The Bank of Japan (BoJ) kept its policy rate unchanged at 0.5% on Thursday in a decision that fell short of some market expectations for a more hawkish signal, sending the Japanese yen tumbling to its lowest levels since February across the board.

The Policy Board voted 7-2 to maintain the uncollateralized overnight call rate at around 0.5 percent, with board members Takata Hajime and Tamura Naoki dissenting in favor of raising rates to 0.75%. In explaining their dissent, Takata argued that Japan had shifted away from a deflationary norm and largely achieved the price stability target, while Tamura noted that upside risks to prices warranted bringing policy closer to neutral.

The BoJ kept core CPI forecasts unchanged at 2.7% for fiscal 2025, with policymakers describing exports and output as moving sideways while consumption holds firm despite external headwinds. The central bank expects growth to slow modestly due to weaker overseas demand and trade policy friction, though it still anticipates a mechanism in which wages and prices rise together.

The board judged economic risks as skewed to the downside and flagged uncertainty surrounding trade policy and its potential spillovers to global prices and markets as key risks requiring vigilance. The central bank reiterated that real interest rates remain deeply negative and pledged to raise rates further only if economic and price trends continue to align with projections.

Link to the October BoJ Statement

During the following press conference, Governor Kazuo Ueda emphasized the need for caution amid global uncertainties. Ueda stated that there remains high uncertainty on the impact of trade policies on overseas economic and price developments, and that the BoJ would like to spend more time scrutinizing wages and price moves, including how companies hit by 15% tariffs would respond and set wages for next year.

When asked about the possibility of a December rate hike, Ueda noted that the BoJ does not need to wait until the final outcome of next year’s wage talks becomes available, suggesting a hike remains possible at the December meeting if conditions warrant.

Market Reactions

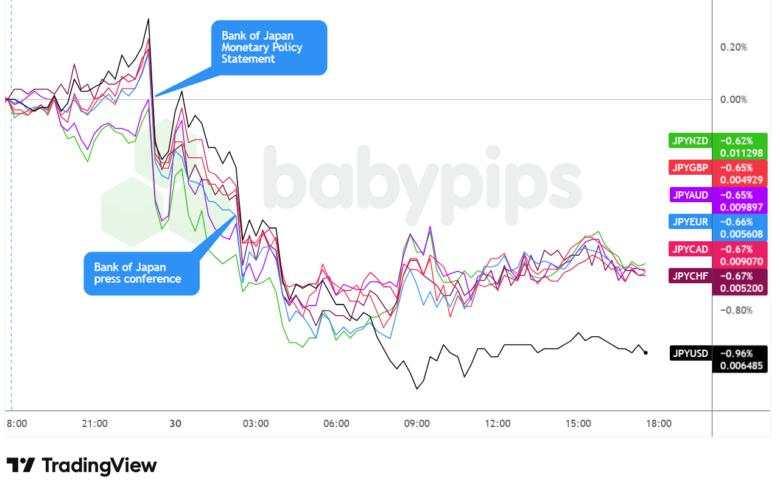

Japanese yen vs. Major Currencies: 5-min

Overlay of JPY vs. Major Currencies Chart by TradingView

The Japanese yen was the worst performing major currency during the Thursday session, experiencing sharp declines that correlated with both the monetary policy statement release and Governor Ueda’s press conference.

USD/JPY jumped 1.2% in post-BoJ trading and hit the highest level since mid-February, with bulls breaking above the 154.00 barrier. The pair’s surge was likely amplified by the previous day’s unexpectedly hawkish tone from the Federal Reserve, which kept US yields elevated and further widened the policy rate differential between the two countries.

The yen’s weakness extended across all major currency pairs. EUR/JPY pushed to multi-month highs, while GBP/JPY and CHF/JPY also saw notable gains against the Japanese currency. Even commodity currencies like AUD and NZD strengthened versus the yen in the aftermath of the decision.

Markets interpreted the BoJ’s decision to hold rates steady, combined with Ueda’s cautious commentary about needing more time to assess global uncertainties and domestic wage data, as a dovish signal that pushed back expectations for near-term tightening.

By the end of the trading session, the yen remained deeply in the red across the board, with traders likely adjusting their positioning to reflect reduced odds of a December rate hike and increased uncertainty about the BoJ’s tightening timeline.

加载失败()