Canada’s September CPI report reflected hotter than expected inflationary pressures for the month, leading market players to tone down dovish BOC expectations.

Headline inflation rate rose to 2.4% year-over-year in September, up from 1.9% in August, as gasoline prices declined less sharply and travel tour costs rebounded. On a month-over-month basis, headline CPI rose 0.1% instead of dipping by another 0.1%.

Core measures showed that roughly one-third to 40% of the CPI basket is experiencing price growth above 3-4% on an annualized monthly basis, suggesting inflation pressures remain relatively contained but not fully extinguished.

Key Takeaways

- Headline CPI increased to 2.4% y/y in September from 1.9% in August, exceeding consensus expectations of 2.2%

- Core inflation measures remained elevated, with both trimmed mean and weighted median at 2.8% on a month-over-month seasonally adjusted basis

- Gasoline prices fell 4.1% y/y, a smaller decline than August’s 12.7% drop, contributing significantly to the headline acceleration

- Grocery prices rose 4.0% y/y, up from 3.5% in August, marking the fastest pace since the recent low in April 2024

- Travel tour prices declined just 1.3% y/y compared to a 9.3% drop in August, as seasonal factors and higher hotel costs during major events pushed prices up

- Rent inflation accelerated to 4.8% y/y from 4.5%, driven largely by Quebec’s 9.6% increase, particularly in Montreal

- On a monthly basis, CPI rose 0.1% (not seasonally adjusted) and 0.4% (seasonally adjusted)

Link to official Statistics Canada Consumer Price Index (September 2025)

Gasoline prices rose 1.9% month-over-month in September 2025, following refinery disruptions and maintenance in both the United States and Canada. This contrasted sharply with September 2024, when prices fell 7.1% amid concerns about weakening economic growth in China and the U.S.

Grocery price inflation accelerated to 4.0% year-over-year, with notable increases in fresh vegetables (rising 1.9% after declining 2.0% in August) and sugar and confectionery (up 9.2% versus 5.8% previously). Fresh or frozen beef and coffee prices also contributed to the acceleration, partly reflecting supply constraints.

Shelter costs rose 2.6% y/y, with rent prices advancing 4.8% nationally despite mixed provincial dynamics. Mortgage interest costs increased 3.6% y/y, while homeowners’ replacement costs fell 1.4%, reflecting the offsetting dynamics within the shelter component.

Market Reactions

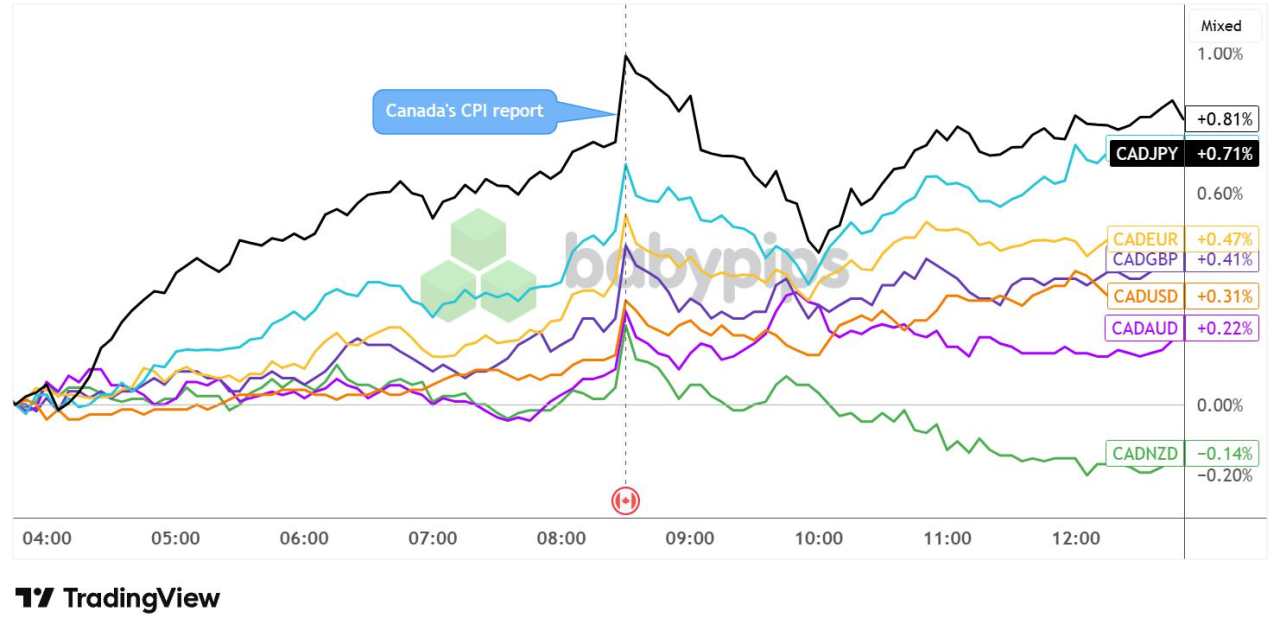

Canadian Dollar vs. Major Currencies: 5-min

Overlay of CAD vs. Major Currencies Chart by TradingView

CAD/JPY posted the strongest gains, rising approximately 0.71% while GBP/CAD slipped roughly 0.41%. USD/CAD dipped 0.31% and AUD/CAD fell 0.22%, as gains against fellow commodity currencies were limited. Against the Kiwi, the Loonie quickly erased its winnings and even wound up 0.14% in the red a few hours after the CPI release.

加载失败()