If you’ve been glued to the news this month, you’re likely witnessing the frustrating uncertainty caused by the ongoing U.S. government shutdown.

Key official releases like the highly-anticipated Non-Farm Payrolls (NFP) jobs report and the top-tier Consumer Price Index (CPI) inflation data have been delayed for weeks now.

In this economic data “guessing game,” traders and the Federal Reserve are desperate for reliable information. This is why a simple monthly survey you might have ignored before can suddenly be the most important number on the calendar: the Purchasing Managers’ Index (PMI).

Understanding the PMI report, why it’s a leading indicator, and how it’s affected by the current political chaos can be crucial to protecting your capital and spotting trading opportunities in the coming weeks.

The Basics: What is the PMI Survey?

The Purchasing Managers’ Index, or PMI, is a monthly survey that tells you whether a country’s economy is growing or shrinking.

Think of it this way: Purchasing managers are the people responsible for buying the raw materials, inventory, and services a company needs to operate. They are the first folks to know if demand is heating up (they need to buy more) or cooling down (they need to cut orders).Twice a month, private firms (like S&P Global and the Institute for Supply Management or ISM) survey hundreds of these managers across the Manufacturing and Services sectors. The managers are asked simple questions: Are New Orders up, down, or unchanged? Is Production higher or lower than last month? Are you hiring or firing?

The Magic Number: 50

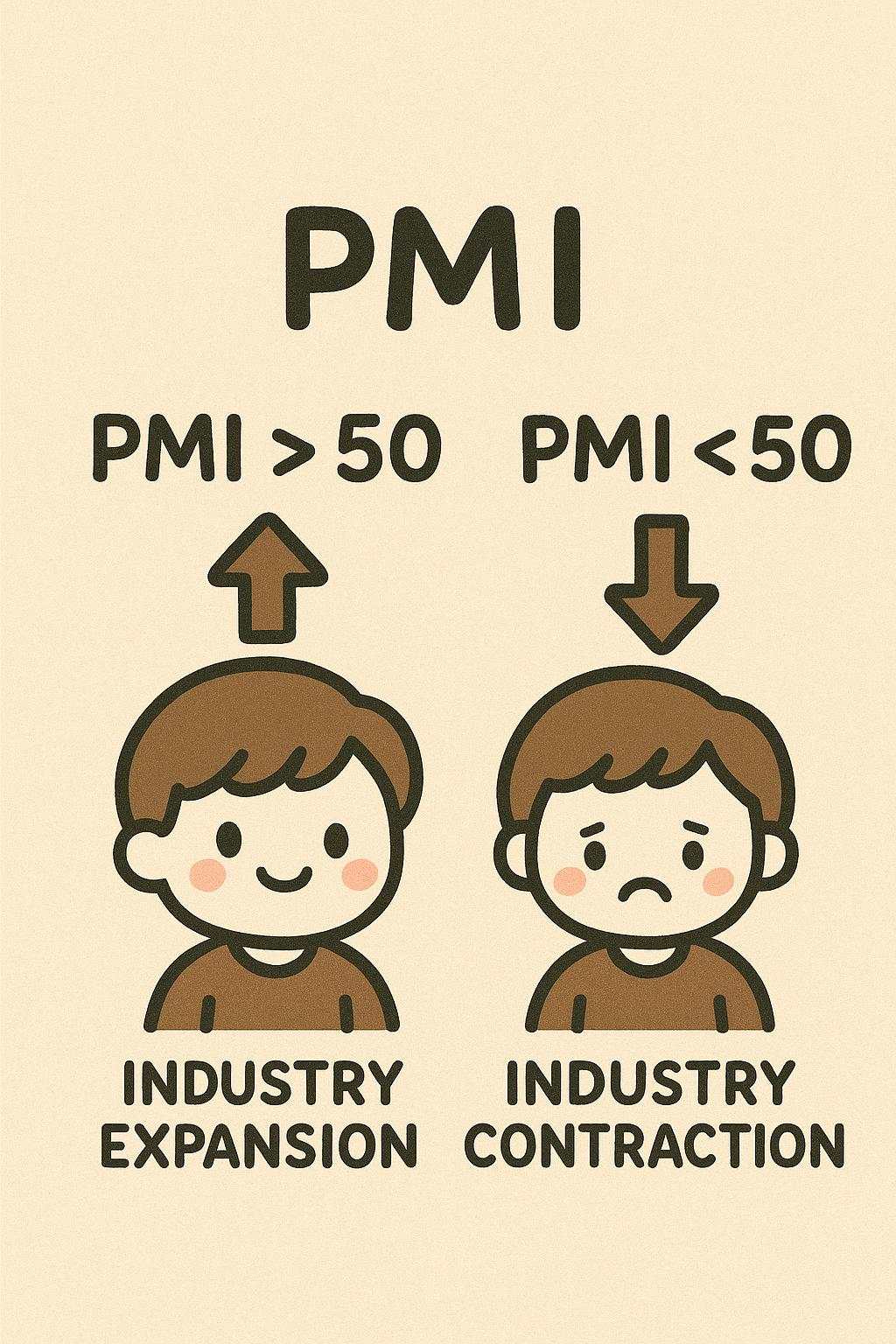

The results are crunche d into a single index number from 0 to 100, and there is one number every trader must keep in mind: 50.

d into a single index number from 0 to 100, and there is one number every trader must keep in mind: 50.

A PMI reading above 50 means the sector is expanding (growing).

A PMI reading below 50 means the sector is contracting (shrinking).

A reading at 50 means no change.

The further the reading is from 50, the faster the rate of expansion or contraction. For example, a PMI of 54.0 signals strong growth, while a reading of 46.0 signals a significant slowdown.

Why it Matters: The Leading Indicator and the Shutdown Effect

The PMI is highly regarded because it is a leading indicator. This is key.

Unlike indicators like GDP (Gross Domestic Product), which tell you what already happened, the PMI is designed to look forward. By capturing changes in New Orders and Inventories before the goods are even produced or the money changes hands, the PMI often forecasts economic turning points several months ahead of official government data.

The October 2025 Shutdown Context

The ongoing U.S. government shutdown and data delay leaves the PMI reports as the only glimpse into U.S. economic activity lately.

- Data Blackout: The shutdown has closed key government agencies like the Bureau of Labor Statistics (BLS) and the Bureau of Economic Analysis (BEA). This means we don’t know when we’ll get official data on inflation or unemployment.

- Private Data Takes Over: PMI surveys are released by private organizations (ISM, S&P Global) that are not affected by the shutdown. This means the PMI reports are the only timely, high-quality, and official-like signposts the market has left to measure the health of the US economy.

- Market Volatility: The absence of other data sources means that PMI releases will have a much bigger impact on the market than usual. Traders will rely on these for clues about future Federal Reserve policy. If the PMI indicates contraction (a reading below 50), it could fuel bets that the Fed will need to cut interest rates, which would typically cause the US Dollar (USD) to weaken.

Key Lessons for Traders

The current economic environment and the PMI’s sudden importance offer a few critical lessons for beginner traders:

- Recognize the Hierarchy of Data: Not all reports are created equal. Understand that leading indicators like the PMI give you an early peek at future trends while lagging indicators (like the Unemployment Rate) confirm trends that are already underway. You can position yourself ahead of the curve by watching the leading data.

- Context is Everything: In normal times, PMI tends to cause a subdued reaction. But right now, due to the US government shutdown, the PMI has temporarily been elevated to a Tier 1, high-impact event. This shift in context means you should expect higher volatility around its release and adjust your risk management accordingly.

-

Watch the Sub-Indices: Don’t just react to the headline PMI number. Pay close attention to two of its most telling sub-components:

- New Orders: This is the best forward-looking gauge of future demand. A drop here is a strong signal of a future slowdown.

- Prices Paid: This tells you what businesses are paying for inputs. A high reading suggests inflation is rising, which the Fed cares about deeply.

The Bottom Line

The PMI is a survey of business health that tells you, via the 50-point line, whether the economy is expanding or contracting. Normally, it’s one of many indicators but this time, with the US government shutdown causing a blackout of official data, the PMI has become the market’s main source of truth.

Any big surprise in the upcoming PMI reports, especially a decisive move deeper into contraction (say, a 47.0 or lower), can trigger sharp volatility in the USD and stock market indices. Always use strict risk management, as major news releases can lead to massive and sudden price moves.

Disclaimer: The views and opinions expressed in this article are for educational purposes only and do not constitute financial or investment advice. Trading in forex and financial markets involves a high risk of loss, and you should only trade with money you can afford to lose.

加载失败()