If you’ve been keeping an eye on the news, you already know the U.S. government has been shut down since the start of October.

You might be wondering: “What the heck is a shutdown?! And more importantly, how do I trade this mess?”

Let’s break it down to help you understand how it might shake up the economic landscape and the FX space.

So, What’s a Government Shutdown?

Congress needs to pass spending bills by September 30 each year to fund the government for the next fiscal year.

When Congress can’t agree on a budget – or pass a “stopgap” bill to keep money flowing – the U.S. government goes into partial shutdown mode.

Think parents fighting over the credit card bill, except instead of cutting Netflix, parts of the government go dark.

That means essential services (military, border patrol, air traffic control) keep running, but non-essential functions like research, reporting, data releases, and a big chunk of federal spending stop.

In a shutdown, non-essential workers usually get furloughed (fancy word for “told to stay home without pay”).

What happened this year?

Funding for federal agencies expired on October 1, 2025.

The Republican-led Senate, which needs more than a simple majority to pass a major funding bill, couldn’t pass either of two “stopgap” bills:

- A GOP proposal funding the government through November 21, and

- A Democratic version that added extensions for Affordable Care Act healthcare subsidies expiring later this year.

We’re on Day 6, and the Senate has voted at least seven times combined on the failed funding bills. Congress remains deadlocked, and the House isn’t scheduled to reconvene until October 14.

Key agencies are still closed. About 750,000 federal workers have been furloughed, while another 700,000 are working without pay. Airports like Burbank have temporarily halted air traffic control operations due to staffing shortages.

For traders, the September jobs report was supposed to drop at the beginning of October is on ice until things reopen. Same goes for CPI, PPI, retail sales, and more (key inputs for gauge interest rate and economic health expectations).

Economic Impact: Is It a Big Deal?

Short Term Effects:

GDP: Estimates suggest the economy could lose about 0.1% to 0.2% of annualized GDP growth for each week the shutdown persists. That may not sound huge, but in a fragile economy, any hit can matter.

Spending & Jobs: Most federal workers eventually get back pay. But “ripple effects” can hit the private sector—think contractors or business owners who rely on government clients. The Council of Economic Advisers thinks that a month-long shutdown means a hit of $15 billion per week to the U.S. economy.

Economic Confidence: Even a short shutdown breeds uncertainty and saps confidence in government decision-making, which can weigh on markets, consumer sentiment, and spending.

Long Term Effects:

The longer it continues, the bigger the risks. Delayed contracts, missed payments, and more consumers tightening their belts can lead to bigger GDP hits and a tougher jobs picture.

Economic losses may even be permanent after the government reopens.

The Congressional Budget Office estimated that the 35-day shutdown in 2018-2019 delayed $18 billion in federal spending and shaved off about 0.2% from the projected Q1 2019 GDP. Yipes!

Impact on Interest Rate Expectations

The government shutdown has left the Fed flying blind, with no fresh jobs or inflation data to guide policy.

With layoffs looming and confidence fragile, Powell’s team will likely lean cautious – cut rates now and ask questions later – to help offset the negative impact of the shutdown.

Markets now see nearly certain rate cuts in both October and December, as the Fed leans dovish to cushion the economy from uncertainty.

Impact on the U.S. Dollar

Shutdowns theoretically may cause a short-term dip in the U.S. dollar, which is exactly what we saw this time around:

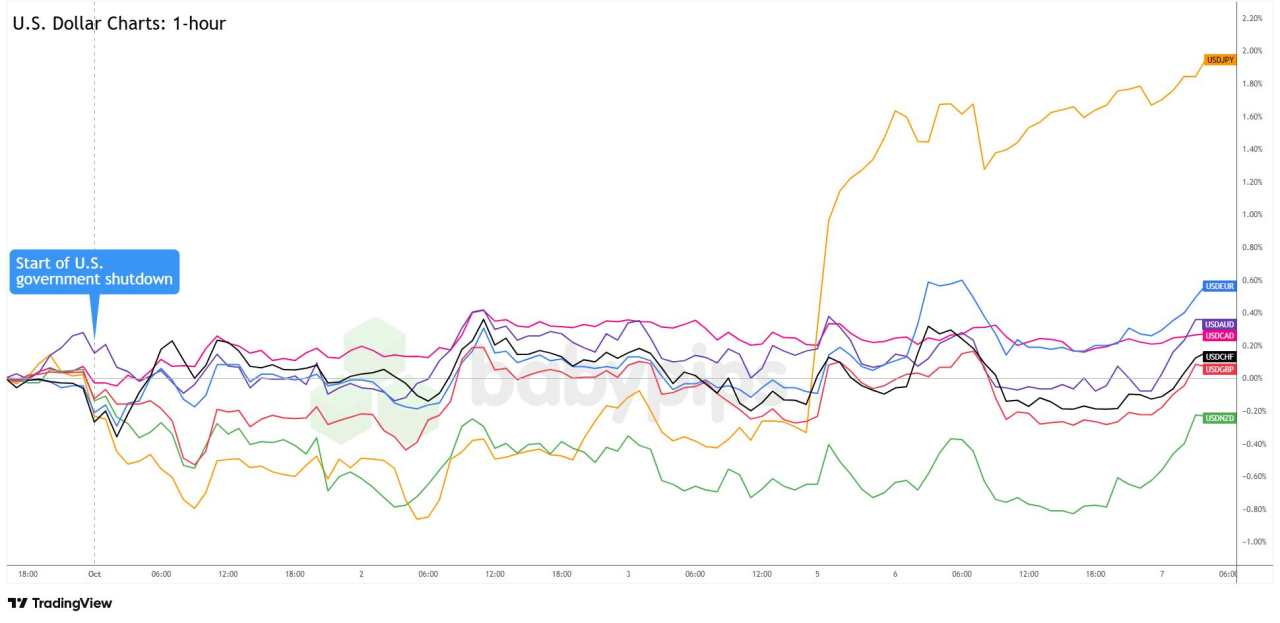

U.S. Dollar vs Major Currencies 1-Hour Forex Chart by TradingView

The U.S. dollar stumbled early in the month as both the anticipation and confirmation of the government shutdown weighed on USD sentiment. The potential economic damage of a shutdown also likely added fuel to Fed rate cut expectations, which also has been net negative for the Greenback.

USD later regained ground, with several arguments for the rebound. Traders may have priced in the possibility that a future Fed rate cut that would help the U.S. economy, or that investors kept favoring USD-denominated stocks that kept hitting notable highs, potentially pulling in capital to U.S. markets.

But more likely, the dollar’s safe-haven appeal was the main driver in the dollar’s bounce, as traders sought refuge in USD over political uncertainty in France and Japan, and a rise in geopolitical tensions last week after Russia warned of a potential ‘appropriate’ response to a scenario where the U.S. sends Tomahawks to Ukraine.

The Greenback is now back in the green against most majors this October, except against the relatively stronger New Zealand dollar, an outcome that once against signals how trader focus can shift quickly to new developments elsewhere, even with major stories like a government shutdown driving sentiment.

What Will All These Mean for Traders?

Historically, markets shrug off U.S. government shutdowns. But with this shutdown coming with threats of mass layoffs and missing economic data, here are points to keep in mind:

Market uncertainty

Shutdowns inject political risk and uncertainty, influencing trader psychology even if underlying market fundamentals like earnings remain stable.

Data gaps add volatility

Without NFP and other data, markets are flying blind. That means more whipsaw moves as traders react to headlines instead of fundamentals. Private data (ADP jobs, ISM PMIs) might fill the gap while official reports are delayed.

Watch for market volatility and range-bound price action – especially in U.S. dollar pairs and U.S. indices.

Watch the other safe havens

Gold’s already at record highs. The yen and Swiss franc may catch bids if the US shutdown situation gets uglier.

But if this turns into a crisis that spills out globally, it’s possibly dollar strength may grow from safe-haven flows.

Embrace Flexibility in a Multifaceted Market Landscape

The U.S. dollar’s shift from government shutdown weakness to safe-haven strength amid global geopolitical tensions highlights the importance of trader agility and vigilance.

While domestic factors like Fed rate cuts dominate, external influences—such as Ukraine-Russia escalations, French and Japanese instability, or the New Zealand dollar’s strength—can rapidly redirect sentiment, demanding broad monitoring and adaptive strategies over singular narratives.

One Final Thought

Government shutdowns sound scary, but they usually don’t wreck markets, and stocks often bounce back once things calm down.

This one is a bit messier, with fights over healthcare, missing data, and talk of layoffs making traders uneasy.

But smart traders aren’t panicking; they’re adapting. Tighten up risk management, use smaller position sizes, and be ready for whipsaws on any positive government breakthrough or news of the standoff likely to extend further.

加载失败()