Weak U.S. private payrolls data reinforced expectations for a December Federal Reserve rate cut, sending the dollar to its worst single-day loss since September. Equities and bonds rallied on growing confidence that policymakers will ease despite lingering inflation concerns.

Check out the forex news and economic updates you may have missed in the latest trading session!

Forex News Headlines & Data:

- Reserve Bank of Australia Governor Michele Bullock said the labor market is still a bit tight and inflation has surprised to the upside

- Australia GDP Growth Rate for September 2025: 0.4% q/q (0.8% q/q forecast; 0.6% q/q previous); 2.1% y/y (2.2% y/y forecast; 1.8% y/y previous)

- Swiss Inflation Rate for November 2025: 0.0% y/y (0.1% y/y forecast; 0.1% y/y previous) – stalled for first time in six months

- U.K. S&P Global Services PMI Final for November 2025: 51.3 (50.5 forecast; 52.3 previous)

- Euro area HCOB Services PMI Final for November 2025: 53.6 (53.1 forecast; 53.0 previous)

- Germany HCOB Services PMI Final for November 2025: 53.1 (52.7 forecast; 54.6 previous)

- ECB President Christine Lagarde said euro area inflation is expected to stay around the ECB’s 2% target in the coming months, with no signal of imminent policy changes

- Euro area PPI for October 2025: 0.1% m/m (0.2% m/m forecast; -0.1% m/m previous); -0.5% y/y (-0.4% y/y forecast; -0.2% y/y previous)

- ADP National Employment Report for November 2025: -32.0k (15.0k forecast; 42.0k previous) – largest decline since early 2023

-

ISM U.S. Services PMI for November 2025: 52.6 (52.3 forecast; 52.4 previous)

- Services Prices for November 2025: 65.4 (70.3 forecast; 70.0 previous) – seven-month low

- Services Employment for November 2025: 48.9 (48.0 forecast; 48.2 previous)

- Canada S&P Global Services PMI for November 2025: 44.3 (50.6 forecast; 50.5 previous) – sharp contraction

- U.S. EIA Crude Oil Stocks Change for November 28, 2025: 0.57M (2.77M previous)

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Wednesday’s session saw broad risk-on sentiment emerge as traders interpreted mounting evidence of U.S. labor market weakness as clearing the path for Federal Reserve rate cuts, despite policymakers’ stated concerns about inflation.

The S&P 500 advanced 0.31% to close around 6,852, rising for the seventh time in eight sessions. The index maintained a positive bias throughout most of the trading day, with the most notable strength emerging during the U.S. session following the disappointing ADP employment report, as traders priced in higher odds of a December rate cut—now exceeding 90% probability, up from around 25% just under two weeks ago.

Gold traded choppily throughout the session, ultimately closing relatively flat near $4,210. The precious metal initially pushed higher during Asian trading hours, possibly tracking broader risk-on flows, before pulling back during the London session. Despite the lackluster daily performance, gold remains supported above $4,200 as Fed rate cut expectations and ongoing concerns about global fiscal dynamics continue to underpin haven demand.

WTI crude oil posted the day’s most dramatic intraday reversal, rallying strongly through the Asian and London sessions to become one of the session’s top performers before chopping sideways during U.S. afternoon trading. Oil ultimately closed up 1.15% near $58.90, but had been slightly higher earlier in the day. The late-session pullback correlated with news of a modest build in U.S. crude inventories (0.57 million barrels versus a 2.77 million build the prior week), likely prompting some profit-taking after the earlier session gains.

Bitcoin emerged as the session’s strongest performer, rallying 2.09% to trade above $93,500. The cryptocurrency found sustained buying interest throughout the day, with no direct crypto-specific news to point to, suggesting the strength likely reflected a continued oversold rebound from October and November’s massive sell-off.

The 10-year Treasury yield declined 0.66% to settle around 4.10%, continuing its retreat from recent highs as the weak ADP data reinforced bond market expectations for Fed easing. Yields fell most sharply ahead of the U.S. session open, with another notable move lower correlating with the U.S. services update.

FX Market Behavior: U.S. Dollar vs. Majors

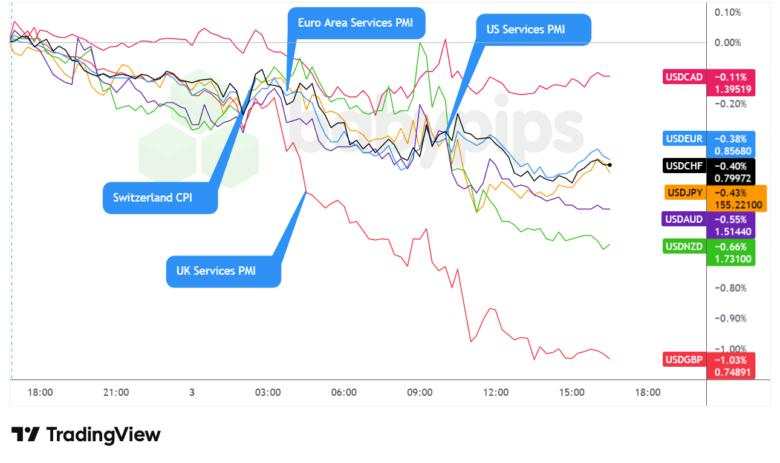

Overlay of USD vs. Majors Forex Chart by TradingView

The U.S. dollar suffered its worst single-day decline since September on Wednesday, posting sustained losses across all major currency pairs from the session open through the close as weak employment data cemented expectations for a December Fed rate cut.

The dollar was under pressure from the Asian session open, with the weakness appearing to reflect positioning adjustments ahead of key U.S. labor data rather than any specific catalyst. The early decline suggested traders were anticipating disappointing employment figures.

The London session saw the dollar’s losses persist despite mixed data from other economies. Notably, the UK Services PMI was revised higher to 51.3, yet the dollar’s broad-based weakness continued unabated, suggesting U.S.-specific concerns were dominating forex flows rather than relative economic performance between regions.

The U.S. session delivered the decisive catalyst when ADP reported private-sector payrolls fell by 32,000 in November—a dramatic miss versus the 15,000 gain expected and the largest decline since early 2023. Companies with fewer than 50 employees shed 120,000 jobs, the steepest one-month drop since May 2020. The dollar extended its losses immediately following the release, with selling pressure sustained through the afternoon despite the ISM Services PMI coming in slightly above expectations at 52.6. The ISM’s prices paid component dropped to 65.4 from 70.0, marking a seven-month low that reinforced the Fed’s room to cut rates.

Markets dismissed the mixed messages—services activity still expanding even as employment contracted—most likely focusing squarely on labor market weakness as justification for Fed easing. The dollar index fell approximately 0.45% on the session. With the delayed November jobs report not due until December 16, Wednesday’s ADP figures became particularly influential in cementing rate cut expectations for the Fed’s December 17-18 meeting, with odds now exceeding 90%.

Upcoming Potential Catalysts on the Economic Calendar

- Australia Balance of Trade for October 2025 at 12:30 am GMT

- Australia Household Spending for October 2025 at 12:30 am GMT

- Swiss Unemployment Rate for November 2025 at 8:00 am GMT

- Swiss procure.ch Manufacturing PMI for November 2025

- Euro area HCOB Construction PMI for November 2025 at 8:30 am GMT

- U.K. S&P Global Construction PMI for November 2025 at 9:30 am GMT

- Euro area Retail Sales for October 2025 at 10:00 am GMT

- U.S. Challenger Job Cuts for November 2025 at 12:30 pm GMT

- U.S. Balance of Trade for September 2025

- U.S. Initial Jobless Claims for November 29, 2025 at 1:30 pm GMT

- Canada Ivey PMI for November 2025 at 3:00 pm GMT

- Euro area ECB Lane Speech at 3:00 pm GMT

- Fed Bowman Speech at 5:00 pm GMT

- Fed Balance Sheet for December 3, 2025 at 9:30 pm GMT

Thursday’s calendar appears relatively light on major market-moving catalysts through the European session, with most attention likely focused on the U.S. afternoon when weekly jobless claims data arrives. Following Wednesday’s shocking ADP employment decline, traders will scrutinize initial claims for confirmation of labor market weakening, with any reading above the 232,000 consensus potentially reinforcing December rate cut expectations and pressuring the dollar further.

The euro area retail sales report could provide insight into consumer resilience amid the region’s manufacturing struggles, though its market impact may be limited given the ECB’s patient stance. Similarly, construction PMI readings from the UK and euro area tend to be lower-tier data points unless they show dramatic deterioration.

Volatility could likely remain subdued until the U.S. session, when jobless claims become the day’s primary focus. With Fed speaker Bowman also scheduled, any commentary on the labor market or December policy outlook could amplify market reactions. However, with the crucial delayed November jobs report still nearly two weeks away (December 16), Thursday’s session may see more consolidation than decisive directional moves as traders await more comprehensive employment data.

Stay frosty out there, forex friends, and don’t forget to check out our Forex Correlation Calculator when planning to take on risk!

暂无评论,立马抢沙发