64.17k previous)

- Euro area Unemployment Rate for July 2025: 6.2% (6.2% forecast; 6.2% previous)

- U.S. Treasury Secretary Bessent reminded that Fed official Cook has not denied any allegations of mortgage fraud

Broad Market Price Action:

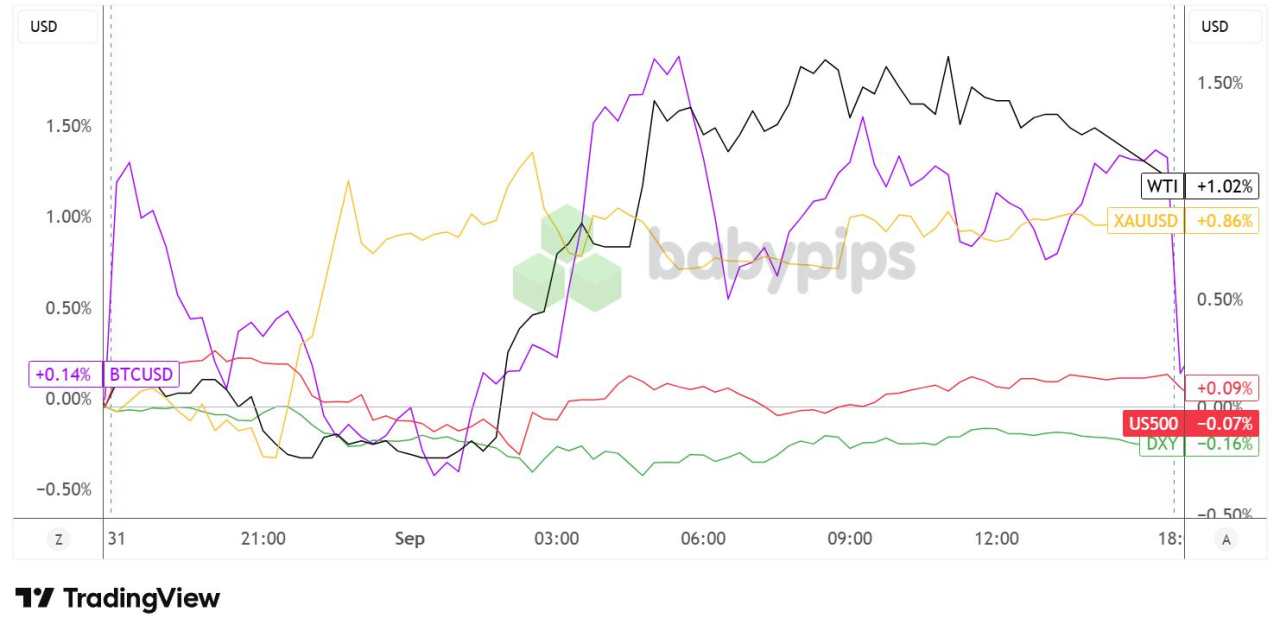

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

The surge in precious metals was the big move for the day, as gold climbed back above the key $3,000 level while silver reached its highest point in fourteen years, likely driven by increased demand for safe-havens after most of Trump’s tariffs were declared illegal by the U.S. Federal Appeals Court.

Thin liquidity conditions stemming from the Labor Day holiday probably contributed to higher volatility as well. There wasn’t much on the economic data front either, leaving traders to adjust positions ahead of the upcoming NFP release later in the week.

WTI crude oil traded cautiously early in the day, then caught a strong bullish wave a few hours into the London session as market players probably anticipated stronger demand for the energy commodity should global trade activity pick up.

Bitcoin, which initially popped up as markets opened, erased its gains throughout the Asian session, before bouncing sharply higher during London market hours. After a bit of a pullback, BTC/USD held on to the $109K level for the remainder of the U.S. session.

FX Market Behavior: U.S. Dollar vs. Majors:

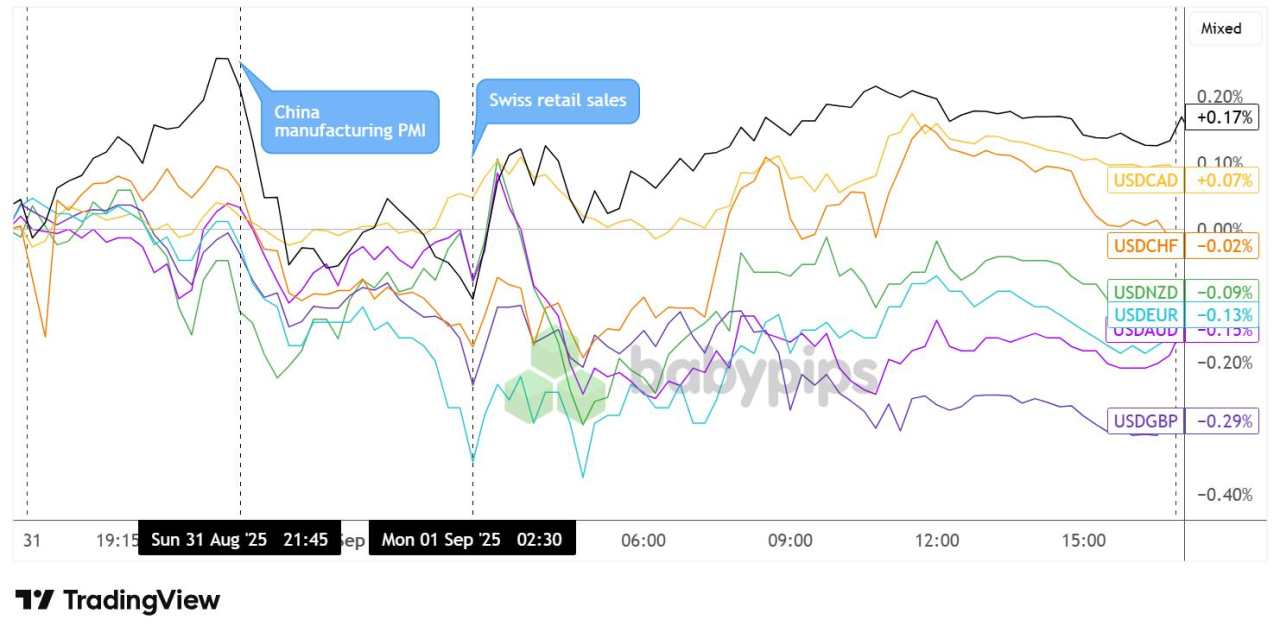

Overlay of USD vs. Majors Chart by TradingView

The U.S. dollar appeared unsteady throughout the day, as most traders were still off enjoying the Labor Day holiday while the rest of the market participants digested the latest updates on Trump’s tariffs. The case is headed for the Supreme Court for ruling by October 14, which means that markets will have to deal with additional uncertainty while waiting.

Mixed PMI readings from China over the weekend, with the manufacturing sector reporting a smaller than expected uptick and the non-manufacturing industry seeing a faster pace of expansion, didn’t exactly help in providing market direction.

Still, a broader turn lower for the safe-haven USD took place a few hours into the Asian session as the S&P Global China manufacturing PMI beat estimates and reflected a return to industry growth for August. The selloff bottomed out as European markets opened, though, with the dollar holding on to its gains against CHF, JPY, and CAD until U.S. market hours.

Upcoming Potential Catalysts on the Economic Calendar

- Eurozone Flash CPI report at 9:00 am GMT

- New Zealand Global Dairy Trade Auction coming up

- Canada S&P Global Manufacturing PMI for August 2025 at 1:30 pm GMT

- U.S. ISM Manufacturing PMI at 2:00 pm GMT

- U.S. Construction Spending at 2:00 pm GMT

- U.S. RCM/TIPP Economic Optimism Index at 2:10 pm GMT

- Australia AIG Manufacturing Index at 11:00 pm GMT

- Australia S&P Global Services PMI Final at 11:00 pm GMT

The spotlight could turn to the eurozone flash CPI readings in today’s London session, as the outcome of the inflation report could have strong implications for ECB policy and EUR price action.

After that, U.S. traders are set to return to their desks after the holiday and be welcomed by the ISM manufacturing PMI for August, which could influence NFP expectations, USD trends, and broader risk behavior.

As always, look out for global trade developments and geopolitical headlines that could influence overall market sentiment. Stay nimble and don’t forget to check out our Forex Correlation Calculator when taking any trades!

加载失败()