If you’ve been trading lately, you probably saw the markets flip from cautious optimism to full-on panic in record time.

So what lit the fuse this time?

If you guessed a central bank announcement or a big economic report miss, not quite.

This time, it was a single, long social media post from the U.S. President that sent traders scrambling for cover.

Trump’s post — and the wild reaction that followed — just goes to show how social media has become an official, high-octane driver of global financial markets. It’s fast, emotional, and capable of moving billions before traders even finish their morning coffee.

Trump’s post — and the wild reaction that followed — just goes to show how social media has become an official, high-octane driver of global financial markets. It’s fast, emotional, and capable of moving billions before traders even finish their morning coffee.

For forex and commodity traders, understanding the mechanics behind these “Tweet-based tremors” is no longer optional; it’s a critical part of your fundamental analysis. You’re not just trading the data; you’re trading the commentary around the data, and sometimes, the commentary replaces the data entirely.

Let’s dive into what happened and, more importantly, what it means for your trading strategy.

What Happened: The 100% Tariff Shockwave

The drama began on October 10, 2025, when U.S. President Donald Trump used his social media platform to announce an aggressive new tariff strategy targeting China.Trump declared that the U.S. would impose a crushing, additional 100% tariff on all Chinese imports, effective November 1, 2025. This staggering new levy would be “over and above” any tariffs already in place.

Trump said the move is a response to China’s “extraordinarily aggressive” new controls on rare earth minerals—a vital resource for everything from smartphones and electric vehicle batteries to advanced military hardware.

This was not a measured statement from the Office of the U.S. Trade Representative (USTR) following an extensive review; it was a unilateral, unscripted, and high-stakes pronouncement delivered straight to the public, completely bypassing traditional, slower diplomatic channels.

How Markets Reacted: Risk Appetite Plummets

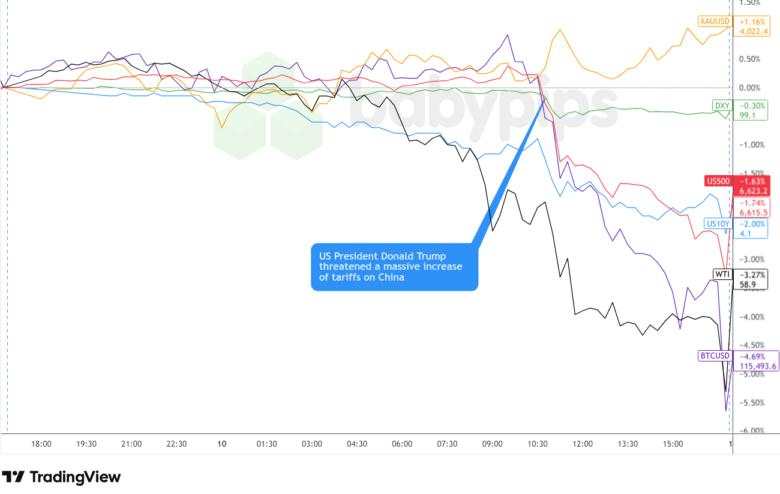

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

The immediate reaction was a swift and brutal repricing of global risk. Traders scrambled to shed growth-sensitive assets and pile into traditional safe havens.

Currencies: Yen Wins, Dollar Mixed

The Japanese yen (JPY) took top spot in FX, solidifying its status as an accessible safe-haven currency. The U.S. dollar (USD) was a bit more mixed, firming against AUD and CAD but losing ground to JPY and gold.

Meanwhile, USD/CNH (offshore Chinese yuan) volatility spiked along trade war tensions, with talks of a potential break above 7.10.

Equities: Tech Takes the Brunt

U.S. stock markets were slammed in what traders called the worst day of trading in six months.

The S&P 500 dropped nearly 3% after futures plunged as much as 4% intraday, with most of the pain centered in sectors tied to China and global supply chains.

Global tech hub Nasdaq Composite got whacked too, sliding over 3.5%, while chip stocks took a nosedive. The Philly Semiconductor Index sank more than 6% as talk of new software export limits and rare earth (critical for chip production) restrictions slammed the tech sector.

Commodities and Bonds: Gold Shines, Oil Sinks

Gold (XAU/USD) held steady near record highs, with futures crossing the $4,000 mark as traders rushed for safety. When politics get unpredictable, gold shines brightest — it’s still the go-to hedge when everything else feels shaky.

Crude Oil, on the other hand, got clobbered. WTI slid about 5% as fears of a trade-war-driven global slowdown crushed demand outlook.

U.S. Treasury (UST) yields initially fell (prices rose) as capital fled equities and sought the safety of government debt. This drop in yields signaled that the market’s fear of a recessionary trade shock was temporarily overshadowing concerns about tariff-driven inflation.

Why Markets Moved: The Core Drivers

Social media posts from high-profile political figures are so market-moving because they hit three core fundamental drivers simultaneously: speed, uncertainty, and economic shock.

1. Geopolitical Grease Lightning

A post goes live instantly — no filters, no warnings. Unlike official statements that leak ahead of time, a tweet or post catches everyone flat-footed.

The sudden info gap leaves traders guessing: Is it policy or posturing? The lack of clarity usually causes algorithmic traders and large hedge funds to immediately de-risk or hedge against the worst-case scenario. This is likely why the VIX spiked and why yen and gold lit up like Christmas trees.

2. The Stagflationary Squeeze: Higher Prices + Slower Growth

A 100% tariff threat is the global economy’s nightmare — the kind that sparks stagflation, where prices climb while growth slows.Inflationary: Tariffs are ultimately a tax on the importer. Companies either absorb the cost (squeezing profits) or, more likely, pass it on to consumers, driving up inflation.

Recessionary: The uncertainty and cost increases freeze corporate spending and investment, slowing down economic growth and global trade.

Central banks can’t win here. Cut rates and you fuel inflation; hike rates and you crush growth. The market knows policymakers are “flying blind,” which is why they do what they always do when policymakers look lost — they run to safe havens like JPY and gold.

3. Political Poker Game: The Weaponization of Uncertainty

When social media becomes a policy tool, diplomacy turns into a real-time poker game. One post can tank global markets, and the next can undo it all before Monday’s open.

Every post becomes a potential Black Swan, with algo desks and hedge funds scrambling to hedge or chase the move. That’s why we get wild swings like Friday’s 2.7% S&P drop, followed by a relief rally on Monday.

This is the fundamental cost of social media-driven policy: it forces traders to react to rhetoric as if it were policy, fundamentally decoupling market price from underlying economic reality.

Looking Forward: Scenarios and Catalysts

All eyes are now on that November 1 deadline. Between now and then, expect a nonstop back-and-forth between handshakes and hardball.

Base Case Scenario: The Bargaining Chip Pause

The most likely scenario is a de-escalation that defers the 100% tariff implementation. Slapping 100% tax on imports would torch U.S. consumers and spark political blowback, and Beijing’s mild response hints there’s still room to talk.

For FX traders, a pause would breathe life back into risk trades. Yen and gold would likely cool off, while AUD/USD and USD/CAD could bounce as traders tiptoe back into higher-yielding assets. USD/CNH could even drift back below 7.05.

Alternative Scenario: Full-Blown Trade War

If cooler heads don’t prevail, we’re looking at a full-scale trade war. The U.S. could roll out those tariff measures as planned, while China might hit back with rare earth export limits and direct retaliation against U.S. firms through antitrust probes and supply chain curbs.

In a full-blown risk-off scenario, stocks would tank, volatility would surge, and the yen could rip toward 150.00 or lower against the dollar. Gold would likely blast through $4,200 as traders run for the nearest lifeboat.

加载失败()