The U.S. private sector unexpectedly shed 32,000 jobs in September versus the projected gain of 54,000, according to ADP’s National Employment Report, signaling mounting employer caution amid persistent economic uncertainty.

The contraction marks a stark reversal from recent months and reinforces signs of a cooling labor market heading into the fourth quarter. The breadth of job losses across most sectors and establishment sizes underscores a widespread pullback in hiring momentum.

Key Takeaways:

- Private sector employment fell by 32,000 in September, marking the first monthly decline since October 2024

- Annual pay growth for job-stayers held steady at 4.5 percent year-over-year, while pay gains for job-changers slowed to 6.6 percent from 7.1 percent in August

- Service-providing sectors bore the brunt of losses, shedding 28,000 jobs, led by declines in leisure/hospitality (-19,000), professional/business services (-13,000), and financial activities (-9,000)

- Large establishments (500+ employees) added 33,000 positions, while small and medium-sized firms cut 60,000 jobs combined

- Regional divergence widened, with the Midwest losing 63,000 jobs while the Northeast gained 21,000

- Benchmark revision reduced August’s job count from 54,000 to -3,000, suggesting labor market weakness emerged earlier than previously thought

Link to the official ADP Jobs Report for September 2025

The stark divergence between large and small employers is particularly notable. While companies with 500 or more employees added 33,000 positions, small establishments (1-49 employees) shed 40,000 jobs and medium-sized firms (50-499 employees) cut 20,000.This pattern suggests larger corporations may have greater capacity to maintain hiring levels or are pursuing different strategic priorities than smaller businesses facing tighter margins and economic uncertainty.

In addition, ADP’s preliminary rebenchmarking based on 2024 Quarterly Census of Employment and Wages data revealed a labor market that has been softer than initially reported. The revision resulted in a 43,000-job reduction in September and transformed August’s initially positive 54,000 job gain into a 3,000-job loss.

Pay dynamics also showed continued moderation in September. While job-stayers saw wage growth hold steady at 4.5 percent year-over-year, compensation gains for job-changers decelerated to 6.6 percent from 7.1 percent in August. The slowdown in job-changer pay was most pronounced in leisure and hospitality and financial activities sectors.

Market Reaction:

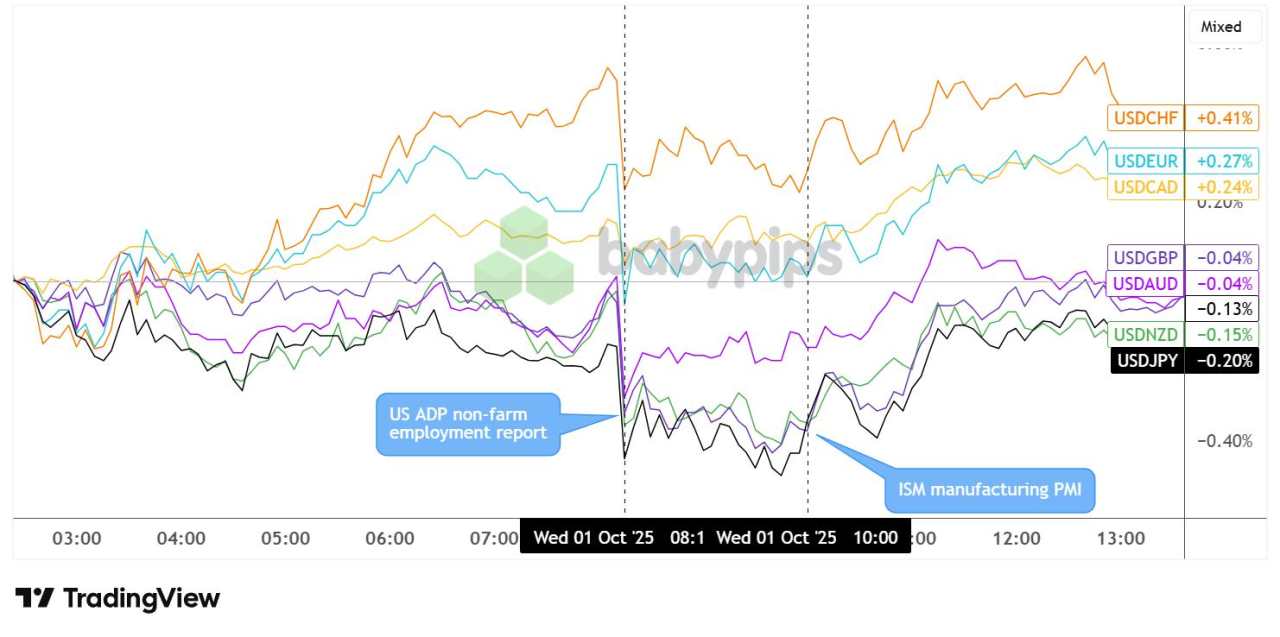

United States Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart by TradingView

The dollar, which had been edging higher against some of its counterparts leading up to the ADP jobs release, turned lower upon seeing the surprise decline in hiring for September and the downward revision to the August figure.

Losses were limited, however, as traders likely held out for the release of the ISM manufacturing PMI later in the session. This report came in mostly in line with expectations, allowing the dollar to stage a gradual recovery for the remainder of the day.

USD managed to recoup its post-ADP losses against CHF (+0.41%), EUR (+0.27%) and CAD (+0.24%) but remained in the red against JPY (-0.14%), AUD (-0.04%) and NZD (-0.15%).

暂无评论,立马抢沙发