New Zealand’s consumer prices rose to 3.0% y/y in the September 2025 quarter, reaching the upper limit of the Reserve Bank’s 1-3% target range.

The quarterly increase of 1.0% doubled the pace from Q2’s 0.5% rise, driven primarily by surging electricity costs and local government rates.

The headline figure matched both the Reserve Bank of New Zealand’s (RBNZ) August forecast and market expectations, providing little surprise for traders.

Despite touching the 3% ceiling, underlying inflation metrics offered reassurance – non-tradeable inflation decelerated to 3.5% from 3.7%, while core CPI excluding food, energy, and fuel held steady at 2.5%.

Key Takeaways

- Annual inflation accelerated to 3.0%, hitting the top of RBNZ’s target band

- Quarterly CPI rose 1.0%, doubling the previous quarter’s 0.5% gain

- Electricity prices surged 11.3% annually – the highest since 1989

- Non-tradeable inflation eased to 3.5% from 3.7%, showing cooling domestic pressures

- Core inflation measures remained contained at around 2.5%

Link to official New Zealand Q3 2025 CPI

The standout contributor was electricity prices, which soared 11.3% annually – marking the steepest increase since 1989. This single component accounted for 10.1% of the overall 3.0% annual inflation rate. Local authority rates jumped 8.8%, while rents rose a more modest 2.6% – the smallest annual increase in over four years.

On the positive side, pharmaceutical products plunged 10.6% year-over-year and telecommunications equipment dropped 15.2%, providing meaningful offsets to the broad-based price pressures.

Market Reactions

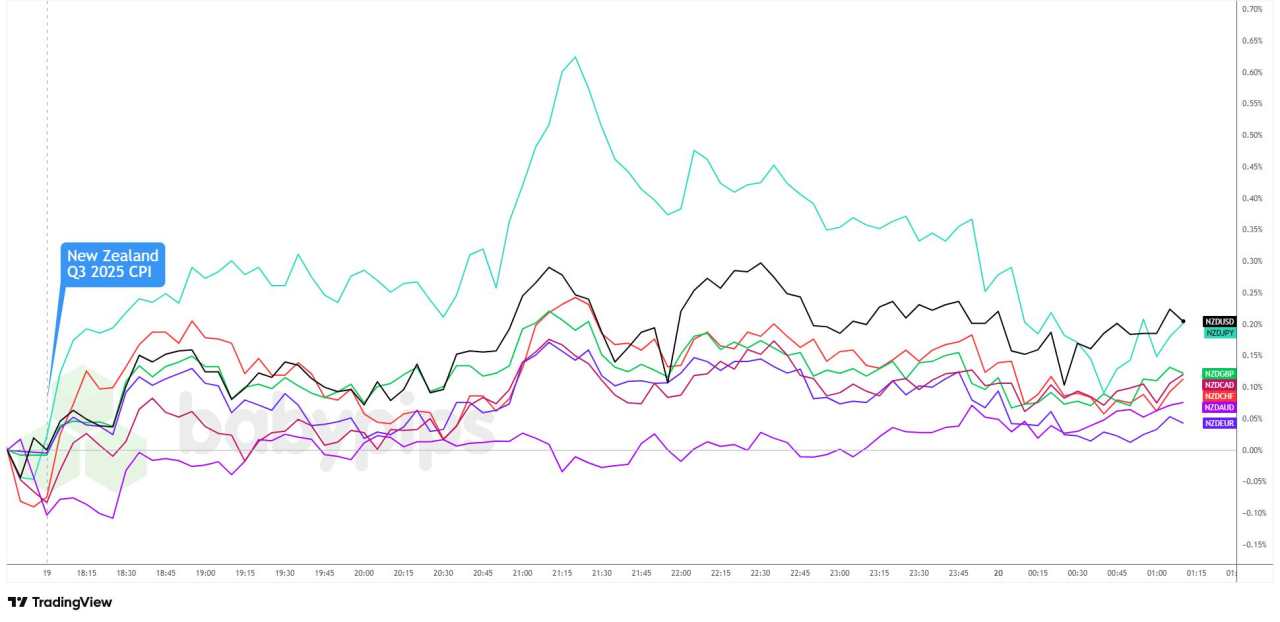

New Zealand Dollar vs. Major Currencies: 5-min

Overlay of NZD vs. Major Currencies Chart by TradingView

But the comdoll quickly steadied once China and Hong Kong markets opened, possibly as traders shifted their focus to the improved risk mood sparked by Trump’s Friday remarks on China tariffs.

The lack of follow-through likely reflects that the CPI figures were in line with RBNZ expectations, underlying pressures continued to ease, and markets were already positioned for another rate cut.

Even so, NZD is still trading higher across the board, posting its strongest gains against USD and CAD, while advances against EUR and JPY remain modest.

加载失败()